- This amply evidences the resilience of Suramericana and SURA Asset Management, this in addition to a recovery with investment income during the second quarter.

- Despite the pandemic, revenues totaled COP 10.0 trillion (USD 2,718 million), with expense rising by just 2% and operating income standing at COP 922,247 million (USD 250 million).

- Our Companies have undergone a transformation in order to continue attending our clients, while creating new products and solutions in support of the region’s economic recovery.

- The SURA Business Group maintains the necessary financial strength, solvency and liquidity in order to deal with this situation.

At the end of the first half of the year, in what was after all a highly challenging environment and in spite of the impact caused by COVID-19, Grupo SURA reported on Friday a consolidated net income of COP 245,296 million (USD 66 million*), which represents a recovery compared to the first quarter of this year, thanks to positive levels of earnings obtained during the second quarter.

This bottom-line figure mirrors the strength of our business in the current crisis. Contributing factors included a growth in written premiums and revenues from services rendered on the part of Suramericana (specializing in insurance and trend & risk management), as well as stable flows of commission and fee income on the part of SURA Asset Management (an expert player in the pension, savings, investment and asset management sectors), in spite of the adverse effect on the region's job markets. Thus, the Group’s consolidated operating income came to COP 10.0 trillion (USD 2,718 million).

"The results for the first half of the year proved to be better than what we had initially projected in the light of this pandemic, thereby demonstrating the capacity of both Suramericana and SURA Asset Management to transform, adapt and remain resilient, having made a gradual recovery over recent months. At the same time, we have upheld our commitment to create added value for both private individuals and companies, creating jobs throughout the region and investing in business development. However, we wish to remain cautious, while constantly evaluating the impact that the current crisis has had on the region," stated Gonzalo Perez, CEO of Grupo SURA.

Likewise, our insurance and pension fund management subsidiaries obtained higher returns on their proprietary investments, following the sharp falls sustained on the capital markets in March.

A mere 2% increase in consolidated expense (COP 9.1 trillion or USD 2,468 million) at the end of Q2, was also a contributing factor, thanks to the cost controls and efficiencies implemented in the face of the current situation, even though the cost of health care services rendered rose given the need to attend the COVID-19 pandemic in Colombia in a timely manner. Consequently, the Company obtained operating earnings amounting to COP 922,247 million (USD 250 million), which were 39.4% less than those posted at the end of the same period last year.

"One of our priorities, amid the current situation has been to ensure our ongoing business efficiency and uphold our cost and expense controls, in addition to maintaining a sound balance sheet and the liquidity of all those Companies belonging to our Business Group. Furthermore, with the local bond issue recently placed, we look forward to ensuring adequate liquidity to meet our obligations in 2021 while improving our long-term debt profile," stated Ricardo Jaramillo, Grupo SURA's Chief Corporate Finance Officer.

Consolidated net income at the end of the first half of this year came to COP 245,296 million (USD 66 million), including that corresponding to Q2, amounting to COP 321,252 million (USD 87 million), which was 18% lower than for the same period last year. This also offset the loss posted in March and shows a change of -74.2% compared to H1 2019.

Higher revenues via the equity method from Grupo Nutresa helped with the overall result, in the light of the lower revenues obtained from Bancolombia caused by higher provisions having to be set up that in turn affected the Bank's earnings, the latter as a prudent measure given the uncertainty prevailing with a possible impairment of its loan portfolio .

