Grupo de Inversiones Suramericana S.A. (hereinafter “Grupo SURA” or the ‘Company’) hereby reports on the most significant activities carried out to date with regard to implementing the Partial Spin-offs[1]by absorption of Grupo SURA, Grupo Argos S.A. (“Grupo Argos”) and Cementos Argos S.A. (“Cementos”), as a result of the corresponding authorization as issued by the Colombian Superintendency of Finance, and reported to the market on June 27, 2025.

In this second implementation stage, consisting of the substantially simultaneous execution of the Sura Spin-Off and the Argos Spin-Off, all the legal activities required for completing these Spin-Offs have been carried out, as follows:

- Public deeds Nos. 1,144 and 1,145 were granted by the Notary Public No. 11 of the Circuit of Medellín, thereby solemnizing the Argos Spin-Off and the Sura Spin-Off, respectively.

- The filing of these deeds before the Chambers of Commerce of both Medellín and Barranquilla took place today. In the case of Grupo SURA, and as announced to the market[2], this statutory reform includes the following amendment to Article 4 of its bylaws:

ARTICLE 4- AUTHORIZED SHARE CAPITAL. The Company’s AUTHORIZED capital shall consist of ONE HUNDRED AND TWELVE BILLION FIVE HUNDRED MILLION COLOMBIAN PESOS (COP 112,500,000,000) divided into five hundred and thirty million four hundred and eighty-nine thousand three hundred and eighty-six (530,489,386) shares each with a par value of $212,068333445966".

The following are the main restated financial figures corresponding to the Company’s Separate Financial Statements at the end of Q1, 2025[3], this in keeping with the adjustments resulting from these Spin-Offs:

| Value (COP) | Number of Shares | |

| Par value: | 212.0683334459660 | N.A. |

| Authorized capital: | 112,500,000,000 | 530,489,386 |

| Subscribed and paid-in capital | 109,120,790,354 | 514,554,854 |

| Total assets | 25,619,319,979,915 | N.A. |

| Total liabilities | 9,801,465,052,325 | N.A. |

| Shareholders' equity: | 15,817,854,927,590 | N.A. |

This second implementation stage called the SURA Spin-Off and Argos Spin-Off, can be summarized as follows:

- The transfer on the part of Grupo Argos in favor of Grupo SURA of a Block of Equity consisting of 197,276,871 shares together with their accounting counterparts. These shares are being absorbed and settled by Grupo SURA. As part of this same stage, Grupo SURA is issuing to the shareholders of Grupo Argos new ordinary and preferred shares in Grupo SURA, this as a result of having applied the Sura distribution ratio.

- Substantially in a simultaneous manner, Grupo SURA is spinning off in favor of Grupo Argos a Block of Equity consisting of 285,834,388 shares together with their accounting counterparts. These shares are being absorbed and settled by Grupo Argos. As part of this same stage, Grupo Argos is issuing to Grupo SURA’s shareholders new ordinary and preferred shares in Grupo Argos, as a result of having applied the Argos Distribution Ratio.

The upcoming activities forming part of this second implementation stage consist of the corresponding book entries to be made by Deceval (the Colombian Centralized Securities Deposit) corresponding to the Sura Spin-Off and the Argos Spin-Off, as a result of which the shareholders of Grupo SURA at the Cut-Off Date shall receive Grupo Argos shares and, in addition, shall increase their economic stakes in Grupo SURA by almost 20%, thereby completing the necessary stages for carrying out these Spin-Offs.

Grupo SURA shall also receive new shareholders from Grupo Argos, thus expanding its shareholder base.

