Several analysts share their views on the relevance of stock exchanges for the region's growth and collective challenges.

By Valora Analitik for Grupo SURA*

The development of capital markets in Latin America is one of the region's pending tasks in terms of their integration and investment attraction.

The capital markets contribute to the development and growth of economies, as evidenced by those of top-tier economies such as the United States and Europe. The securities markets also offer products and services that enable short- and long-term savings and investment financing.

"Stock markets play a key role in the democratization of capital. Consequently, both private and state-owned companies are able to issue a certain percentage of their shares in order to finance their investment projects and, in turn, allow potential shareholders to take part in the financial and operating decision-making processes of these companies," stated Fabiano Borsato, Chief Operating Officer of the investment firm Torino Capital, a firm which focuses on Latin America.

For Fabiano Borsato, the latter involvement helps to improve company performance, strengthen corporate governance and enhance profitability. "In this regard, we should note that a robust and deep stock market must go hand in hand with inclusive and sustained economic growth," he commented.

The Inter-American Development Bank (IDB) in a report written in collaboration with South Pole and Sitawi, highlighted the need to leverage existing public and private sector investment vehicles as well as regulations for infrastructure investments through the capital markets.

This study shows that the region has not yet adopted the capital market tools needed to drive change towards sustainable infrastructure. Even if these instruments are driven by market-led initiatives, the next crucial step is to support regulators so that they may encourage investment in this field.

To this end, the key steps to be taken include encouraging innovation and adapting existing regulations and investment vehicles by developing green, social and sustainable labels for instruments other than bonds. There is also a need to create incentives such as specific risk mitigation mechanisms (e.g., foreign exchange risk mitigation, first loss provisions, viability gaps and liquidity facilities) as well as labeling standards for issuing sustainable infrastructure instruments on the capital markets.

An uneven stock market performance throughout the region

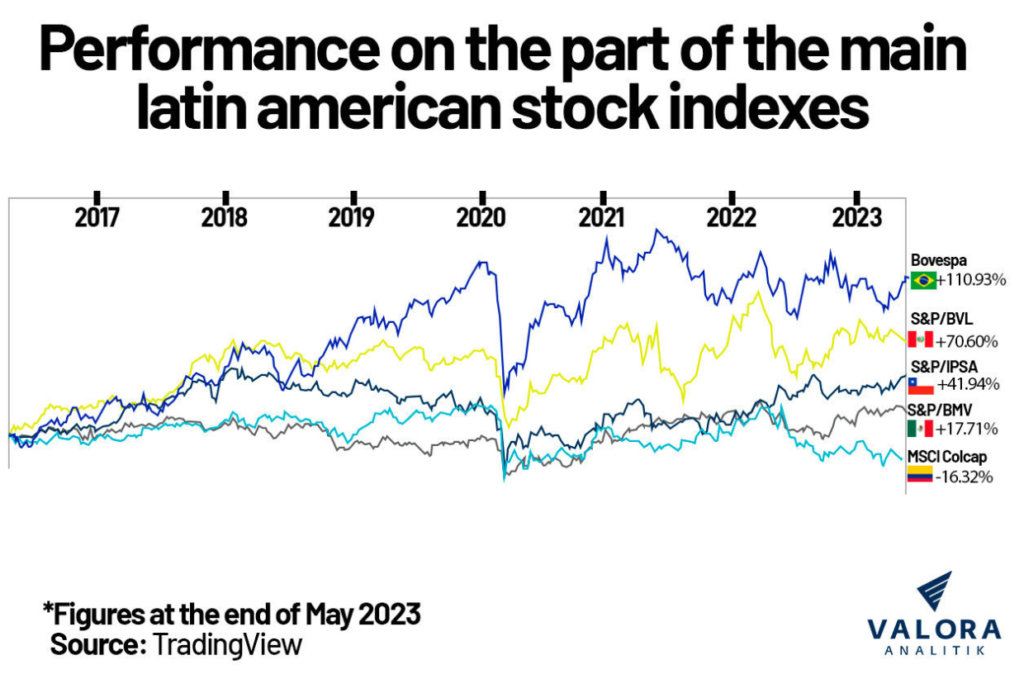

Over the last six years, Latin American capital markets have performed unevenly, with the performance of the benchmark indices of the Brazilian and Peruvian stock exchanges outstripping the rest, despite the effects of political cycles, the pandemic, and the impact of global markets.

