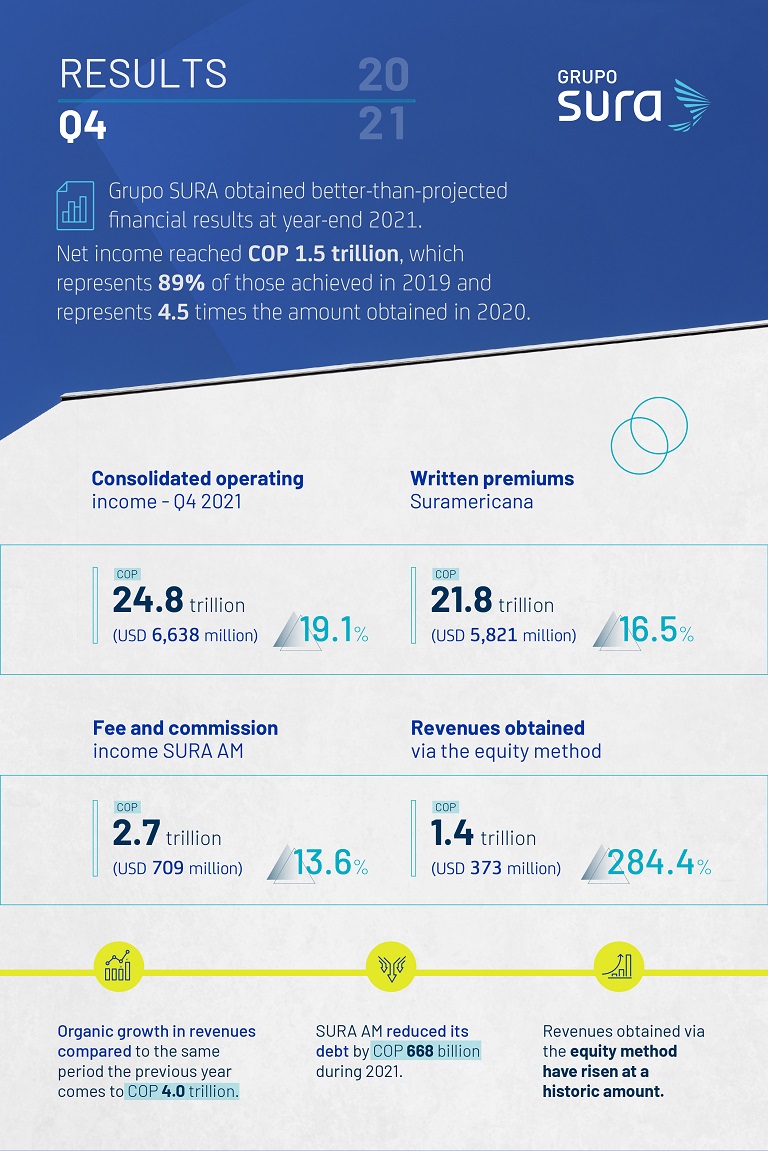

- Operating earnings came to COP 24.8 trillion, that is to say COP 4 trillion more than that corresponding to 2020, due to the performance dynamics of its subsidiaries and a record high in revenues obtained via the equity method.

- Grupo SURA made strides with different initiatives in 2021 with regard to the integrated management of financial, social, human and natural capital, to ensure its ongoing sustainable profitability.

- This year, Grupo SURA expects its net income to increase between 10% and 15%.

- Grupo SURA's Board of Directors shall propose at the upcoming Annual Ordinary Shareholders' Meeting to be held on March 25 an ordinary dividend of COP 784 per share, for an annualized growth of 30%.

Grupo SURA reported to the market its year-end consolidated results for 2021, which show a better-than-expected recovery, thanks to the resilience of Suramericana's businesses, the progress of SURA Asset Management and the recovery of the other strategic portfolio investments, namely Bancolombia, Grupo Nutresa and Grupo Argos.