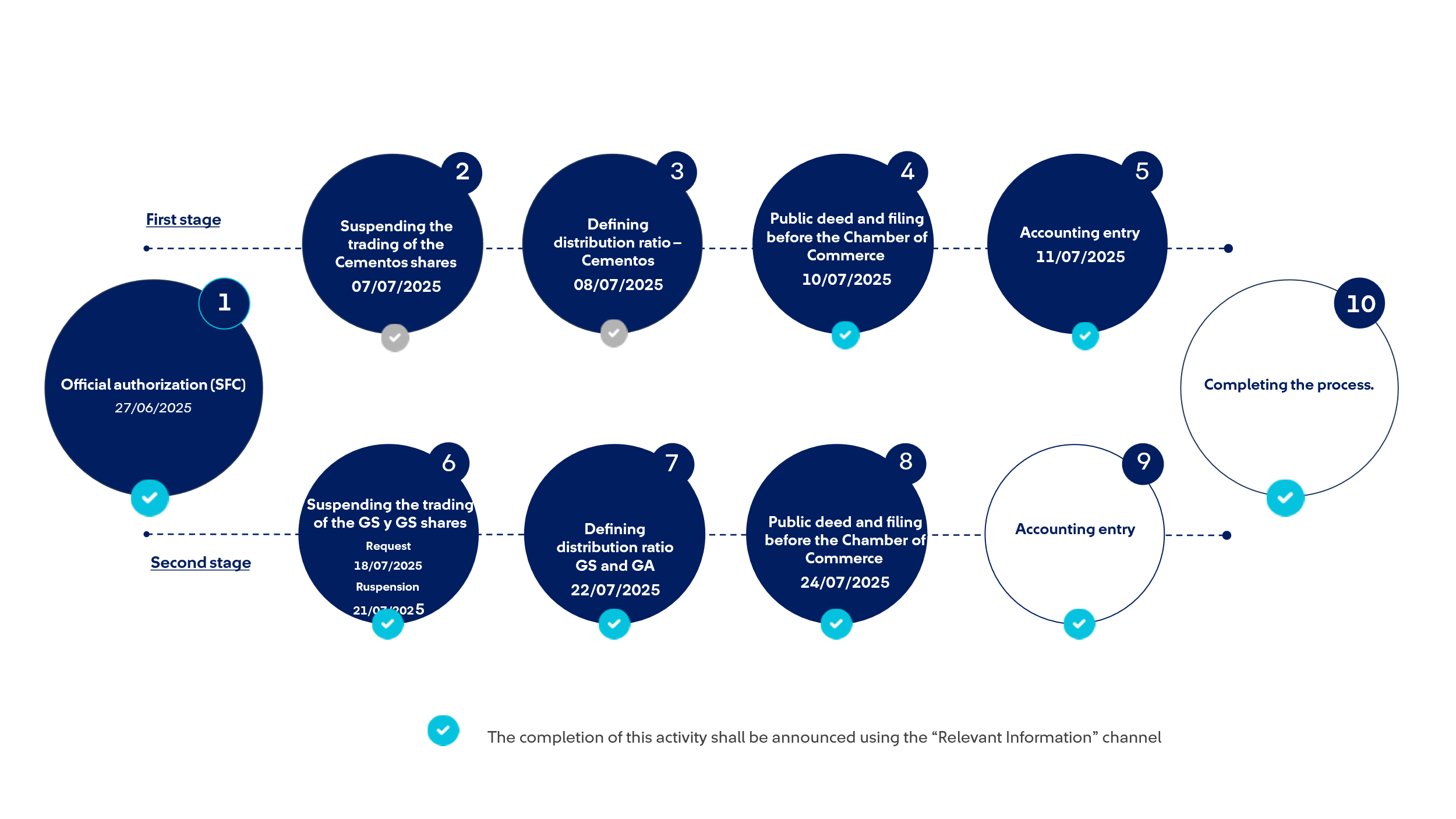

The progress made with these implementation activities is shown in the diagram below:

The implementation of this operation does not require any particular action on the part of the shareholders of both Grupo SURA and Grupo Argos. Each of the details of this Spin-Off by Absorption, its corresponding stages, as well as the terms and conditions set forth in the Proposed Spin-Off, can be found here these having been made available as of January 31, 2025.

[1] Capitalized terms and terms in quotation marks shall have the meaning assigned to them in the "Proposed Spin-Off “ as published on the Company’s website

[2] See Relevant Information published by Grupo SURA on July 22, 2024.

[3] The Financial Statements corresponding to Q1 , 2025 are the most recent ones disclosed to the market. Within 20 business days following the end of July, the Company will update the figures corresponding to this cut-off date.