Grupo de Inversiones Suramericana S.A. (hereinafter “Grupo SURA” or the ‘Company’) hereby reports on the successful completion of the entire Partial Spin-offs[1]by absorption of Grupo SURA, Grupo Argos S.A. (“Grupo Argos”) and Cementos Argos S.A. (“Cementos”), as a result of the corresponding authorization as issued by the Colombian Superintendency of Finance, and reported to the market on June 27, 2025.

The last step of the Spin-Offs was completed with the corresponding book entries[2], being made, after applying the final distribution ratios of both the Sura Spin-Off and the Argos Spin-Off.

The completion of this transaction marks a milestone in Grupo SURA´s evolution, by focusing its portfolio on the financial services industry while simplifying its structure, thereby facilitating value disclosure for more than 41 thousand shareholders that the Company currently has. The main benefits of this transaction include the following:

- Grupo SURA's shareholders shall retain their current shares and also increase their stakes in the Company by approximately 20% as a result of the number of the Company’s outstanding shares having been reduced.

- Additionally, the Company's shareholders received shares in Grupo Argos in proportion to their stakes in Grupo SURA.

- The shareholders of each company now retain the economic value they initially held, divided up into the direct stakes held in both companies.

- As of this moment, each shareholder, having shares in both Grupo SURA and Grupo Argos, will receive their economic right to a dividend from both issuers at the times approved by each of these.

- As a result of this transaction, Grupo SURA has a higher float on the stock market, thereby allowing for greater share liquidity and making it more eligible to be admitted to stock market indexes, as confirmed by the Company’s ordinary shares being included in the MSCI Global Small Cap Indexes last July 15th.

- The simplification of the Company’s structure enables greater value disclosure for its shareholders.

As a result of these Spin-offs, there was also a significant variation with Grupo SURA’s shareholder structure which shall be announced in a separate relevant information communication, in which it will be possible to consult a list of the twenty-five (25) main shareholders of the Company, while noting that the non-voting stand-alone trust, FAP Grupo Argos - Inhibidor, and Grupo Argos S.A. have definitively ceased to be shareholders of Grupo SURA.

Grupo SURA would like to thank Grupo Argos and Cementos Argos for their role as Company shareholders. We have formed with these companies, a bond regarding the way we do business, this based on our mutual principles, which has had a positive impact on different territories across Latin America. Grupo SURA, now as a company focusing on providing its financial services, would like to state its conviction that this legacy shall endure over time.

