Different analysts agree that equities are one of the best options for structuring investment portfolios while at the same time pointing out various factors to be borne in mind.

By Valora Analitik for Grupo SURA*

Questions regarding how to allocate investor capital in 2020 are one of the main issues that investors and the market in general have to resolve at the beginning of the year, especially in terms of the main variables to be taken into account.

In this sense, equities are one of the main attractions for investors, in spite of their inherently higher risk, since with the right portfolio mix and adequate diversification, healthy returns can be obtained in the midst of prevailing global volatility and greater investor concerns that could otherwise impact their decisions.

Bancolombia’s Economic Research Group, for example, has forecast that the Colombian Stock Exchange’s benchmark index (the Colcap) is set to rise by 8% reaching 1,790 points by the end of 2020.

A good part of this valuation potential can be explained by three models: the first has to do with fundamentals, which is the more optimistic approach since it assumes that all companies would unleash their full potential by the end of 2020, this based on their individual target prices. The fundamental modeling methodology provides a valuation potential of 13% which in this case would reach 1,870 points on the Colcap Index; this based mainly on upward revisions of the target prices of shares belonging to the financial sector along with other assets.

On the other hand, the relative valuation model, which shows growths in company profits provides a target level of 1,750 points, suggesting a gain of 6%, this mainly driven by positive estimates for profits to be obtained by the consumer goods and financial sectors.

Thirdly, we have the sentiment model, which although is the most conservative of them all does show a positive change compared to previous projections. This model suggests a year-end level of 1,740 points, with a potential market gain of 5%. Although an upward trend with this model has been clearly evident, this in keeping with the level of market optimism seen since year-end 2018, the projections for 2020 reveal a 7% increase, thus showing the greatest upward change out of all three models used.

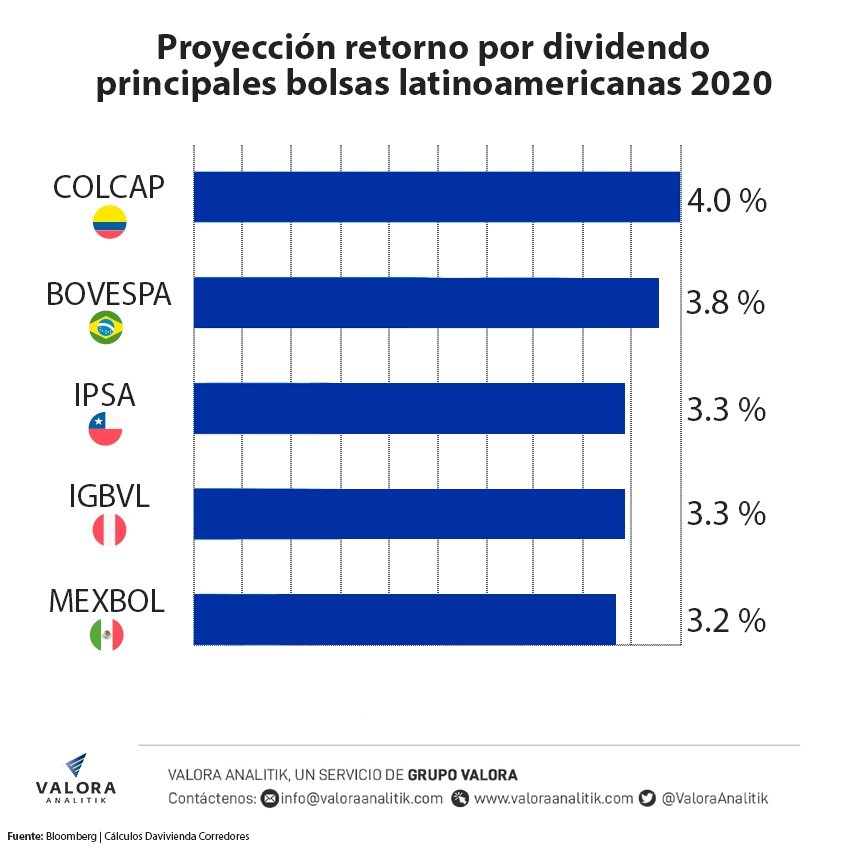

Meanwhile, based on the projections drawn up by the brokerage firm, Davivienda Corredores, the Colombian Stock Exchange (BVC), compared to the other major stock exchanges in Latin America, shall be providing the best dividend yields, with a projected gain of 4%.

Projected Dividend Yields for the Major Latin American Stock Exchanges in 2020

Variables to be taken into account

That is why, when choosing the stocks in which to invest, an investor must take into account the "fundamental variables as well as timing, liquidity and sentiment, in addition to a possible rebalancing of the international stock indexes that could also affect the liquidity of certain assets," explained Gabriel Mendoza, an expert in international markets from the Universidad Externado de Colombia.

According to María Fernanda Díaz, Head of Capital Market Structuring at Bancolombia, it is of strategic importance that the investor remains keenly aware of his or her investment objectives: "not only are these defined by what happens next year, but also by what happens during the time horizon that investors have established for attaining their investment objectives".

Now, if we were to take into account only what is likely to happen in 2020, Ms. Diaz is quick to point out that that an investor with a "moderate growth" profile should bear in mind the following factors:

- That global growth expectations have been lowered which have their own implications for how the financial markets are likely to perform.

- That the expected stock market yields are lower than those seen in 2019 and, even if these are positive, they shall lower expectations a little which is why investors should consider instruments that protect them from the effect of inflation.

- Evaluating the possibility of investing in real estate could help to provide interesting returns, without compromising profitability and risk nor sacrificing liquidity.