Operating revenues increased by 19.0%, that is to way, an organic growth of COP 4 trillion in a single year, for a total of COP 24.8 trillion (USD 6,638 million*) for a growth of 16.5% compared to that corresponding to 2019, prior to the pandemic. This was driven by increases in (i) written premiums on the part of Suramericana; (ii) fee and commission income obtained by SURA Asset Management, as well as (iii) the good performance of the equity method in associated companies which had a record amount, given the freeing up of provisions with Bancolombia due to a lower risk exposure to its loan portfolio.

"The results obtained at year-end 2021 exceeded our growth expectations for all of the SURA lines of business thereby bringing us closer to our pre-pandemic figures. They also reflect our commitment to creating added value for our shareholders and to the harmonious development of society this with a long-term view. In 2022, we shall continue to support the profitability efforts of our portfolio companies and their initiatives to provide greater wellbeing to our Latin American people," said Gonzalo Pérez, Chief Executive Officer of Grupo SURA.

Operating expense increased by 15.7% during the year, mainly due to a higher claims rate at Suramericana as a result of the pandemic, which was partially mitigated by a greater control over administrative expense as well as greater efficiencies obtained by the different companies. Consequently, consolidated operating earnings rose by 59.2% to COP 2.6 trillion (USD 685 million) and consolidated net income came to COP 1.5 trillion (USD 407 million), 4.5 times higher than for 2020 and corresponding to 89% of that obtained in 2019. Consolidated shareholders' equity rose to COP 31.3 trillion (USD 7,853 million**), for an increase of 9.5%, this driven by the increase in net income.

"Our financial performance at year-end 2021 is approaching pre-pandemic levels. The good levels of business performance, adequate flows of income and ongoing expense controls shall allow us to move forward in 2022 on a positive path towards providing an economic return above the cost of capital for our shareholders," stated Ricardo Jaramillo, Chief Business Development and Finance Officer of Grupo SURA.

According to current business plans, by year-end 2022 Grupo SURA would obtain a consolidated net income between 10% and 15% higher than that recorded for 2021, which would allow the return on adjusted equity (adjusted ROE) rising by between 8% and 9%*.

Non-financial highlights in 2021:

As part of our ongoing strategy, Grupo SURA has deployed and assisted its subsidiaries in various initiatives that form part of its handling of human, social and natural capital.

- An action framework was introduced to manage the risks and opportunities associated with climate change and the Group´s Sustainable Investment Policy was updated in line with global trends.

- The Company´s human rights strategy and the exposure to human rights risks on a sectorial basis were defined in order to adequately manage potential human rights violations.

- Companies belonging to the SURA Business Group recorded a total of 33,408 employees and over the last year much emphasis was placed on preserving jobs as well as providing opportunities for young people last year. In this regard 42% of the 5,279 new hires corresponded to the under 30s age group.

- The SURA Foundation in Colombia celebrated its 50th Anniversary and last year grew hand in hand with a total of 126 institutions with which it promoted 95 initiatives that benefited more than 124 thousand people and almost 1,500 organizations.

- Grupo SURA remains the only Latin American company in the diverse financial services industry included in S&P's Dow Jones Sustainability Index. It also won the bronze medal in the Sustainability Yearbook 2022.

Subsidiary performance

SURA Asset Management (expert in retirement savings, savings, investment and asset management) amassed 21.6 million clients in six countries throughout the region and its assets under management increased by 7.4% to COP 566 trillion (USD 142,163 million). In 2021 it recorded COP 3 trillion (USD 810 million) in operating earnings income which was 10.6% higher than for the previous year.

This was mainly driven by its fee and commission income, which increased by 11.8% in the Retirement Savings business and 25.4% in the Voluntary Savings segment, through Inversiones SURA (voluntary savings for private individuals) and SURA Investment Management (the regional platform for the institutional segment). All in all, SURA AM's consolidated net income rose by 45.3% reaching COP 626,838 million (USD 167 million). It is worth noting that in 2021, this subsidiary continued its deleveraging initiative, reducing its debt by COP 667,978 million (USD 155.9 million).

