- This shows the positive levels of performance on the part of the different lines of business of both Suramericana and SURA Asset Management throughout the region, which produced a 45% increase in accumulated operating earnings which stood at COP 3.4 trillion at the end of Q3 2023.

- Grupo SURA’s controlling net income came to COP 1.1 trillion which, upon excluding the non-recurring accounting effects of divestitures, would have totaled COP 1.9 trillion at the end of the last quarter having risen by 35%.

- Grupo SURA obtained positive ratings as a result of independent sustainability assessments that were carried out by S&P, MSCI and Sustainalytics.

This Tuesday, Grupo SURA presented to the market its financial results for the third quarter of this year. At the end of Q3, the Company posted COP 26.5 trillion in revenues, up by 28% compared to the same period last year, with operating earnings amounting to COP 3.4 trillion, for a year-on-year increase of 45%. These results are due to the growth in premiums in Suramericana's insurance segments, even with the higher claims rate in the health care segment in Colombia, as well as the increase in SURA Asset Management's revenues, particularly from fees and commissions corresponding to the Savings and Retirement line of business as well as YTD returns from legal reserves and greater operating efficiencies.

Consequently, Grupo SURA recorded a controlling net income of COP 1.1 trillion at the end of Q3, a figure that, upon excluding non-recurring accounting effects affecting the comparability of the figures, would have come to COP 1.9 trillion 1, for an increase of 35% compared to the same YTD period last year. These effects consist of: (i) deferred tax on the Nutresa transaction, which does not as yet represent cash items; (ii) the fact that the Nutresa investment has now been excluded from the Revenues via the Equity Method account; and (iii) Suramericana´s divestitures in Argentina and El Salvador.

"In this past third quarter, we would like to highlight the operating performance of the different businesses that make up our portfolio, which has allowed us to remain on a path to further growth in terms of our revenues and controlling net income, this upon excluding the aforementioned specific accounting effects. We also remain focused on implementing the Framework Agreement, which will bring benefits to our shareholders as well as the Company as a whole, this based on a more focused investment portfolio in the financial service segment," stated Gonzalo Pérez, CEO of Grupo SURA.

Likewise, Grupo SURA's bottom line at the end of this past third quarter reflects the amount of revenues obtained via the equity method from associated portfolio companies, which totaled COP 1.5 trillion, mainly from Bancolombia and Grupo Argos, taking into account that for this last quarter Grupo Nutresa is no longer accounted for as part of this line item.

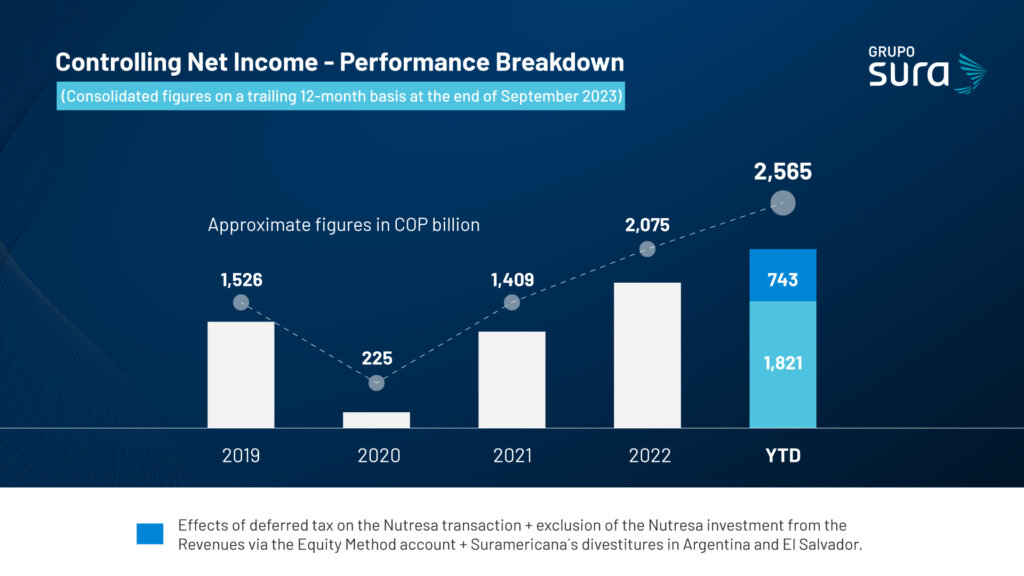

In this context, the Company's controlling net income on a trailing 12-month basis continues to perform well thereby reflecting the soundness of the Company’s strategy in its role as an investment manager:

