- Suramericana and SURA Asset Management focused their efforts on a series of initiatives including financing for SMEs and programs in support of the current economic recovery.

- The accelerated transformation of our operating models, together with having secured greater efficiencies, implemented expense controls and maintained sustained streams of revenues have paved the way for a positive result.

- The SURA Business Group maintains the required solvency and liquidity ratios with which to tackle the current situation and has taken the appropriate early measures to ensure cash management requirements in 2021.

Grupo SURA and its subsidiaries, Suramericana and SURA Asset Management, have focused their efforts on transforming and adapting their different lines of business so as to continue creating added value for both private individuals and companies that have placed their trust in SURA in the midst of the current pandemic; this as part of their role in making a tangible contribution through the various programs, solutions, funds and products offered so as to drive the current economic recovery and preserve jobs in all 10 countries where we are present.

“We are fully aware that we are still in the midst of this complex, atypical year and still laboring under a great deal of uncertainty unleashed by the COVID-19 pandemic, nevertheless we are pleased to report a resilient level of results for this past third quarter. Now the most important thing that remains to be done is to continue ensuring the well-being of our SURA employees as well as the liquidity and solvency of our companies so as to be able to provide knowledge, solutions and alternatives that are relevant for both private individuals and companies alike at such a crucial time for the region’s economic recovery”, stated Gonzalo Perez, CEO of Grupo SURA.

In this sense, and as part of the different initiatives deployed this year, SURA Asset Management recently arranged for different financing funds to provide liquidity to small and medium-sized enterprises. The Suramericana subsidiaries, based on their trend and risk management expertise, have provided specialized knowledge and advice to more than 82,000 SMEs in a total of nine countries during the pandemic. With regard to the health care services we provide in Colombia, more than 2,300 new jobs have been created and furthermore, with regard to our COVID-19 caseload, the corresponding death rate came to just a quarter part of the average nationwide death rate and less than a third of the average global rate.

Furthermore, our SURA subsidiaries throughout the region have strengthened their operating models by providing customer care services, access and solutions through our digital channels, thereby helping to ensure the biosafety of their clients and employees, while accelerating their technological transformation that in turn is creating greater efficiencies.

