- Consolidated net income reached COP 1,5 trillion (USD 460.8 million), for an increase of 31.1% for Q3 2019 alone.

- Operating income rose by 14.8% to COP 16.2 trillion (USD 4,999.7 million), which was higher than the increase in consolidated expense (13%).

- Specific impacts on some operations were offset by the good levels of performance of its core subsidiaries, SURA Asset Management and Suramericana as well as their own particular investment portfolios.

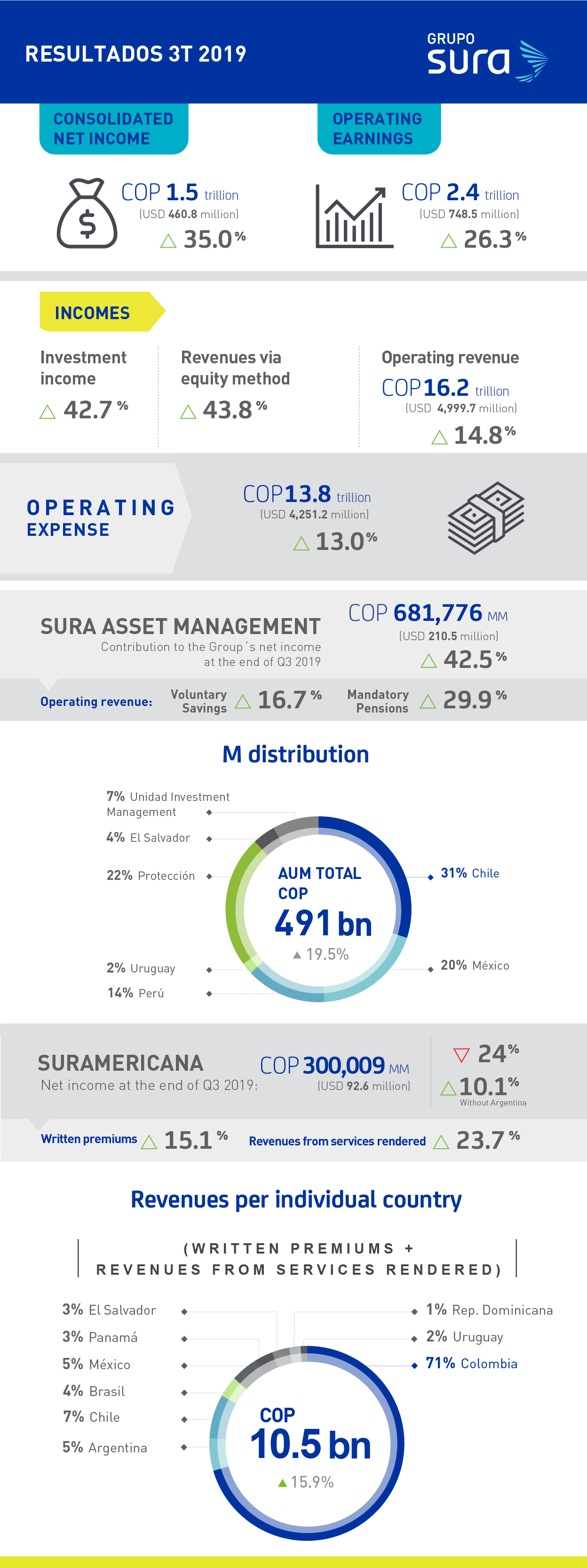

Grupo SURA reported its financial results for this past quarter, the most salient highlights being a 35% growth in YTD net income that is to say, COP 1.5 trillion (USD 460.8 million *), which is a record high in terms of YTD earnings at the end of a third quarter, while surpassing the net income figure for all of last year (COP 1.3 trillion). Net income for this past third quarter alone stood at COP 542,116 million (USD 167.3 million), for an increase of 31.1% compared to the same period last year.

This amply evidences the good levels of performance obtained by the Group's core subsidiaries, Suramericana and SURA Asset Management as well as higher returns on investment portfolios, and increased revenues obtained from associates via the equity method, particularly, Bancolombia and Proteccion.

