The growth potential for investments and companies committed to environmental, social and government issues are sparking greater interest for global funds. A global and regional panorama that still presents challenges.

By Valora Analitik for Grupo SURA*

Global investors are paying more and more attention to environmental, social and corporate governance practices, commonly referred to as ESG factors, when making investment decisions. Their participation in responsible funds that observe ESG criteria is currently a frequent strategy, even more so after the impact of the Covid-19 pandemic.

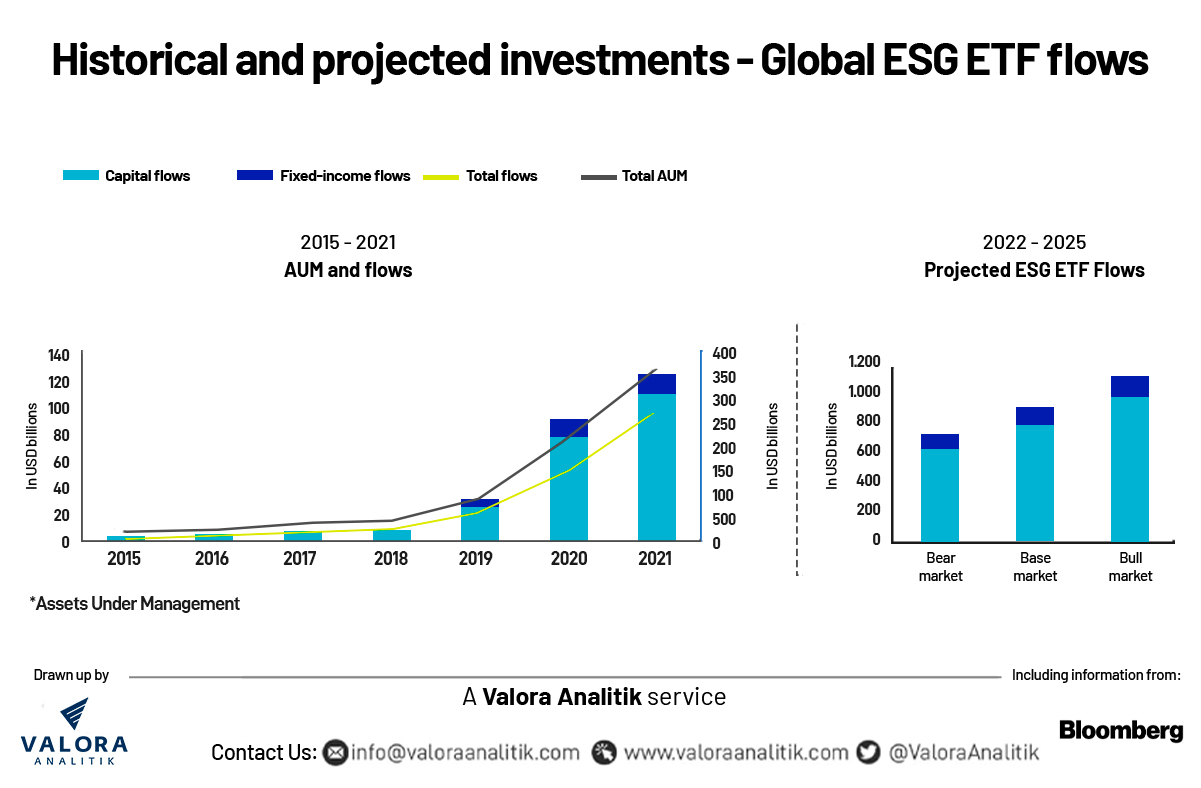

According to consolidated data on the Bloomberg platform, ESG assets exceeded USD 35 billion in 2020, compared to USD 30.6 million in 2018 and USD 22.8 million in 2016, to become a third of total global volume of assets under management.

The Bloomberg forecasts highlight the fact that, assuming a growth of 15% growth, which is a third of the pace recorded over the last five years, ESG assets could exceed USD 41 billion by the end of 2022 and USD 50 billion by 2025. This outlook comes amid an environment of uncertainty in the face of increasing pressure prevailing on the financial markets as well as macroeconomic issues such as high interest rates and inflation levels.

Furthermore, as early as 2021, cumulative ESG inflows from exchange-traded funds (ETFs) exceeded the $121 billion projected by Bloomberg Intelligence, based on a bullish scenario. According to this report, the pace is not slowing, with ESG ETF investments rising for more than 38 consecutive months.

Europe accounts for half of the global volume of ESG assets and dominated the market until 2018. However, the United States is now taking the lead with a growth of more than 40% over the last two years and is expected to exceed the USD 20 billion mark by year-end 2022, even if its rate of growth declines by half of much this year.