Subsidiary performance

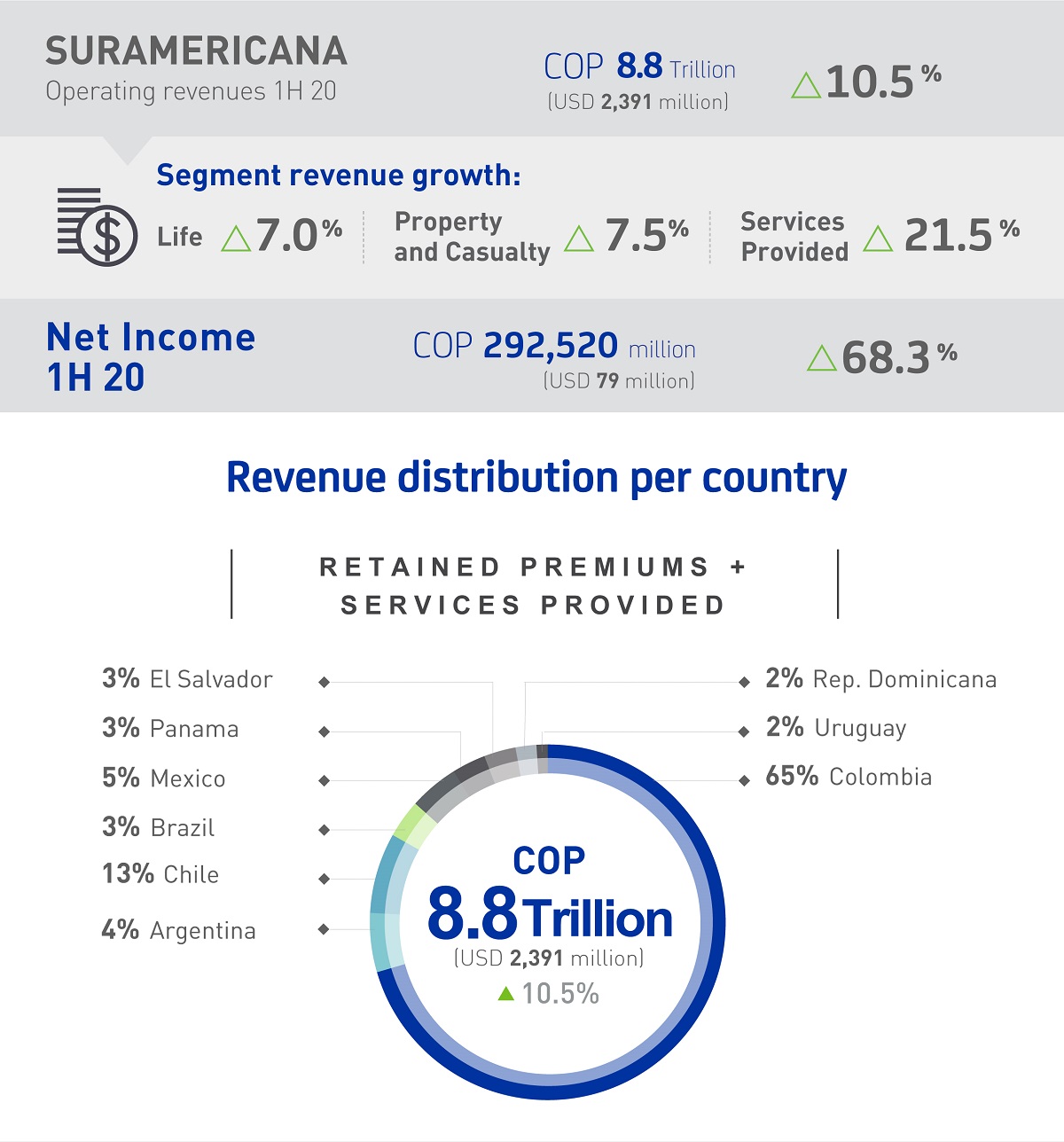

Suramericana ended the first half of this year with a consolidated net income of COP 292,520 million (USD 79 million), which was 68.3% more than for the same period last year. This included total revenues that rose by 10.5% to COP 8.8 trillion (USD 2,391 million), thanks to growths in the Property & Casualty (7.5%) and Life (7.0%) insurance segments as well as Health Care services rendered (21.5%) in Colombia. Furthermore, higher returns were posted on the portfolios held by the Insurance subsidiaries, particularly in Argentina, where the results obtained helped this subsidiary to end up on a positive note for the first half of the year.

"These results reflect our efforts to build customer loyalty on the following three fronts: transforming our operating model; developing new solutions while re-engineering others in order to respond to the current circumstance of private individuals and companies throughout the region; while at the same time reinforcing our means of access and channels. Likewise, we have taken great care of our investment to reserves, solvency and liquidity ratios in the face of the scenarios we have projected with the current pandemic," stated Juana Francisca Llano, CEO of Suramericana.