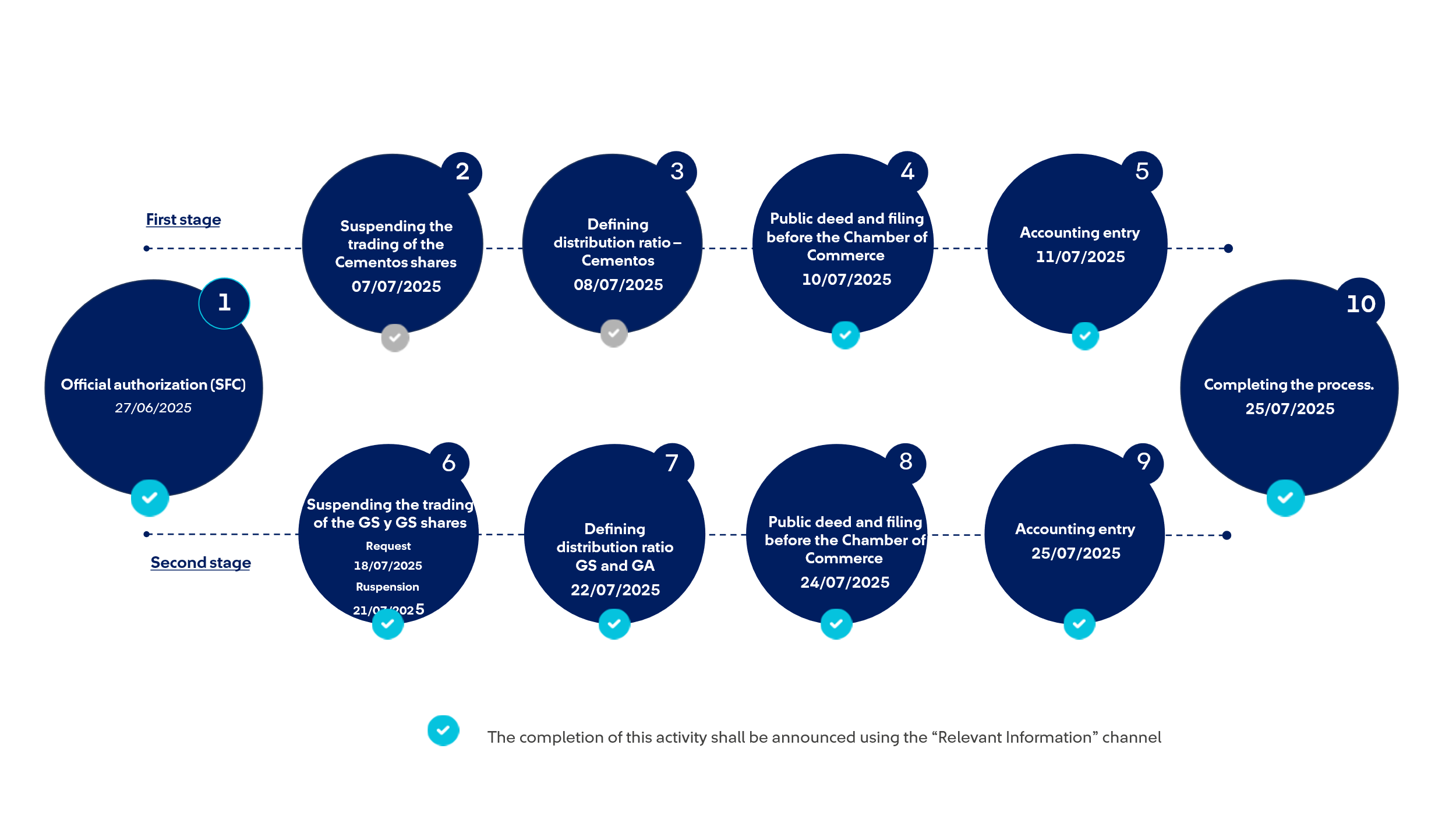

Finally, and by way of a summary, the main activities carried out upon executing these Spin-offs are described below:

- As a consequence of the Cementos Spin-Off [3], both the non-voting stand-alone trust, FAP Cementos Argos - Inhibidor del Voto and Cementos Argos S.A. have definitely ceased to be shareholders of Grupo SURA.

- Grupo SURA spun off in favor of Grupo Argos a Block of Equity consisting of 285,834,388[4] shares together with their accounting counterparts. Grupo Argos then absorbed these shares, cancelled them and, in exchange, issued to all Grupo SURA shareholders as of July 22 Grupo Argos shares applying the SURA Distribution Ratio of 0.723395840821982 Grupo Argos shares for each Grupo SURA share held.

- Grupo SURA, as a shareholder of Grupo Argos, received shares of its own ordinary stock and cancelled them.

- Substantially in a simultaneous manner, Grupo Argos spun off in favor of Grupo SURA a Block of Equity consisting of 197,276,871 shares together with their accounting counterparts. Grupo SURA then absorbed these shares, cancelled them and, in exchange, issued to all Grupo Argos shareholders as of July 22 applying the Argos Distribution Ratio of 0.235880284767547 Grupo SURA shares for each Grupo Argos share held.

- Finally, the Company currently has 327,705,908 shares outstanding, of which 165,834,026 are ordinary shares and the remaining 161,871,882 are preferred shares.

The completion of these implementation activities is shown in the diagram below:

Each of the details of these Spin-Offs by Absorption, their corresponding stages, as well as the terms and conditions set forth in the Proposed Spin-Off, can be found here these having been made available as of January 31, 2025.

[1] Capitalized terms and terms in quotation marks shall have the meaning assigned to them in the "Proposed Spin-Off “ as published on the Company’s website.

[2] The term “book entry” is understood to be the electronic record made by Deceval (the Colombian Centralized Securities Deposit) that certifies the identity of the holder of each share.

[3] Please refer to the Relevant Information communication dated July 12th.

[4] Corresponding to the sum of the shares held by Grupo SURA and the stand-alone trust, PA Acciones SP as holder.