Key factors for a portfolio going into 2020

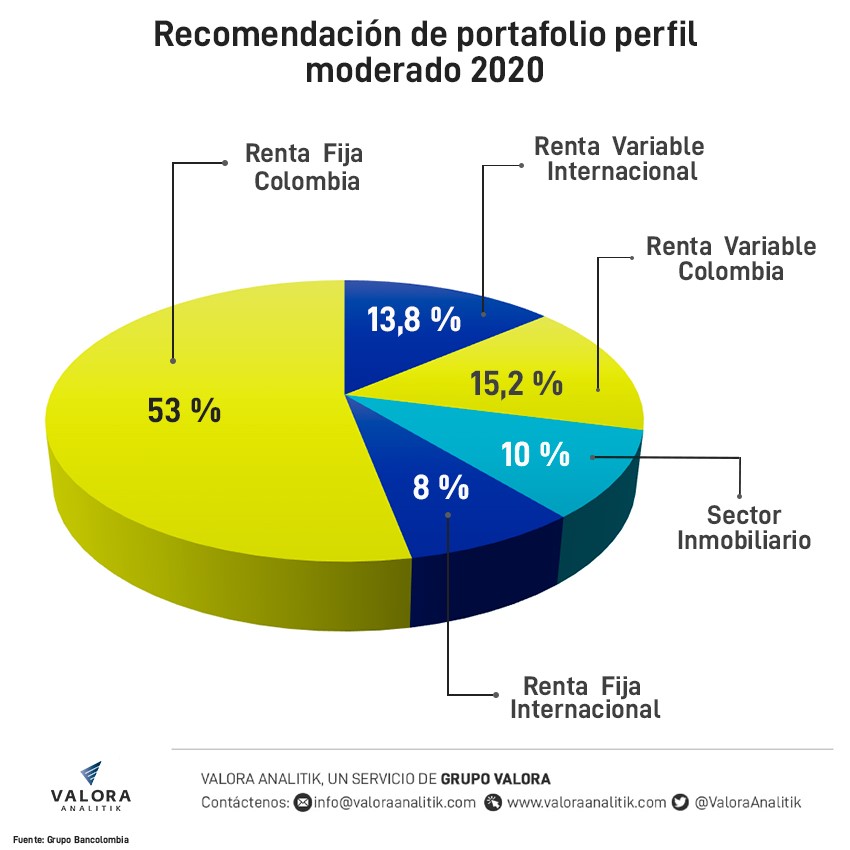

Consequently, Ms. Diaz explained that in order to obtain an interesting portfolio mix for next year, equities carry an important weighting, although real estate assets combined in part with fixed income securities should be considered in the case of a moderate investor profile, as shown below:

Portfolio recommendations for a moderate investor profile for 2020

Colombian fixed income securities

International equities

Colombian equities

Real estate assets

International fixed income securities

With this portfolio mix, the Head of Capital Market Structuring at Bancolombia forecasts an expected effective annual rate of return of almost 7.20% for 2020, this divided up as follows: 5.8% corresponding to Colombian fixed income securities; approximately 8.2% for Colombian equities; between 9% and 9.2% for real estate vehicles; almost 6% in Colombian pesos for international fixed income securities, while international equities would see a yield of 11%.

On the other hand, Germán Cristancho, Head of Economic Research and Strategy at the brokerage firm, Davivienda Corredores, explained that recommendations regarding equities should be based on the fundamentals of the specific investment along with the corresponding risk rating, this according to the different variables inherent to each economy or region at the beginning of the year.

That is why, and taking into account the global situation, which has been especially difficult this year for the developed markets given growth rates that for the most part have not surpassed the 2.5% mark, the Latin American economies and emerging markets, as in the case of Colombia, have taken on an strategic importance, given the positive dynamics seen from the regional standpoint.

This situation has begun to translate into better levels of performance on the part of local equities which, according to the MSCI index, accumulated a total yield of 21.7% which is almost double that of the Latin American region, which reached 11.9%, "which are very positive results, given the amount of global volatility prevailing and the impact suffered by the more developed markets," added Mr. Cristancho.

As for the Latin American outlook, the aforementioned officer from Davivienda Corredores believes that this year shall be more positive compared to 2019, based on the expected recovery for several major economies throughout the region, which shall in turn improve the outlook for investors.

"2020 may see some recovery with the growth rates of our trading partners, particularly those in Latin America. Brazil or Mexico, which have so far sustained very low growth rates, are cutting their interest rates, as are Chile and Peru. This should lead to an increase in growth rates in 2020, albeit slight. According to the International Monetary Fund’s projections, Latin America is expected to grow from 0.2 % in 2019 to 1.8% by the end of this year. So, generally speaking, we should see a rebound in this respect," stated Mr. Cristancho.

Furthermore, although overall yields on the part of Colombian equities remained favorable from a regional standpoint in 2019, stock prices have yet to reflect the fair value of the financial circumstances of their issuers. In turn, low levels of interest rates on the fixed income market have made stocks that more attractive as an alternative investment for portfolio managers.

So to conclude, experts consider that aspects such as low trading volumes, the amount of uncertainty triggered by situations such as the trade dispute between the United States and China, as well as the outcome of different investigations regarding specific companies, are risks that are likely to persist throughout 2020 and this should be borne in mind by investors.

Therefore, it is ultimately more important to focus on investing in financially sound companies with reasonable leverage metrics along with profitable growth opportunities.

*This article was prepared by the Valora Analitik staff for Grupo SURA. Its content is of a purely journalistic nature and does not compromise any specific positions taken or recommendations made by our Organization.