Spin-Off Project

To learn more about Grupo SURA, we invite you to visit the following pages

Relevant Information

Investor Relations

Ethics and Corporate Governance

News Center

Here you can find the official information from Grupo SURA regarding the Partial Spin-Off by Absorption Project with Grupo Argos and Cementos Argos. This project, which follows the comprehensive agreement signed by the three companies on December 27, 2024, outlines a transaction that reorganizes Grupo SURA’s ownership structure, eliminates cross-shareholdings, and enhances the specialization of its investment portfolio in financial services. Its execution benefits all shareholders and ensures fair treatment throughout the process.

Relevant events

Learn what this operation is about

Message from Grupo SURA's CEO about SFC approval of the Spin-off Project

Spin-off operation between Grupo SURA and Grupo Argos

Process and Next Steps

Process and next steps

What are the steps to be followed and the estimated timeframe after approval by the SFC?

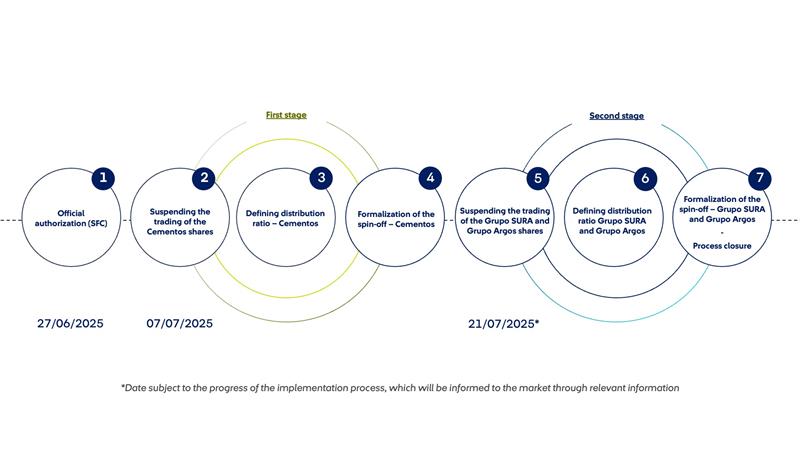

Following initial approval by the Colombian Financial Superintendency, the transaction will be executed in two main stages. The first consists of the spin-off of Cementos Argos in favor of Grupo SURA, and the second contemplates substantially simultaneous spin-offs between Grupo SURA and Grupo Argos.

Each of these stages will involve several processes, including the temporary suspension of trading of the shares and the formalization of the spin-offs. The transaction is expected to be completed in approximately one month.

What are the final exchange ratios?

In the case of Grupo SURA, each shareholder will receive 0.723395* Grupo Argos shares for each Grupo SURA share held. This value is calculated based on the ratio between the outstanding shares of Grupo SURA (395 million) and the shares that Grupo SURA holds in Grupo Argos (286 million), which results in 0.723395* (285,834,388/395,128,602). Each shareholder will receive the same type of share currently held in Grupo SURA.

The definitive ratios will be announced to the market by means of relevant information and in no case will be lower than those indicated in the Spin-Off Project.

*Although the figures have been expressed with six truncated decimals, the number of shares that each shareholder will receive will be calculated taking into account the total number of decimals resulting from the calculation and application of the Distribution Ratio.

Until when do I have the right to participate in the Spin-Off by Absorption?

Those shareholders who are registered in the shareholders' book on the cut-off dates established in the Spin-Off Project for each of the spin-offs will have the right to participate in the Spin-Off by Absorption.

As a shareholder of Grupo SURA, when do I receive Grupo Argos shares?

The delivery of Grupo Argos shares to Grupo SURA shareholders will be made once Grupo Argos makes the corresponding book entry, which will take place during the days on which its shares are suspended.

Why did Grupo Argos and Grupo SURA agree to cease being reciprocal shareholders?

Because it allows both companies to have a more straightforward shareholding structure as well as to specialize in their respective sectors, which is in keeping with today´s global capital market trends as well as the current views on the part of investors. In the case of Grupo SURA, the evolution of our ownership structure allows us to continue to focus our portfolio on the financial service sector, this based on our three main investments all of which have built up a strong footprint in Latin America, these being SURA Asset Management, Suramericana and Bancolombia.

What is the impact of this transaction with Grupo Argos for Grupo SURA´s shareholders?

This agreed option guarantees equal treatment for all holders of both ordinary and preferred shares in the two companies from start to finish.

In simple terms, with this transaction, each of Grupo SURA´s shareholders shall maintain their original shares, and shall also receive a number of Grupo Argos shares equivalent to the economic stake it previously held in said company through Grupo SURA. Furthermore, Grupo SURA's current shareholders shall increase their economic stakes, since the Company will have a smaller number of shares outstanding once this transaction is completed.