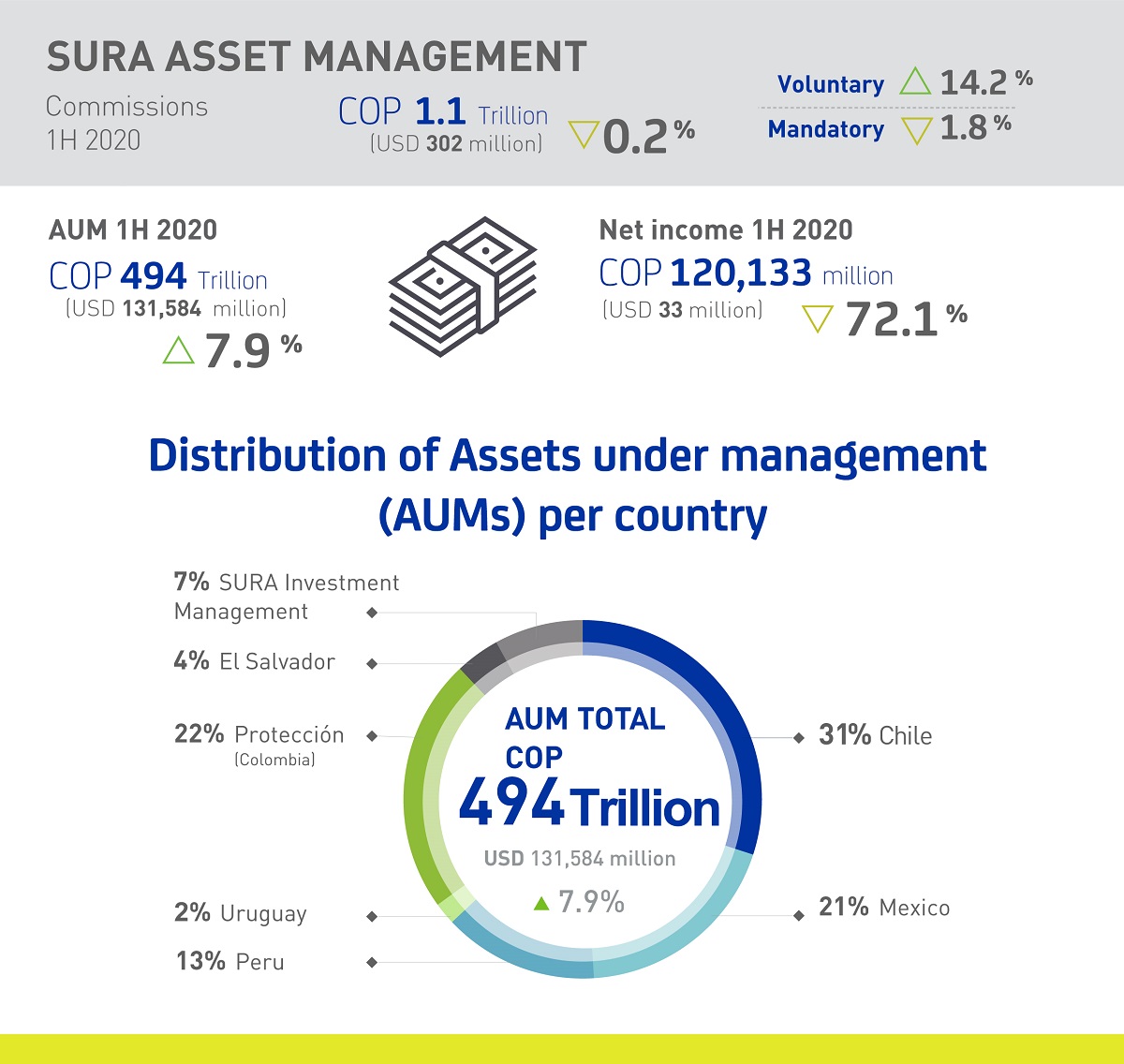

In turn, SURA Asset Management now has 20.9 million clients with Assets under Management (AuM) rising by 7.9% compared to the same period last year for a total of COP 494 trillion (USD 131,584 million**). In spite of the effects of the Coronavirus on the regional job markets, fee and commission income for the Mandatory Pension business only fell by 1.8% at the end of Q2, having risen by 14.2%, in the case of Voluntary Pensions, thanks to optimum sales management and a greater tendency to save on the part of our clients throughout the region. Strict spending controls were maintained, which barely rose by 5.6% compared to the first half of last year, in spite of the expense incurred with the regulatory changes introduced in Peru.

"During this past second quarter we saw an improvement with the global financial markets, which has meant a recovery with the portfolios we manage belonging to more than 20 million clients in the region. So, we continue to work on proper resource management to protect and strengthen the savings of the Latin American people," stated Ignacio Calle, CEO of SURA Asset Management.

Higher returns between April and June on SURA AM’s own investments in its Mandatory Pension business (legal reserve) helped to move its net income onto positive territory, and helping on Grupo SURA's net income figure with a further COP 120,133 million (USD 33 million) at the end of first half, which was 72.1% less than that posted in June of last year, which after all was a very positive year for this subsidiary.

Quarterly Highlights:

- Seguros SURA Colombia increased its capabilities for providing health care services amid the present pandemic: today, this Subsidiary is attending 35 thousand requests (telecare and telemedicine); providing oxygen therapy for members and policy-holders; and SURA diagnostic aids has processed 13% of the country’s total COVID tests.

- Grupo SURA, in planning ahead for the funds required to meet its obligations in 2021, placed COP 1 Trillion (USD 265 million) in bonds on the Colombian market on August 11, which received a bid-to-cover ratio of 2.23 times. This issue was rated as neutral by S&P, as its objective is to substitute liabilities.

- SURA Asset Management, through its Investment Management Unit, launched a fund worth USD 86.5 million, in alliance with Credicorp Capital, the purpose of which is to finance infrastructure projects in Colombia, Peru, Chile and Mexico.

- In July, S&P confirmed Suramericana's AAA rating for its local debt, with its main subsidiary, Seguros SURA Colombia, obtaining this same rating. On the other hand, Fitch Ratings reaffirmed Grupo SURA its long-term and local AAA rating, with a stable outlook.

- In support of the economic reactivation of both Micro- and Small and Medium-Sized enterprises: Suramericana has provided assistance to 44,500 entrepreneurs via its regional platform, Empresas SURA; while at the same time SURA AM launched a line of factoring as well as a fund in Colombia for financing this segment.

Re-stating amounts in dollars: *Figures taken from the Statement of Comprehensive Income, based on the average exchange rate for Q2 2010: COP 3,690.82; figures corresponding to AUM appraisals and Statement of Financial Position were based on the closing rate at the end of Q2 2020: COP 3,756.3.