Reasons for the ESG investment boom

The reason why the speed of ESG investing is not going to slow and is rather set to continue driving the global markets is the subject of another analysis on the part of Jefferies Group, which notes that investment decisions are increasingly taking into account regulatory and policy changes as national governments and central banks take climate change targets and decarbonization initiatives more credibly.

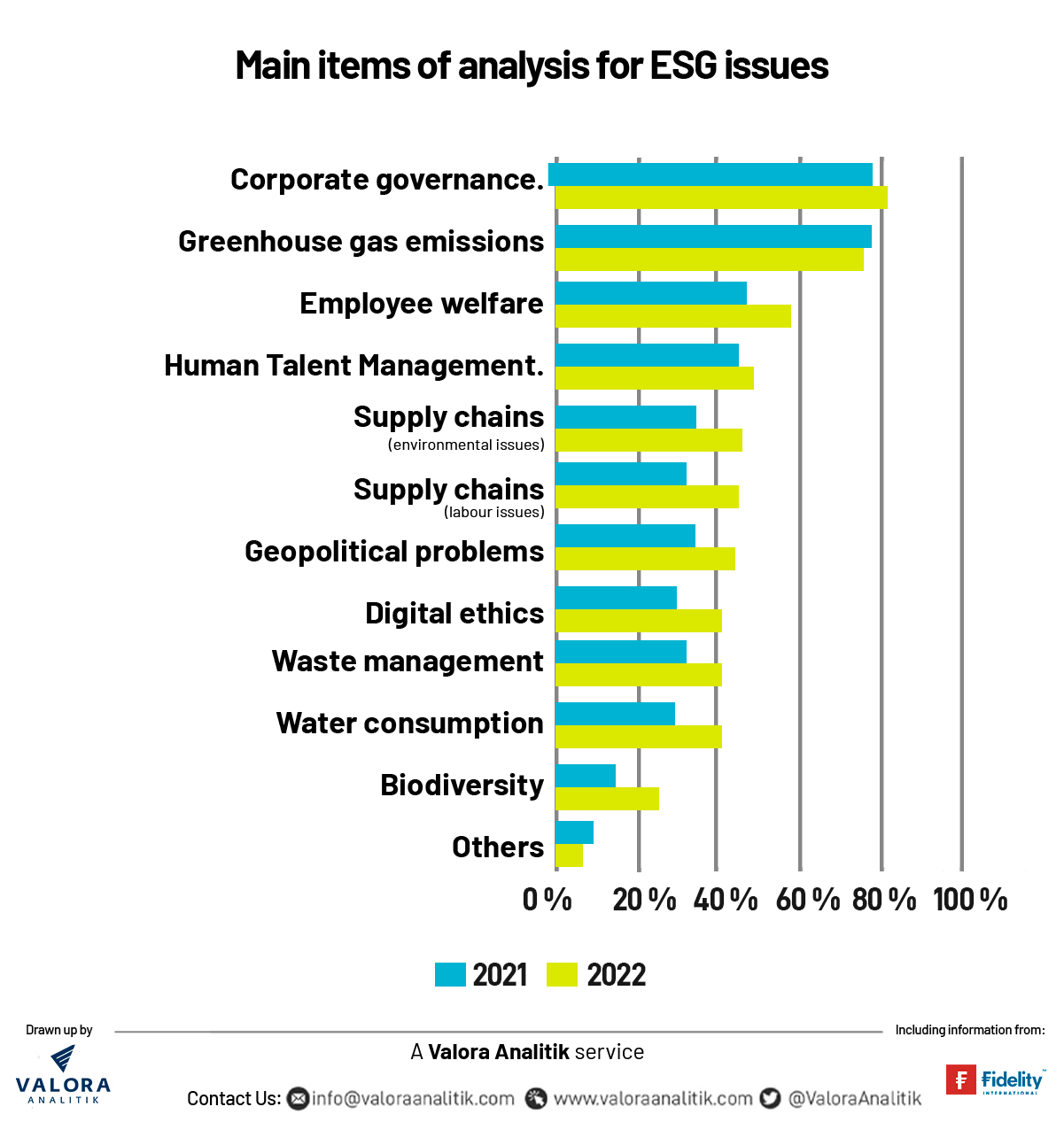

In this regard, the Jefferies Group highlights the importance of corporate governance factors as well as social and environmental initiatives because "hefty decisions are being made to invest in items such as renewable energies. We are also seeing a greater role being played on the part of central banks and private actors, which will become a good supporting factor to what was already happening before 2020”.