How can shareholders and the market be informed of the progress of this operation?

As the milestones of this transaction are reached and the corresponding progress is obtained, we shall be communicating with our shareholders and the market in a timely manner through the Relevant Information mechanism on the web page of the Colombian Superintendency of Finance Shareholders may also consult a specific section dedicated to this operation on the gruposura.com website as well as the Company's social media accounts (X and LinkedIn). Our Investor Relations team is also at hand to attend both our shareholders as well as market agents.

Why was an absorption spin-off option chosen and what are its benefits?

The option agreed between both companies and approved by their respective Boards of Directors is both regulated and efficient from the financial and legal standpoints as well as the time it would take to complete. It also guarantees equal treatment for all the Company's shareholders, maintains the same rights that each one had before the transaction and increases their economic stakes.

What is the effect of this transaction on Grupo SURA's financial statements?

In compliance with international accounting standards governing Grupo SURA, once the necessary corporate approvals are obtained, the investment in Grupo Argos S.A. shall no longer be recognized in the form of revenues obtained via the equity method on the consolidated financial statements and therefore shall be treated as an asset held for distribution to owners; therefore, the results of continuing operations in Grupo SURA's Statement of Income shall not reflect the results of this investment and in the Statement of Financial Position it shall remain as an asset until the transaction is carried out. It is possible that the transaction shall produce accounting profits based on valuation of the investment at fair value which shall be recognized in the Statement of Income.

How shall Grupo SURA's investment portfolio remain ?

Once this operation is fully completed, Grupo SURA shall be a company 100% focused on the financial service sector through its three main investments: its subsidiary SURA Asset Management, the regional leader in pension savings in terms of its volume of assets under management; its other subsidiary Suramericana, the fourth largest Latin American insurance company in terms of written premiums; and Bancolombia, the leading bank in the country with significant operations in Central America of which Grupo Sura is the main (non-controlling) shareholder.

Would this transaction modify the number of outstanding shares of Grupo SURA's ordinary and preferred stock?

Once this transaction is carried out , the number of outstanding shares will be reduced and all of our current shareholders will increase their economic stakes in the Company. Pursuant to the terms thus envisaged and subject to the required corporate and regulatory approvals, the number of Grupo SURA's outstanding shares shall total 328 million, 166 million ordinary and 162 million preferred shares.

Explore more about this transaction

Relevant Information

- Completion of First Stage of Spin-Offs – July 12, 2025

- Execution and Registration of the Deed for the Partial Spin-Off of Cementos Argos in Favor of Grupo SURA – July 10, 2025

- Superfinanciera Approves Grupo SURA Spin-Off – June 27, 2025

- Bondholders’ General Meeting Decisions – March 21, 2025

- Notice of Bondholders’ General Meeting – March 10, 2025

- Notice of Ordinary Shareholders’ Meeting – January 31, 2025

- Board Decisions January 30, 2025

- Cementos Argos' Inclusion in the Spin-off Agreement - December 27, 2024

- Subscription of Material Agreement - December 18, 2024

- Memorandum of Understanding (MOU) Subscription between Grupo SURA and Grupo Argos - October 25, 2024

- Value Neutrality Calculator

Corporate News

Press Articles

- Valora Analitik. "With the spin-off, Grupo SURA seeks to unlock greater value and profitability for its shareholders" – March 27, 2025

- Valora Analitik. Future Outlook for Grupo SURA with Ricardo Jaramillo Mejía – March 19, 2025

- El Tiempo: Grupo SURA's Plans Following Spin-off with Grupo Argos - December 27, 2024 (ESP)

- El Colombiano: Interview with the President of Grupo SURA on the Spin-off and Future of the Company - December 22, 2024 (ESP)

- Portafolio: Sura-Argos Shareholding Split Will Be Equitable for Shareholders - December 20, 2024 (ESP)

- El Colombiano: Details of the Shareholding Split Between Grupo SURA and Grupo Argos - December 20, 2024 (ESP)

- Teleantioquia Noticias: "Spin-off Announcement is Positive for Shareholders," Say Analysts - December 19, 2024 (ESP)

- Data IFX: SURA and Argos Move Toward Mutual Independence - December 18, 2024 (ESP)

- Revista Semana: Spin-off of Grupo SURA and Grupo Argos Announced - December 18, 2024 (ESP)

- "The Shareholding Split Was More a Tool Than a Goal," Says Ricardo Jaramillo - December 13, 2024 (ESP)

Investor Relations

If you need additional information beyond what is provided here, you can contact the following:

Investor Service Center

Carlos Eduardo González Tabares

Investment and Capital Markets Manager

Daniel Mesa Gómez

Director of Investors and Capital Markets