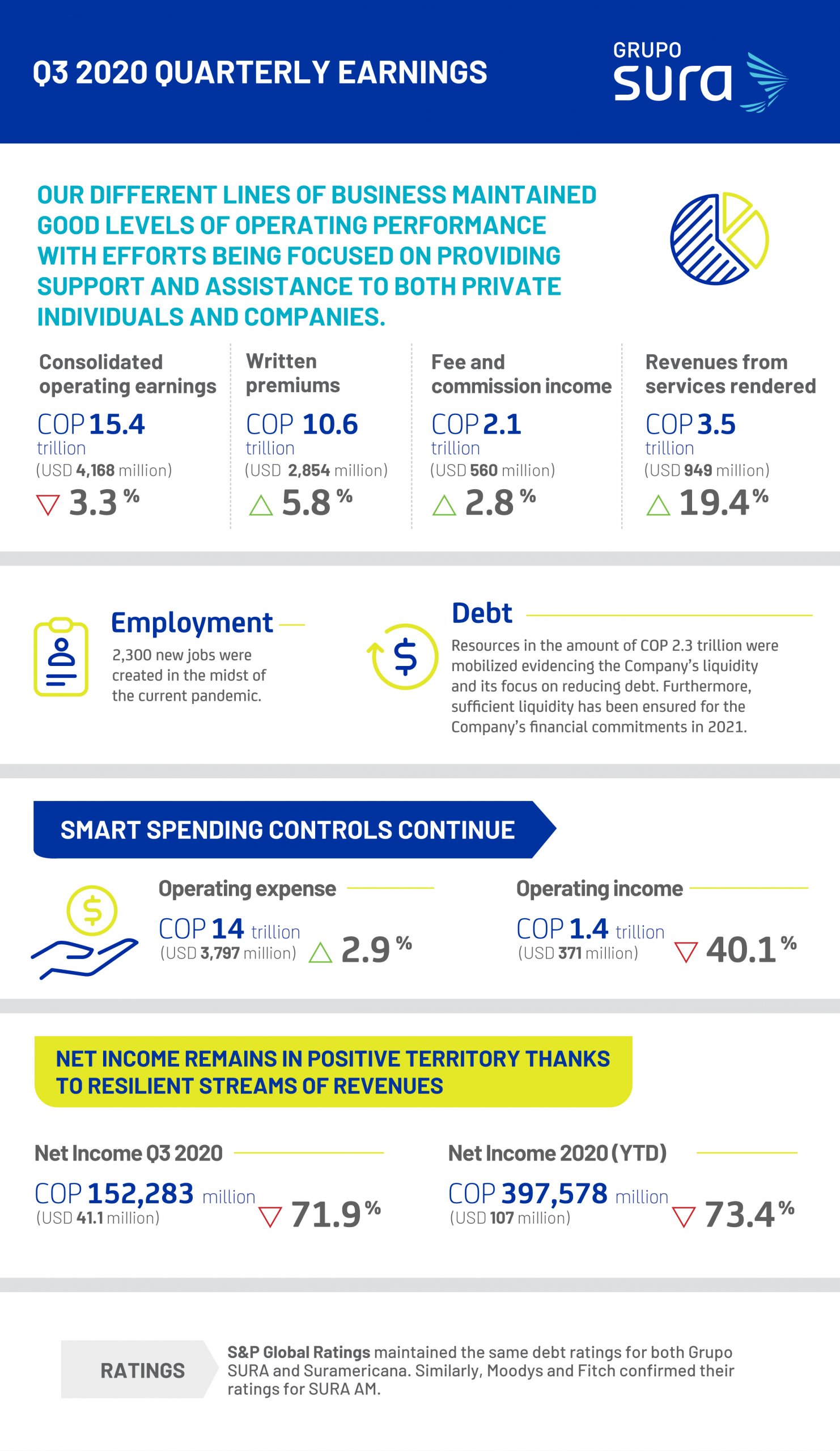

Consolidated results for Q3 2020

The ability to transform our business during the pandemic is also reflected in Grupo SURA's consolidated financial results, which have shown a marked resilience to the ongoing situation, with income declining by just 3.3% at the end of the third quarter compared to the same period last year, this driven by a 5.8% growth in written premiums and a 2.8% increase in fees and commissions this in spite of lower investment returns given the amount of volatility prevailing on the capital markets together with the decline in revenues from associates via the equity method, such as Bancolombia.

"These results show a controlled growth in operating expense of just 2.9%, in spite of the adverse effects of the pandemic, while maintaining a sound financial position and gaining greater efficiencies. Similarly, we have taken appropriate early measures to ensure the necessary liquidity for 2021 as well as for compensating for the impacts of the pandemic on our business," stated Ricardo Jaramillo, Grupo SURA's Chief Corporate Finance Officer.

Consequently, on a YTD basis, Grupo SURA obtained a consolidated net income of COP 397,578 million (USD 107.3 million), which is 73.4% lower than that posted for the same period last year

