- The Company had a net profit before accounting impacts, due to divestments of COP 1.4 billion (USD 475.7 million) during the year, and COP 300,848 million (USD 454.4 million), in the Fourth Quarter.

- Suramericana (insurance, trends, and risks), recorded a net profit, for the year, in the amount of COP 524,867 million, which represents an increase of 3.6%.

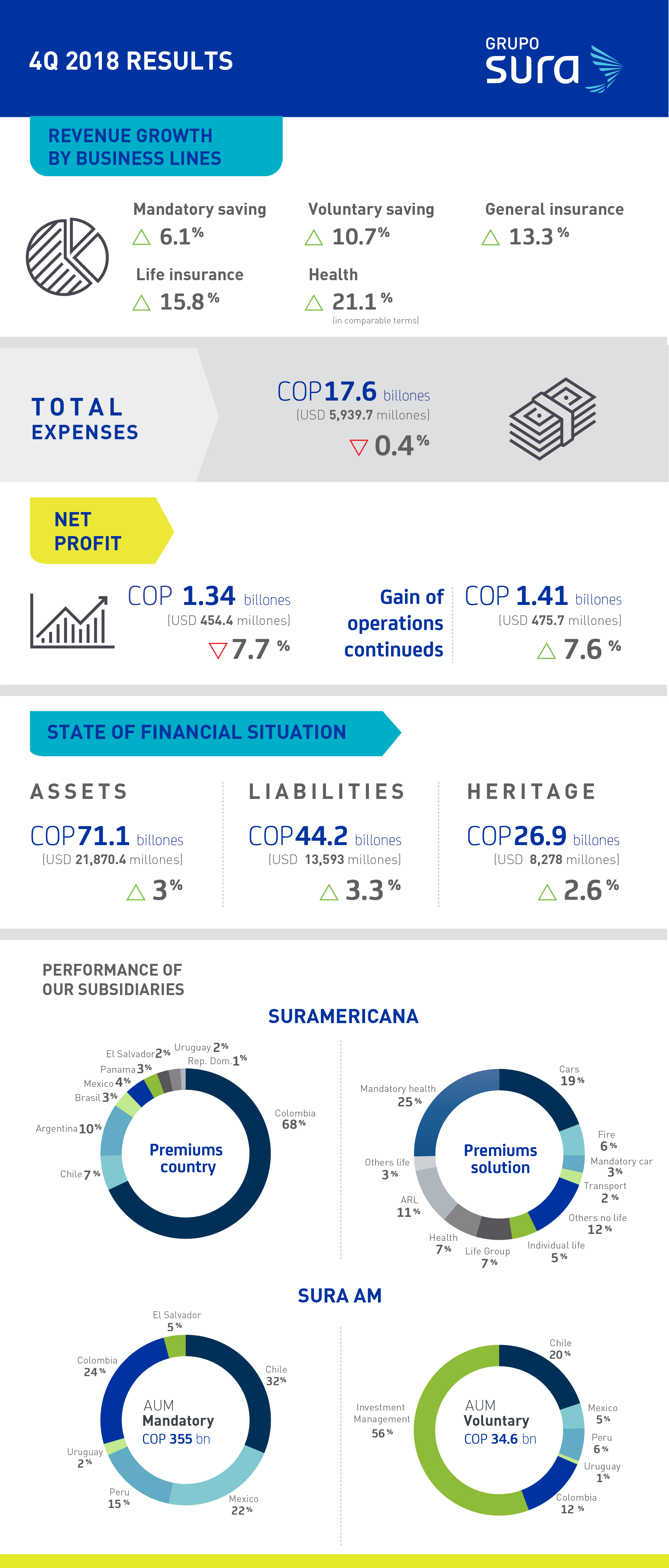

- SURA Asset Management (pensions, savings, and investment) grew its business revenue, in comparable terms by 6.1% for mandatory and 10.7% for the voluntary.

Grupo SURA reported their Financial Results for the Fourth Quarter of 2018, which highlights a positive operating performance and organic growth of the main business lines of the subsidiaries of Grupo SURA, as well as the 7.6% annual increase and 28.3% in the last quarter of the net profit before the accounting effects of divestments.

