Net income came to COP 950,715 million (USD 298.1 million) thanks to higher levels of returns on investment portfolios as well as revenues obtained from the equity method.

Operating income rose by 13.3% compared to the same period last year, reaching COP 10.5 trillion (USD 3,297.9 million).

The results obtained during this first half of the year showed a growth that is furthering Sura Business Group’s financial strength, which continues to be one of our top strategic priorities.

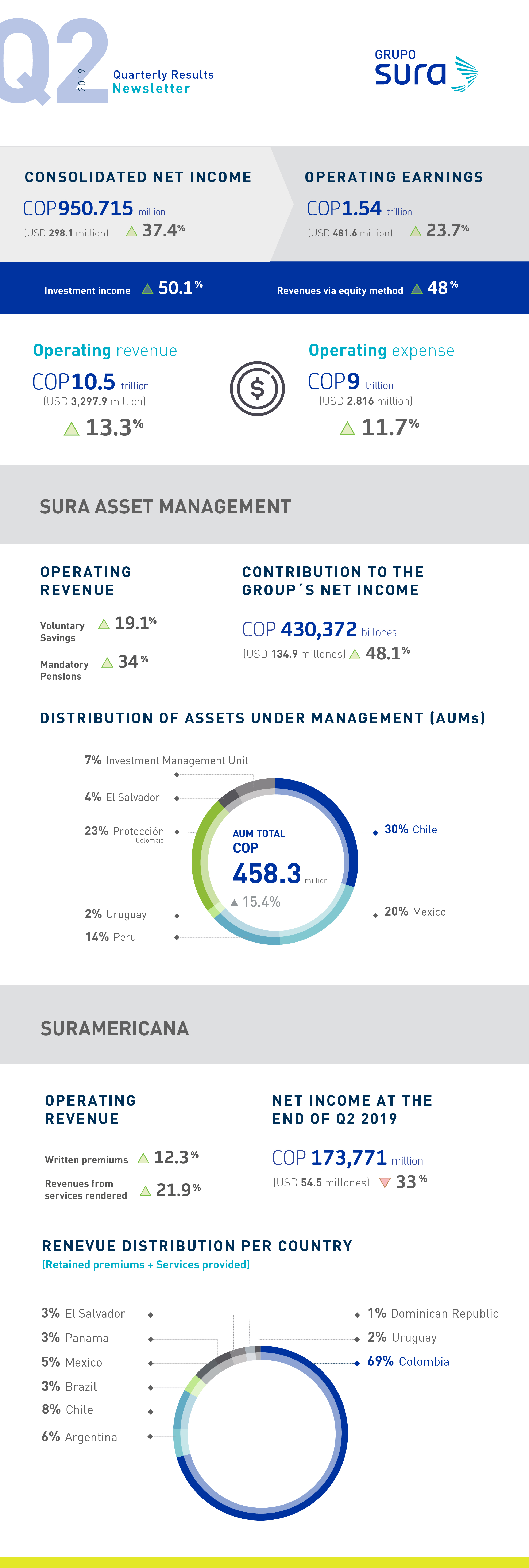

Grupo SURA reported its quarterly earnings for Q2 2019 on Wednesday 14, which showed a 37.4% increase in YTD net income at the end of said quarter reaching COP 950,715 million (USD 298.1 million *). This is mainly due to a recovery in the returns obtained from the portfolios belonging to the pension fund management and insurance subsidiaries, together with good levels of sales dynamics at subsidiary level and improved revenues obtained from associates via the equity method.

Operating income rose to COP 10.5 trillion (USD 3,297.9 million), for an increase of 13.3%. This was higher than the 11.7% increase in total expense, that ended up at COP 9 trillion (USD 2,816.4 million).

“We are seeing a growth in net income thanks to higher returns obtained from our investment portfolios in keeping with the recovery of the capital markets as well as higher revenues from associates, especially Bancolombia and Proteccion; while Suramericana and SURA Asset Management continue with a good level of sales dynamics throughout the region. This, in spite of the impact that certain issues had on some of our lines of business, namely new taxes, a higher claims rate for the Colombian mandatory healthcare subsidiary (EPS) and adjustments for inflation in Argentina, " stated David Bojanini García, Chief Executive Officer of Grupo SURA.

Subsidiary performance

SURA Asset Management contributed to Grupo SURA´s consolidated results with a net income figure of COP 430,372 million (USD 134.9 million), showing an increase of 48.1% compared to the same period last year. It is worth noting the 34% growth in operating income from the mandatory pension business, and another 19.1% growth from the Voluntary Pension business, which includes savings and investment for private individuals as well as the SURA Investment Management unit.

At the end of Q2 2019, this subsidiary´s client base numbered 20.2 million with Assets under Management (AUM) totaling COP 458 trillion (USD 142.971 million **), for a year-on-year increase of 15.4%.

SURA Asset Management continues to consolidate its leadership position in the Latin American pension industry while driving the value-added offering of its savings and investment business. The projects in which the Company has been investing are aimed at securing greater operating efficiencies, enhancing our customer service levels and improving our overall investment processes.

On the other hand, Suramericana, operating in nine countries across the region, obtained growths in consolidated revenues from written premiums and services rendered of 12.3% and 21.9% respectively. Furthermore, investment income rose by 15.1% for this first half of the year.

However, YTD net income at the end of Q2 2019 amounted to COP 173,771 million (USD 54.5 million), for a decline of 33%, this due to various issues including a higher claims rate for our mandatory healthcare subsidiary, given the increase in its membership base and the general state of the healthcare sector in Colombia; VAT levied on life insurance broker commissions, also in Colombia, this as a result of the new Financing Law; as well as inflation adjustments in Argentina, affecting investment income.

As for this subsidiary´s latest performance, it is worth noting its market development strategy and the successful launching of the SURA Enterprise program, which is aimed at transcending its insurance business and providing skills and capabilities to the micro and SME sector in Latin America.

Holding Company Results

In terms of Grupo Sura´s performance in its role as Holding, it is worth noting the growth in net income thanks to level of results obtained by Bancolombia and Protección, along with lower interest expense and the positive exchange rate effect corresponding to hedging arrangements as well as exchange differences on the Group´s indebtedness.

Consequently Shareholders´ Equity for this first half of the year came to COP 27.6 trillion (USD 8,612.4 million), which was 2.68% higher than for the same period last year, as we continue to make progress with our deleveraging initiative.

"These results also evidence our focus on building our financial strength and investment capacity, which continues to be one of our Business Group´s strategic priorities. We would also like to underscore the reduction made so far to Grupo SURA´s individual financial debt. So far this year we have amortized COP 265 billion of our indebtedness and expect to reach COP 330 billion by year-end, as initially projected”, concluded Ricardo Jaramillo, Grupo SURA´s Chief Corporate Finance Officer.

* Figures taken from the Group´s Statement of Financial Position based on the average exchange rate corresponding to the first quarter of the year: COP 3.189.40

** Exchange rate at the end of Q1 2019: COP 3.205.67