Subsidiary performance

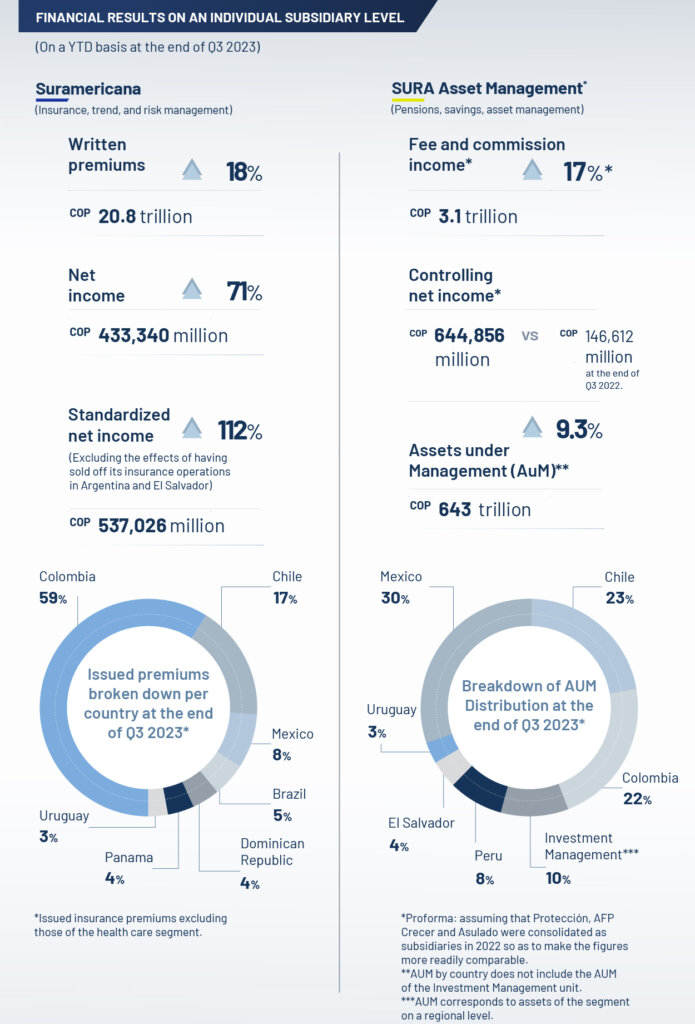

In the case of SURA Asset Management, fee, and commission income for Q3 2023 came to COP 3.1 trillion, which in comparable terms2 represented a pro forma growth of 17% versus the same period last year. Controlling net income closed at COP 645 billion, for an increase of 343%, this driven by a growth in fee and commission income that exceeded expense, along with an increase in assets under management (AUM) and the YTD returns of the pension funds' own investments (legal reserves). This subsidiary's profitability continued to improve ending up with an adjusted ROE of 9% on a trailing 12-month basis.

Suramericana's written premium income increased by 18% at the end of Q3, totaling COP 20.8 trillion, thanks to the growths recorded for all its insurance segments. These results also reflected the effect of a higher claims rate (73.4%3 at the end of Q3 2023), in spite of the improvement with this indicator in the Life and Property and Casualty insurance segments, this due to an increase in both the frequency and severity of claims corresponding to the Mandatory Health Care subsidiary (EPS SURA). With this, YTD net income at the end of Q3 rose by 71% to reach COP 433 billion, thanks to better levels of performance with the Life and Property and Casualty insurance segments, in contrast to the accumulated losses in Health Care, corresponding to the Mandatory Health Care subsidiary (EPS SURA); were we to exclude the effect of the recent divestitures in Argentina and El Salvador, this bottom line figure would have amounted to COP 537 trillion, that is to say 112% higher compared to the same YTD period last year. On the other hand, adjusted ROE on a trailing 12-month basis came to 11.6%

"The results we are currently reporting to the market this quarter reaffirm the benefits of an investment portfolio that is not only diverse in terms of geographies, but also in risk levels, lines of business and channels. The strength of this sound mix is reflected in a controlling net income that, upon excluding the impact of non-recurring effects, reached COP 2.6 trillion on a trailing 12-month basis ending this past quarter," stated Ricardo Jaramillo, Grupo Sura´s Chief Business Development and Finance Officer.

Recent Highlights:

- Grupo Sura announced in September that its Board of Directors gave its approval to arranging and implementing certain amendments to the Framework Agreement, this in order to speed up and make more efficient the process of exchanging the Company's stake in Grupo Nutresa for the Company’s own shares and those of Grupo Argos.

- Grupo SURA received various external ratings on its sustainable management of economic, environmental, social and governance (ESG) matters, which also included the performance of both Suramericana and SURA Asset Management:

- S&P ranked the Company’s performance above 98% out of a total of 618 companies belonging to the Diverse Financial Services sector that were included in S&P´s Corporate Sustainability Assessment (CSA).

- MSCI awarded the Company a "BBB" rating highlighting its performance in sustainable investment and human talent development.

- Sustainalytics issued an ESG management rating of 71.8 out of total of 100, which places the Company at a low sustainability risk within its respective sector.

- The Corporate Reputation Monitor (MERCO) ranked SURA as the sixth organization with the best reputation in Colombia; Seguros SURA and Protección maintained their leadership in their respective sectors. Likewise, the CEOs of the Companies belonging to the SURA Business Group in Colombia were included among the 100 most valued leaders in the country.

- This year´s #PensarConOtros initiative for building citizenship and democracy in Colombia received 474 proposals from 29 departments in all 4 of its different modalities. This is the third year that this initiative being held, and Grupo SURA now has the Bolivar Davivienda Foundation as a partner. The projects selected for implementation next year shall be announced on November 28.

1 Non-recurring effects in the Financial Statements total COP 743 billion at the end of Q3 2023.Financial results

2Proforma variations assume that SURA AM consolidated Protección and AFP Crecer in 2022 in order to make the figures more readily comparable.

3 Corresponds to retained claims / retained earned premiums.