Diego Mora, Managing Director for Colombia and Central America at BlackRock explained that "investing based on sustainability criteria is not a fad, it is the right thing to do from the standpoint of our fiduciary duty to seek out the best risk-return ratio for our portfolios".

In fact, according to BlackRock, access to ESG metrics is key to ensuring common frameworks and many companies are already reporting relevant information as standard corporate practice. Since 2018, 86% of the companies listed in the S&P 500 index have published corporate responsibility reports, which shows the relevance of this practice in markets like this one, in the United States.

Likewise, recent studies show that contrary to what was initially thought, incorporating sustainability criteria in investment processes not only does it not imply sacrificing returns, but also allows portfolios to provide a better risk-return profile in the long term.

“And this is based on two fundamental premises. On the one hand, companies that are able to provide a good handling of ESG variables are that much more resilient, that is to say , they can withstand periods of volatility and uncertainty. And on the other, prices of financial assets still do not adequately reflect the massive flow towards sustainable investments, of which we are just seeing the first offshoots”, stated BlackRock's Managing Director for Colombia and Central America.

Lina Uribe, Head of Sustainability at Grupo SURA, also emphasized that there is an increasing awareness of the implications and risks that make ESG criteria visible.

She explained that this is a vision that complements the traditional risk vision and shows that companies with strong ESG criteria, and a proper management of these same, have assets that can become safer and the investments they make are less volatile.

Ms. Uribe added that, although climate change is a priority as well as a differentiating factor in handling ESG issues, "we cannot overlook those Companies that invest in society and its well-being, along with factors concerning corporate governance, since many cases throughout the world are showing that bad corporate governance leads to major problems in the future”.

For this reason, investors are now much more aware of the importance of all ESG aspects, since these generate confidence in the decisions made in terms of ethics and transparency.

Challenges to ESG investment growth

On the other hand, BNP Paribas Securities Services also highlights the importance of investing in strategies based on ESG criteria, since 79% of managers and companies incorporate these criteria in the way they invest or in terms of the products they sell.

In the case of 77% of all insurance companies and pension funds that are currently applying ESG criteria, nearly half of these are presently investing 25% or less of their portfolio in specific strategies based on ESG criteria, and plan to increase this percentage to 50% or more over the next two years.

Similarly, out of 80% of all asset managers that are presently incorporating ESG factors, 40% of these are currently marketing 25% of their funds as linked to ESG or Socially Responsible Investment (SRI) criteria.

However, this figure is expected to increase considerably in the coming years, with more than half of asset managers (54%) trading 50% or more of their funds as ESG products, according to BNP Paribas Securities Services.

Therefore, the implementation of these increasingly responsible practices on a corporate level is crucial today, at a time when attractive strategies must be created for investors, given the present global economic situation and the uncertainty that prevails on the stock markets. In turn, benchmarks such as S&P, the Dow Jones Indices, MSCI ESG Indices and the FTSE4Good Index, track companies that are taking into account ESG criteria.

ESG investment challenges in Latin America

Eduardo Atehortúa, Director for Latin America of the global Principles for Responsible Investment (PRI) network of investors, explains that there are three critical issues in the region regarding ESG aspects:

The first is that it is necessary for “the corporate sector to report better ESG information, thereby fundamentally allowing the investor to better understand the organization's performance and facilitating investment decisions. In this sense, I underline the fact that items such as the information must be comparable and credible”.

The second aspect is that the Latin American corporate sector, mainly its senior management and board members, must expand their knowledge of ESG issues, since this is still scant throughout the region. He also emphasized the presence of generational influences, where improving training is key.

And the third aspect, adds Atehortúa, has to do with political factors, since the business sector must address the just transition towards a low-carbon economy, "to start talking more about that and how we are going to deal with climate change," says PRI's regional director.

For his part, Juan Carlos Mora, CEO of Bancolombia, underlines the need "to continue working to ensure that ESG criteria form part of the strategies of both the business sector and countries as a whole, so as to achieve a level of development based on environmental protection and the well-being of society.

This financial institution is a benchmark in Latin America in this regard and projects close to COP 500 trillion in ESG-based loans by the year 2030. The CEO of Bancolombia added that the intention is to contribute tangible facts to the fulfillment of the Sustainable Development Goals (SDGs) and Colombia's commitment to reduce greenhouse gases by 51% over the next 10 years.

With this global outlook, short- and long-term investments consider relevant analyses on these strategic issues that include, among others, aspects such as future vision, sustainability, talent and culture, financial performance and the international vision of the companies, among others.

*This article was prepared by the Valora Analitik staff for Grupo SURA. Its content is of a purely journalistic nature and does not compromise any specific positions taken or recommendations made by our Organization.