According to the TradingView platform, the Colombian Stock Exchange has been the only stock market that has recorded a significant drop in recent years. Regarding the local Msci Colcap Index, this reverse for the Colombian market comes to 16.32 %. In particular, the Colombian market has been hit during this period by the withdrawal of certain issuers as well as a low number of new players that could otherwise energize the local market.

Graph 1:

Andrés Restrepo, CEO (acting) of the Colombian Stock Exchange, made special mention of the fact that with various alliances such as the Climate Bonds Initiative, "the stock exchange continues to make headway with being able to build sustainability as a fundamental pillar in developing the capital market, not only in Colombia but also throughout the region. One of the great advantages of being an issuer on the Stock Exchange is to be able to take advantage of this type of alliance that allows for companies in Colombia to grow, via a sustainable level of development that promotes the greening of the Colombian business fabric".

Contrary to the case of Colombia, the indicator of the Sao Paulo Stock Exchange (Bovespa) has increased in value by 110.93 % during this same period, as well as the Peruvian and Chilean stock markets, which recorded hikes of 70.60 % and 41.94 %, respectively.

“Latin American stock markets need to develop to a further degree, there are markets such as Mila, but these still need to be much more integrated," stated Jeisson Andrés Balaguera, CEO of the firm Values AAA.

What are the opportunities that lie ahead for the stock markets in Latin America?

According to Andres Balaguera, the opportunities for Latin America's stock markets "are enormous" if the region were to eventually come together under a single currency, which would "increase liquidity" and attract more investors.

Andrés Abadía, Chief Latin American Economist for Pantheon Macroeconomics, believes that the region's stock markets enjoy "good prospects" for the remainder of 2023, given the fact that the U.S. Federal Reserve is expected to cut interest rates, provided that the recession does not become so strong in this part of the world, the US being the main trading partner of most Latin American countries.

Another international factor could be the rebound of the Chinese economy in the fourth quarter of this year, thanks to its construction and mining sectors, which would boost demand for raw materials, these forming the basis of Latin America's exports, and the corresponding commodity exporting companies.

Also, the interest rate cuts expected in the region could be a catalyst for greater progress on the part of sectors dependent on the economic cycle.

In addition, Andres Abadía, of Pantheon Macroeconomics, points out that "Latin American stock markets are relatively cheap today", a phenomenon that can be explained by the lack of investors, the lack of new issuers and few tax incentives.

However, Fabiano Borsato points out that, despite the political problems, in Brazil "many international investors are still in an active buying position".

Chile, with a market characterized by the presence of robust banks, also presents opportunities. "The fear of what a new constitution might entail has now been diluted, given the local political landscape and lesser possibilities of adopting a radical reform of the current economic regime," he said.

Challenges for developing the capital markets

While analysts agree that developing the region´s capital markets is a key factor, they are also aware of the challenges that must be overcome. These are often associated with the notion of "what they should be", namely that the region needs to become more attractive as an investment destination.

For Andrés Abadía, the challenges have to do with political stabilization and the existence of clear rules and regulations that help attract foreign investment.

On the other hand, respect for the rule of law and the level of commitment for strengthening institutions "shall be key factors," according to Fabiano Borsato, so as to be able to ensure the region´s consolidation as a pole of attraction for investing in the securities markets.

Initiatives such as the Capital Market Mission in Colombia, which provided more than 50 recommendations in 2019 for boosting the local stock market sector, left several measures still to be put in place in favor of being able to consolidate a better financial system for the benefit of the public.

From the perspective of an activity-based approach, as opposed to that relating to the type of entity, two relevant impacts can be foreseen: the first is associated with a more adequate risk measurement and the second has to do with product offerings. In this way, according to the Mission's conclusions, the public will have more alternatives to choose from, and greater competition and specialization will encourage innovation and efficiencies, which in turn will result in a more modern market capable of responding better to the needs of its customers.

"In most of the region's stock exchanges, the most important players tend to be state-owned companies associated with commodity exports, so their performance has a significant degree of exposure to political dynamics," said Torino Capital's Chief Operating Officer.

Beyond respecting institutions and economic rules, Andres Balaguera, of Values AAA, believes that one of the biggest challenges has to do with integrating marketplaces: "We must move towards joint state policies in favor of markets, communications between regulated operators and unified tax rates in Latin American countries," concluded Andres Balaguera.

*This article was prepared by the Valora Analitik staff for Grupo SURA. Its content is of a purely journalistic nature and does not compromise any specific positions taken or recommendations made by our Organization.