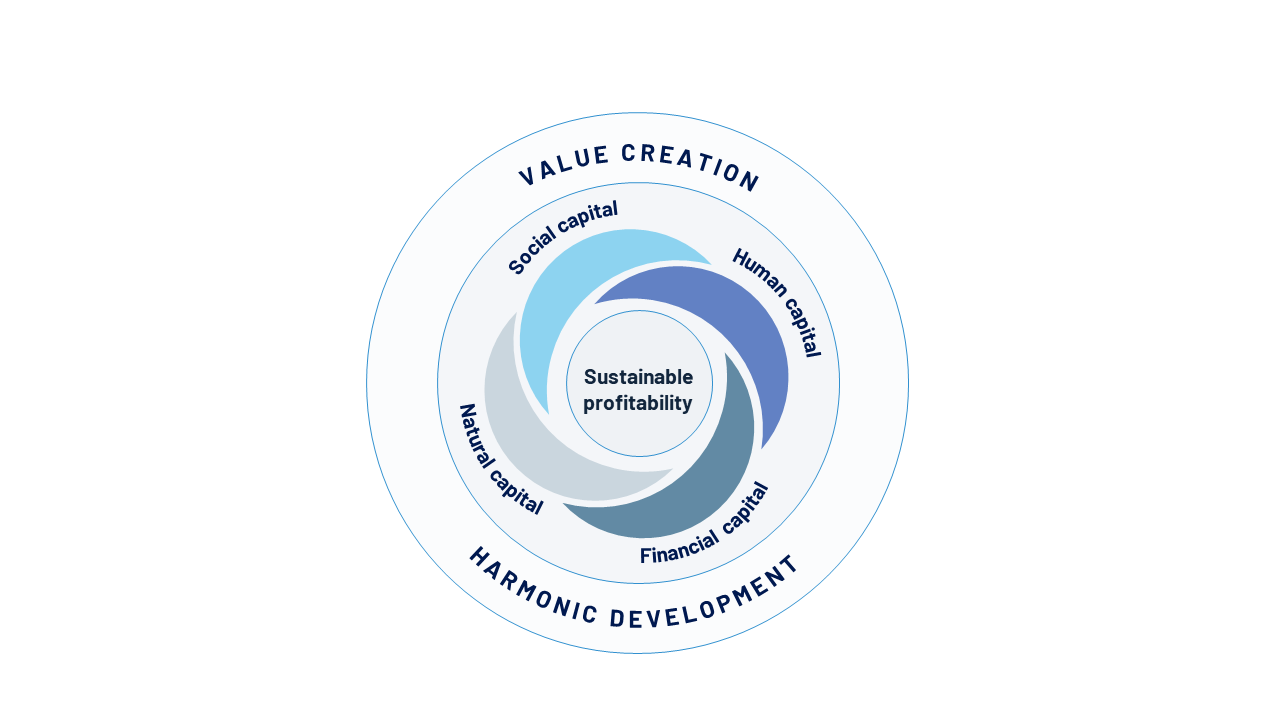

At Grupo SURA we understand sustainability as the ability to rethink, anticipate, ask ourselves the right questions and manage risks to face the challenges of a competitive environment, in this way we contribute to the harmonious development of society, based on our corporate principles.

We are sustainable when we are useful and relevant to society; when our proposal promotes the competitiveness of organizations and the well-being of people; when we maximize the generation of value for our stakeholders. We achieve this with coherence between what we are, what we declare and what we do, thus we grow responsibly to remain in time.

Sustainability has been present since our beginnings as an insurance company. This explains the vision and philosophy that its leaders have had regarding the way in which corporate responsibility should be assumed and its link with corporate sustainability. Since its creation, our Company has been conceived as a form of social organization with a great mobilizing capacity to build better contexts, where the social, environmental and economic spheres are favored. To this end, the Organization has focused on ethical, comprehensive and consistent management of its businesses, first in Colombia and now in Latin America.