“The results obtained for this past third quarter show that it has been a good year for Grupo SURA and its different businesses, thanks to our well-diversified sources of revenues in spite of the economic and social challenges facing the region. That is why we are renewing our commitment to driving the sustainable development of our Latin American citizens as well as their present and future well-being through the efforts of each of the Companies that belong to the SURA the Business Group,” stated David Bojanini, Chief Executive Officer of Grupo SURA.

Operating income rose by 14.8% at the end of Q3 2019, reaching COP 16.2 trillion (USD 4,999.7 million), for a double-digit growth for our main operations, while consolidated expense rose at a slower rate, that is to say 13% to stand at COP 13.8 trillion (USD 4,251.2 million). Consequently, operating earnings rose by 26.3%, to COP 2.4 trillion (USD 748.5 million), which is in keeping in line our focus on gaining greater efficiencies and maintaining expense and the claims rate under firm control.

“These results show the benefits of our well-diversified sources of revenues, our ongoing focus on achieving a profitable level of organic growth and the positive effects of optimizing our invested capital. Furthermore, SURA Asset Management and Suramericana showed a good level of operating performance which offset specific impacts such as the economic situation in Argentina and the situation of the healthcare sector in Colombia,” added Ricardo Jaramillo, Grupo SURA’s Chief Finance Officer.

SURA Asset Management contributed a net income figure of COP 681,776 million (USD 210.5 million) to Grupo SURA´s consolidated results, showing an increase of 42.5% compared to the YTD figure recorded for this same period last year. This was due to higher returns obtained on this subsidiary’s portfolio, an 8.9% increase in commission income in the Mandatory pension business , in spite of recent regulatory cuts to these charges in certain countries, as well as a 14.3% increase in revenues obtained from its Voluntary business, handled by its Savings and Investment as well as Investment Management Units .

On the other hand, Suramericana produced a 15.1% growth in revenues from written premiums as well as a 23.7% increase in revenues from services rendered in its healthcare segment. YTD growths in premiums on an individual segment basis were led by Life Insurance with 24% trailed by Property and Casualty with another 9.7%.

However, this subsidiary’s net income figure declined by 24% at the end of Q3, 2019, reaching COP 300,009 million (USD 92.6 million), this due to the following three factors: VAT now levied on life insurance commissions in Colombia; higher claims rates and costs given the amount of users migrating to the mandatory healthcare provider, EPS SURA, also in this country; as well as the results of the Argentinean subsidiary, which were affected by high levels of inflation coupled with the depreciating Argentinian peso and lower investment income. If we were to exclude the effects of this situation in Argentina, Suramericana’s net income would have risen by 10.1% at the end of Q3 2019.

Quarterly Highlights

- Afore SURA, a subsidiary of SURA Asset Management in Mexico, received the Morningstar Plata rating, the highest awarded this year to the country's pension fund management firms. Analysts made special mention of the firm’s " deep talent pool" and the fact that its staff "inspires confidence."

- Empresas SURA, a program through which Suramericana provides its specialized support to Small and Medium-Sized Enterprises in Latin America, is now up and running in Colombia, Panama and Brazil, and is scheduled to be rolled out in Argentina, the Dominican Republic and Mexico by the end of this year.

- On October 5, more than 3,200 SURA employees throughout the region took part in our Corporate Volunteer Day, called Sumando Voluntades. This was held simultaneously in 27 cities in all 10 countries throughout Latin America, where the Sura Business operates.

Finally, Grupo SURA posted a consolidated shareholders’ equity of COP 28.8 trillion (USD 8,292.7 million **), at the end of Q3 2019 for an increase of 7.2% compared to the figure recorded at year-end 2018, this as a result of the increase in consolidated net income.

* Figures taken from the Group´s Statement of Financial Position based on the average exchange rate on a YTD basis at the end of Q3 2019: COP 3,239.57.

** Based on the exchange rate at the end of Q3 2019: COP 3,477.45.