Subsidiary performance

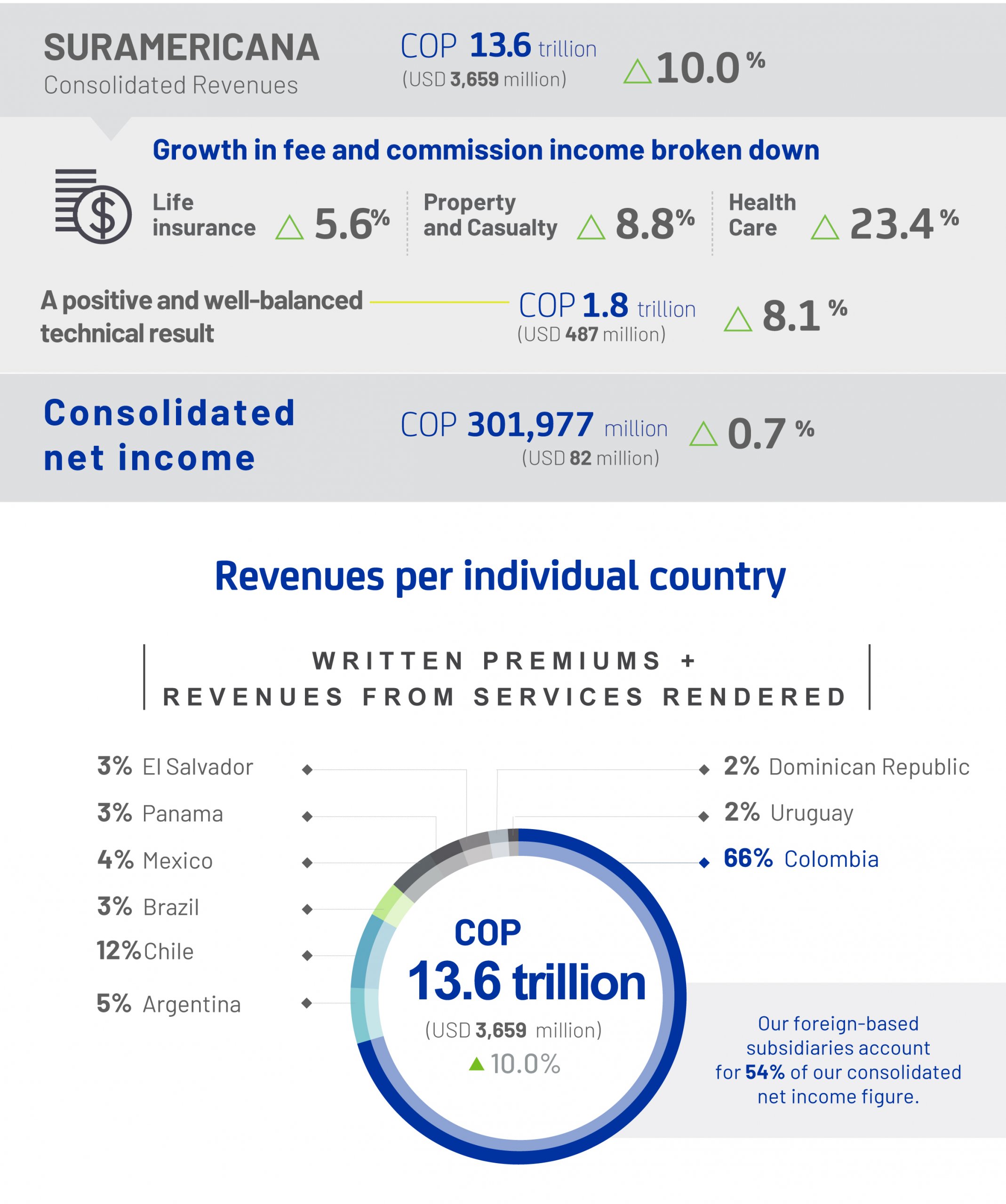

Suramericana (specializing in insurance as well as trend and risk management) obtained a YTD growth of 10% in total revenues at the end of Q3 2020, with operating expense increasing by 6.8% and net income rising by 0.7%, for a total of COP 301,977 million (USD 81.5 million). In addition to a good level of sales performance, it is important to note that Suramericana managed to sustain its net income in spite of a higher claims rate particularly in the Life Insurance segment as well as higher costs of health care services rendered. This was made possible, by a strict control over non-essential expense, and more diversified streams of revenues, with our foreign-based subsidiaries accounting for 54% of Suramericana’s net income figure at the end of Q3 2020.

