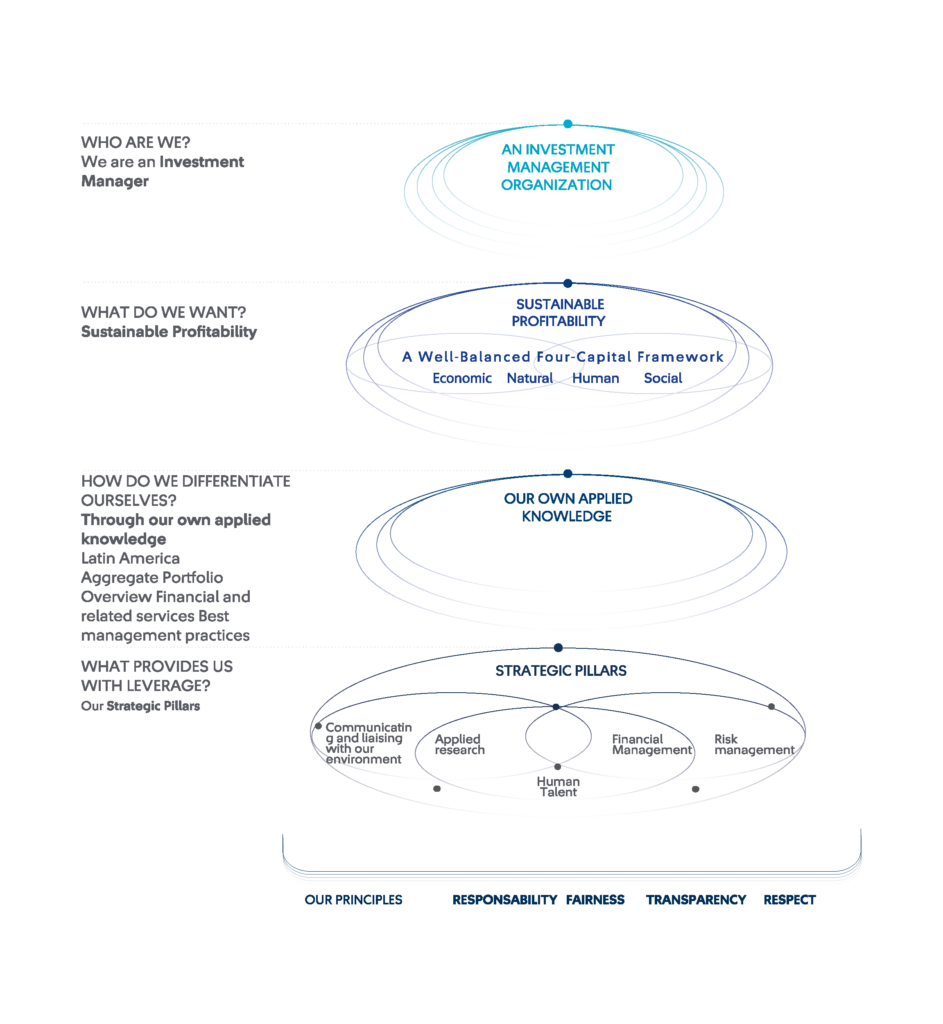

About us

We are a Colombian investment manager that develops with a long-term vision a solid investment portfolio focused on financial services and growth potential in Latin America, through leading companies in insurance, savings, asset management and banking, complemented with industrial investments.

With the strategic objective of obtaining sustainable profitability, we seek to provide our shareholders with an economic return that exceeds the cost of capital and to create value for our other stakeholders, with a view towards the long-term.

We are also evolving our strategy, which is allowing us to anticipate risks, opportunities and strengths of a balanced management of the four capitals: financial, social, human and natural. This is only sustainable when our portfolio companies, through their own lines of business, help people and companies face the uncertainties both now and in the future while promoting the well-being and development of the territories where these are present.

The priority focus of our capital allocation strategy is on the financial and related service industry, with our three core investments:

• Suramericana, a specialized player in the insurance industry, which, as a trend and risk manager, provides capabilities to people and companies in all nine countries where we are present. It is the third largest insurance company of Latin American origin measured in terms of written premiums.

• SURA Asset Management, an expert player in pension, savings, investment and asset management industries, with a presence spanning six countries. It leads the regional pension industry and is currently positioning itself as an investment platform for its institutional and corporate clients.

• Bancolombia, a company in which Grupo SURA is the main shareholder (albeit non-controlling), offering specialized and complementary universal banking services as the leading bank in Colombia. Its subsidiaries make up the main financial network in Central America.

We are also the main shareholders (albeit non-controlling) in two industrial investments with which we share equity ties and a philosophy of doing business:

• Grupo Argos, an infrastructure holding company with a direct presence in 18 countries throughout the Americas, through its cement and energy lines of business as well as its road and airport concessions.

• Grupo Nutresa, is a leader in processed foods in Colombia and a relevant regional player in its industry, with direct operations in 17 countries and brands present in 82 markets, from its 8 business lines in meat, cookies, chocolates, coffees, consumer foods, ice cream, pasta, and Tresmontes Luccetti. Since the third quarter of 2023, this investment has been reclassified in the financial statements as a non-current asset held for sale, by the Framework Agreement* signed on June 15, 2023.

• Sociedad Portafolio, since December 2023, we have been the main shareholder of this company, which was created as part of the execution of the Framework Agreement signed on June 15 of that year. This investment company is the result of the symmetrical spin-off process of Grupo Nutresa and manages the portfolio of shares that this food company had in Grupo Argos and Grupo SURA.

All in all, our investments provide a well-balanced diversification and exposure to different risks, industries, geographies, and stages of maturity of the portfolio’s businesses.

Since 2011, Grupo SURA has been included in the Dow Jones Global Sustainability Index (DJSI), which recognizes companies with the best economic, social, and environmental practices.

*Defines the terms and conditions to enter into a series of transactions that, once the pertinent corporate and regulatory authorizations are obtained, will result in Grupo SURA and Grupo Argos ceasing to be shareholders of Nutresa and, in turn, JGDB, Nugil and IHC will cease to be shareholders of Grupo SURA.