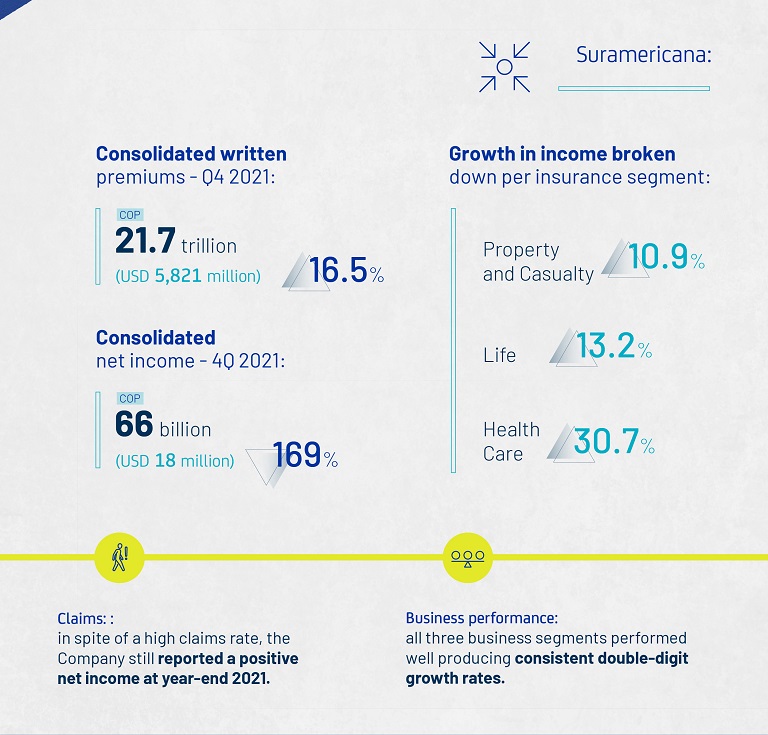

For its part, Suramericana (specializing in insurance and trend/risk management) posted a growth of 16.5% in written premiums at year-end 2021, these reaching COP 21.8 trillion (USD 5,821 million), driven by the good levels of performance for all three of its insurance segments, namely Life (13.2%), Health Care (30.7%) and Property and Casualty (10.9%). This, together with a rigorous control over administrative expenses, partially mitigated the increase in claims due to the reopening of the economies and the pandemic. In 2021, Suramericana allocated COP 1.6 trillion to COVID-related claims, however, thanks to the progress made with mass vaccination programs, the claims rate has so far shown an improvement in the Life and Health Care segments.

Consequently, net income came to COP 66,349 million (USD 18 million), which was 68.6% lower than for 2020, this driven by the returns obtained from the Company’s investment portfolios. Finally, Suramericana ended the year with technical reserves worth COP 23.3 trillion (USD 5,853 million), having increased by 10.6%, thereby demonstrating its strength to meeting its obligations with more than 21.2 million clients in all nine countries throughout the region.

DIVIDEND PROPOSAL

Grupo SURA's Board of Directors approved presenting a proposal at the upcoming Annual Ordinary Shareholders' Meeting, to be held on March 25, for an ordinary dividend payment of COP 784 per share, this represents a growth of 30% compared to what was paid out in 2021. In this way, the Company is consistently upholding its objective of generating greater shareholder value, taking into account a 10% compounded annual growth of its ordinary dividend since 2002.

1The statements of future disclosures related to Grupo SURA, Suramericana, SURA Asset Management and their respective subsidiaries, have been made under assumptions and estimates of the Company's management. For a better illustration and decision making, the figures are administrative and not accounting, for this reason they may differ from those presented by official entities. Grupo de Inversiones Suramericana no assumes obligation to update or correct the information contained in this press release.

*Restated figures in US dollars: *Statement of Comprehensive Income figures, at the average exchange rate for 2021: 3,743.09; * *Figures taken from the Statement of Financial Position based on the exchange rate corresponding to year-end 2021: COP 3,981.16