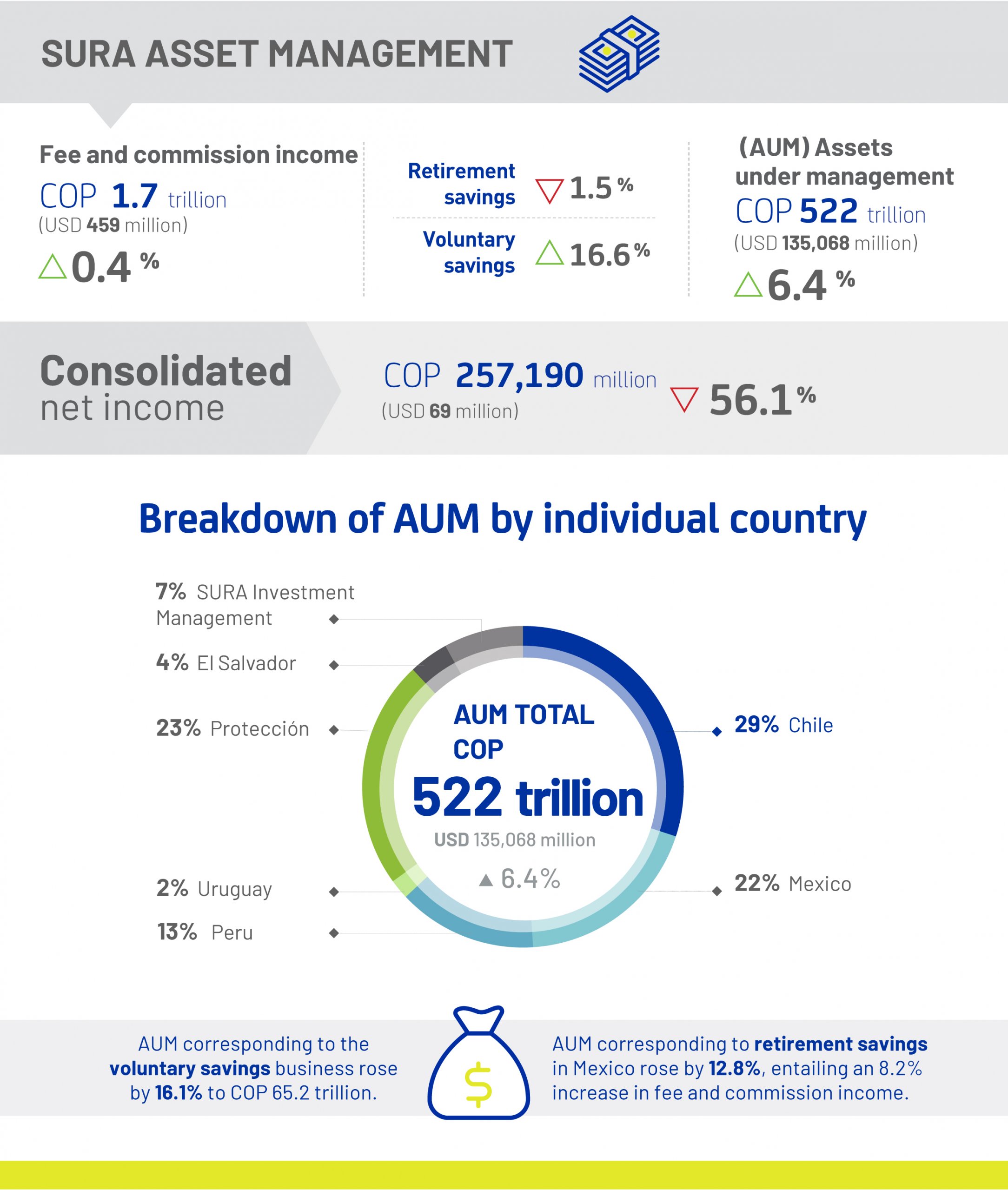

SURA Asset Management (an expert player in the pension, savings, investment and asset management industries) was able to maintain the same level of fee and commission income, this partly due to its voluntary savings business, as well as the geographic diversification of its retirement savings business, thereby demonstrating a good level of resilience even amid rising unemployment throughout the region as well as the regulatory tariff cuts introduced in some countries. This partially offset lower returns from the legal reserves held by our pension funds. Operating expense increased by just 2.9% with net income ending up at COP 257,190 million (USD 69.4 million), which was 56.1% lower than the YTD figure for the same period last year. However, it is well worth mentioning the 16% growth in AUM corresponding to the voluntary savings segment.