History

- Grupo SURA is advancing in the spin-off process in order to evolve its shareholder structure and specialize its portfolio in financial services.

- Ricardo Jaramillo Mejía took over as Grupo SURA’s Chief Executive Officer after Gonzalo Perez retired.

- Juan Esteban Toro took over the position of Grupo Sura's Chief Corporate Finance Officer, after a decade serving as the Company´s Investment Manager.

- VaxThera, the SURA Business Group's biotechnology company, inaugurated its biologics packaging plant in Rionegro, Antioquia, while also receiving a patent for its Covid-19 vaccine.

- Grupo SURA completed the implementation of the Framework Agreement signed in 2023 and, as a consequence, the Company's ownership structure was modified.

- Grupo SURA signed the Spin-Off Project together with Grupo Argos and Cementos Argos, with the aim of eliminating cross-shareholdings and evolving the Company's ownership structure.

- Grupo SURA was included for the first time in the Bloomberg Gender Equity Index for promoting equality and diversity.

- Grupo SURA was included in the 2023 edition of the S&P Sustainability Yearbook. It was also included for the 13th consecutive time in the Dow Jones Sustainability Global Index.

- Grupo SURA signed and made progress in the execution of a Framework Agreement establishing the conditions for the modification of the Company's ownership structure.

- SURA Asset Management consolidated SURA Investments, a regional platform specialized in wealth and asset management for individuals, companies and institutions, with global reach.

- Suramericana subscribed the disposal of its assets in Argentina and El Salvador, with a view to recomposing its Latin American operation by optimizing capital management to consolidate and maintain its regional footprint.

- After three successive unsuccessive takeover bids for Grupo SURA shares, its composition changes and the Shareholders' Meeting modifies the Board of Directors.

- SURA was included in Colombia in the Private Social Investment Index (IISP) and highlighted for best practices in social capital management.

- Suramericana launches its insurtech to boost the digital market of Seguros SURA in 9 Latin American countries.

- Grupo SURA is the sixth company with best practices in its industry as part of S&P's Dow Jones 2022 Global Sustainability Index.

- VaxThera, Suramericana's investment in the development, packaging and manufacturing of vaccines, is born.

- Fundación SURA celebrates 50 years of history and consolidates its position as a social investment benchmark.

- Grupo SURA shares begin trading on the Santiago de Chile Stock Exchange.

- EPS SURA applies 5 million vaccines against COVID-19 and its lethality rate is three times lower than in Colombia.

- Gonzalo Alberto Pérez takes over as Chief Executive Officer of Grupo SURA after David Bojanini announces his upcoming retirement.

- Juana Francisca Llano succeeds Gonzalo Pérez as Chief Executive Officer of Suramericana.

- The Companies belonging to the SURA Business Group take measures to ensure their ongoing business continuity in the face of the COVID-19 pandemic.

- Grupo SURA is given the Latin Trade Index Americas Sustainability award for 2020 (in the “Multi-Latina” category).

- 76.3% of Grupo SURA's investment portfolio is concentrated in the financial service sector.

- Grupo SURA obtained the Silver Class medal by entering the Robeco SAM Sustainability Yearbook for the eighth time.

- Seguros SURA Mexico acquired SURA AM Life business in Mexico.

- We increased our participation in SURA Asset Management to 83.58%.

- Our subsidiary Suramericana acquires the operation of RSA Insurance Group Plc in Latin America. Suramericana thus consolidates a leading insurance platform, geographically diversified, with presence in 9 countries.

- We are included in the Dow Jones Sustainability Index, which groups the companies with the best sustainability performance in the world.

- We acquire ING's Latin American operation, which includes pension fund and mutual fund managers in five countries. SURA Asset Management is created to manage the acquired operation.

- We are included in the Dow Jones Sustainability Index, which groups the companies with the best sustainability performance in the world.

The brand is renewed and henceforth it is called SURA.

We define the provision of diverse financial services and insurance in the Latin American market as our strategic focus.

Conavi and Corfinsura merge with Bancolombia, creating a universal banking group which is the current leader in the Colombian market and is present in 6 countries.