In comparable terms, Suramericana’s revenues (specializing in insurance, trends and risk management) grew in all its segments: General (13.3%), Life (15.8%), and Health (21.1%). Likewise, in SURA Asset Management (experts in pensions, savings and investment) the mandatory business increased by 6.1% and the voluntary by 10.7%.

Also, in 2018 strategic decisions were made with the objective of making the main businesses of the subsidiaries profitable, which generated lower income impact in the short-term, among which the following are notable: the divestment of the life annuity operation in Chile, by SURA Asset Management, which is in the process of approval by regulators, the decision not to participate in the bidding of the pension insurance, in Colombia, and a change was also made in the method for registering premiums of the voluntary health policies, of Suramericana.

"The operating growth of the main lines of business of Suramericana and SURA Asset Management, in 2018, as well as higher efficiencies, allowed us to offset, part of the impact, from the high volatility that the financial markets had on the returns of the Companies’ investments, throughout the year. Strategic decisions were also made, in our subsidiaries, to ensure profitable and sustainable growth, in the long-term", said David Bojanini, CEO of Grupo SURA.

Under these conditions, the total consolidated revenues were COP 19.2 billion (USD 6,507.8 million) and decreased by 0.8 % during the year because of the volatility of capital markets, which impacted the revenue yields of the investment portfolios, of pension and insurance companies. In addition, the strategic decisions, mentioned in the insurance business and the devaluation of local currencies, due to fewer accidents and adjustments to reserves, as well as and increased cost control.

As a result, earnings before accounting impacts grew 7.6% to COP 1.41 billion (USD 475.7 million) and the net profit was COP 1.34 billion (USD 454.4 million), 7.7% less than in 2017, which reflects the lower income from yields and the accounting impacts associated with the mentioned divestments, which do not impact the cash flow.

Results of our subsidiaries

Suramericana's net income increased by 3.6% in 2018, adding up to COP 524,867 million (USD 177.5 million). There were notably fewer accidents, which boasted a 13% increase in the technical result and control in operating expenses.

"In the last year, we made significant progress in consolidating Seguros SURA, in the region, highlighting that we met our income and profit budgets. Also, in 2018 we evolved our value offer, with, for example, the introduction of individual life and equity solutions, in countries other than Colombia, as well as by reaching greater efficiency and creating value in operating models, as well as channel management, always seeking to be more refined and relevant to people and businesses”, highlights Gonzalo Pérez, CEO of Suramericana.

In turn, SURA Asset Management grew its commission income by 6.6%, which totaled COP 2.1 billion (USD 706.6 million). The Assets Under Management (AUM) increased by 2.8%, for a total value of COP 418.6 billion (USD 128,798 million), from 19.6 million customers, which increased by 4.1%, in the year.

The normalized operating profit of the subsidiary grew 0.4% and contrasted against net profit that decreased to 39.7%, explained by an accounting loss associated to the divestment annuities in Chile, lower income from reserve requirements and impacts partially offset by operating income.

"We had a good year, in terms of operations, and we made progress in the implementation of projects that allowed us to approach and accompany our almost 20 million customers, in the region. Another relevant aspect, of the last, was the consolidation and start-up of the Investment Management Unit, that serves institutional clients and seeks to be the leading investment platform in Latin America", said Ignacio Calle, CEO of SURA Asset Management.

Grupo SURA closed the Fourth Quarter of the year with assets amounting to COP 71.1 billion (USD 21,870.4 million), 3 % more than in December of 2017. Liabilities grew a 3.3 %, to COP 44.2 billion (USD 13,593 million), while equity increased 2 .6%, closing at COP 26.9 billion (USD 8,278 million).

Highlights of the Fourth Quarter of 2018

- Grupo SURA was honored with the Silver Medal (Silver Class) when it was included in the Sustainability Yearbook of RobecoSAM. This recognition reflects a permanent commitment to responsible and comprehensive management.

- The Caisse de Dépôt et Placement du Québec (CDPQ) reached an agreement to acquire the shareholdings of Grupo Bancolombia (3.65%) and Grupo Wiese (3.03%), in SURA Asset Management.

- AFP Integra, a SURA AM company, in Peru, won the bidding for affiliates to the private pension system, which expects to add about 800 thousand new members and rejuvenate its customer base.

- SURA Asset Management Chile announced a strategic alliance with J.P. Morgan Asset Management, one of the leading Mutual Fund Managers, in the world.