- Total revenues amounted to COP 9.6 trillion, thanks to positive levels of performance on the part of the companies in its investment portfolio.

- On a trailing 12-month basis at the end of Q1 2023, controlling net income amounted to COP 2.5 trillion representing a return on equity (adjusted ROE) of 11.1%, the highest ever obtained over the last seven years.

- The baseline quantification of the financed carbon footprint has now been completed and S&P gave Grupo SURA an above-average ESG performance rating compared to the rest of the region.

On Monday, Grupo SURA reported to the market its consolidated financial results for Q1 2023. The Company obtained a record level of controlling net income amounting to COP 834,275 million, for a year-on-year growth of 94%, thanks to the positive levels of performance on the part of the companies that make up its strategic investment portfolio.

"The historical results obtained in this first quarter are the result of the efforts made by all our portfolio companies to secure a growth based on a long-term vision underpinned by their knowledge of their different lines of business, together with the efficiencies gained and a focus on profitability. This demonstrates the benefits of having a well-balanced portfolio in order to move ahead with our strategy," stated Gonzalo Perez, Grupo SURA´s CEO.

When comparing the financial results reported at the end of Q1 the following accounting effects should be taken into account: SURA Asset Management having consolidated Protección, AFP Crecer and the new insurance company Asulado as its new subsidiaries (carried out at the end of 2022), as well as the recent depreciation of the Colombian peso against other currencies in the region. As a result, total consolidated revenues rose to COP 9.6 trillion, 39% higher than for the first quarter last year. Total costs and expense increased by 33% for the quarter with operating earnings amounting to COP 1.4 trillion, for an increase of 80% compared to the same period last year.

In terms of the natural capital management, the Company concluded during this first quarter the baseline quantification of the financed carbon footprint for both Grupo SURA and its subsidiaries. This marks the starting point to move ahead with designing the Group´s decarbonization strategy.

Furthermore, Standard & Poor's (S&P Global) issued Grupo SURA with a rating of 66 points out of 100, after evaluating its performance, preparation and vision in regards to environmental, social and corporate governance (ESG) aspects. This rating is higher than the average obtained by the organizations evaluated throughout the Americas and is close to the European average.

Performance of Grupo SURA's portfolio companies during the first quarter:

Suramericana. This subsidiary recorded an all-time high net income totaling COP 318 billion, due to double-digit growth of the revenues obtained by all three insurance segments: Life (20%), Property and Casualty (29%) and Health Care (24%). This was coupled with a stable claims rate and a year-on-year increase in investment income of 122%. Return on equity (adjusted ROE) came to 12.8% on a trailing 12-month basis.

SURA Asset Management. This subsidiary obtained a controlling net income of COP 206 billion, as a result of higher fee and commission income and the recovery seen with its legal reserves, together with a 35% growth in operating revenues, after adjusting for the effects of having consolidated Protección, AFP Crecer and Asulado as subsidiaries, in addition to the depreciation of the Colombian peso, this compared to the same period last year. This was accompanied by strict controls over operating expense, which rose by 6% on a like-for-like basis.

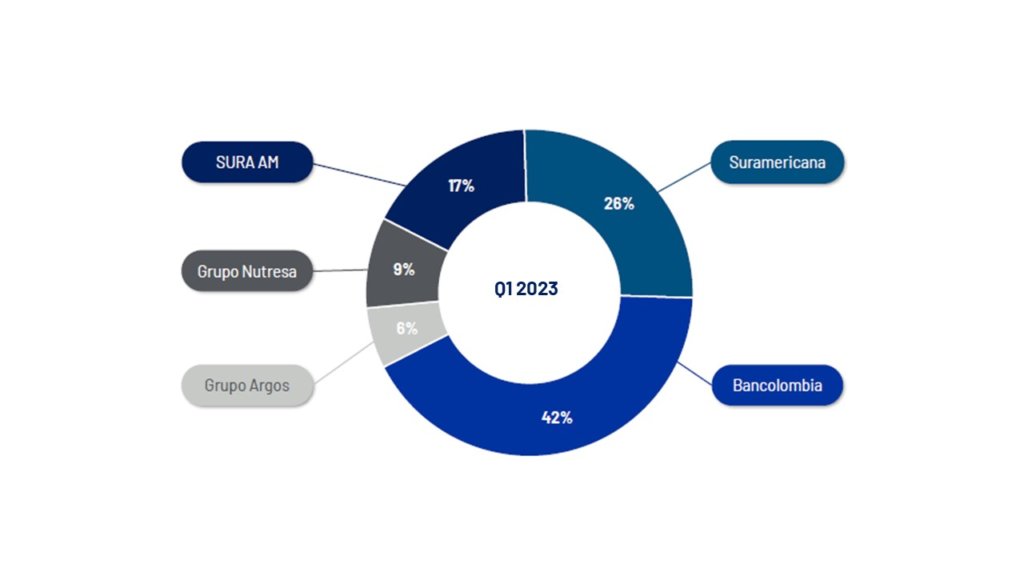

Equity method – Associates. Grupo SURA's bottom line also reflects the contributions made by the associated companies that form part of its portfolio. Revenues via the equity method totaled COP 575 billion, for an increase of 6% compared to the first quarter of 2022. This reflects Bancolombia's positive return on equity (ROE), the double-digit increase in all of Grupo Nutresa's business lines and higher earnings on the part of Grupo Argos.

Contributions to Grupo SURA's controlling net income on the part of its portfolio companies

Consequently, Grupo SURA ended this past quarter with a controlling net income of COP 2.5 trillion on a trailing 12-month basis, which represents a return on equity (adjusted ROE) of 11.1%, compared to the 9.9% recorded in 2022.

Based on the increase in dividends declared by the portfolio companies, dividends receivable are projected to reach COP 1.7 trillion by the end of 2023. This represents a compound annual growth of 12.6% compared to the dividends received in 2019, taking into account that approximately 40% of these dividends correspond to operations outside Colombia.

"The 48% growth in dividends receivable this year compared to last year provides us with a sound cash flow position, greater flexibility in servicing our debt while improving our leverage ratio, with net debt to dividends receivable projected to be below three times by the end of 2023," concluded Ricardo Jaramillo, Grupo Sura´s Chief Business Development and Finance Officer.

Finally, it is worth noting as a recent highlight, that at an Extraordinary Meeting held on April 19,Grupo SURA´s General Assembly of Shareholders unanimously ratified the current structure of the Board of Directors until the end of its statutory term in March 2024.

* Pro forma variation and at constant currency rates, in order to make the figures comparable.