- We started operating in international markets when we acquired the majority of the company Interoceánica, in Panama.

- We separated our investment portfolio from the insurance activity. Our stocks for Suramericana de Inversiones (currently Grupo SURA), holding of the affiliate Suramericana de Seguros, was listed in the stock exchange.

- Banco Industrial Colombiano buys 51% of the shares of Banco de Colombia, and Bancolombia is created.

The professional risk administration company Suratep, now ARL SURA, was created.

- The pension fund administrator Protección was created.

- The stock brokerage company Suvalor was established.

The prepaid medicine company Susalud, which later became EPS SURA, was created.

- We acquired Colombo Mexicana de Inversiones and Sufinanciamiento was created.

- In association with Cementos Argos, we created Suleasing.

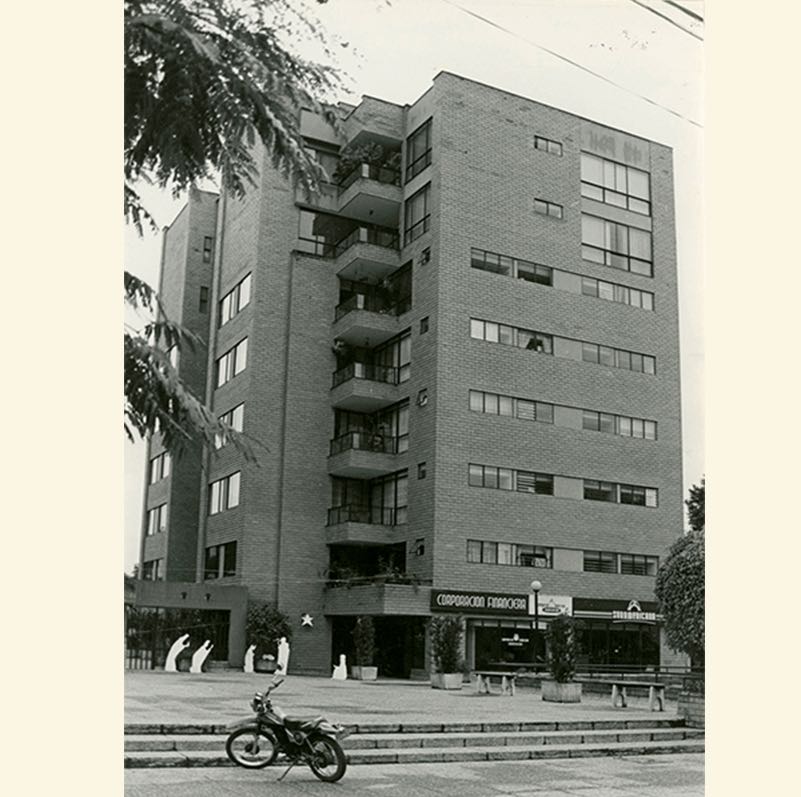

- Corfinsura was created with the merger of Corporación Financiera Nacional and Corporación Financiera Suramericana.

- Our Tiger makes its appearance, one of the best positioned characters in Colombian advertising.

- The pension fund administrator Protección was created.

- We acquired Colombo Mexicana de Inversiones and Sufinanciamiento was created.

- We participated in the creation of Fundación Suramericana, currently Fundación SURA, to implement social responsibility actions.

- We participated in the creation of Corporación Financiera Industrial Agrícola, which we purchased in its entirety in 1976, and became Corporación Financiera Suramericana.

- We published the first art book sponsored by Suramericana, which is part of a tradition of cultural support that continues.

Creation of the Compañía Suramericana de Capitalización, which offered savings services.

- We televised the news program Noticiero Suramericana, which aired for 20 years.

- We reached the figure of 1,000 employees.

We purchased our first computing equipment to process our information.

- We bought our own headquarters in downtown Medellin.

- We reached the figure of 1,000 employees.

- We televised the news program Noticiero Suramericana, which aired for 20 years.

- The affiliate Suramericana de Seguros de Vida is established.

Investor Kit Q125

Download our investor kit, a tool that will allow you to easily utilize the figures of our organization.

DOWNLOAD HERE