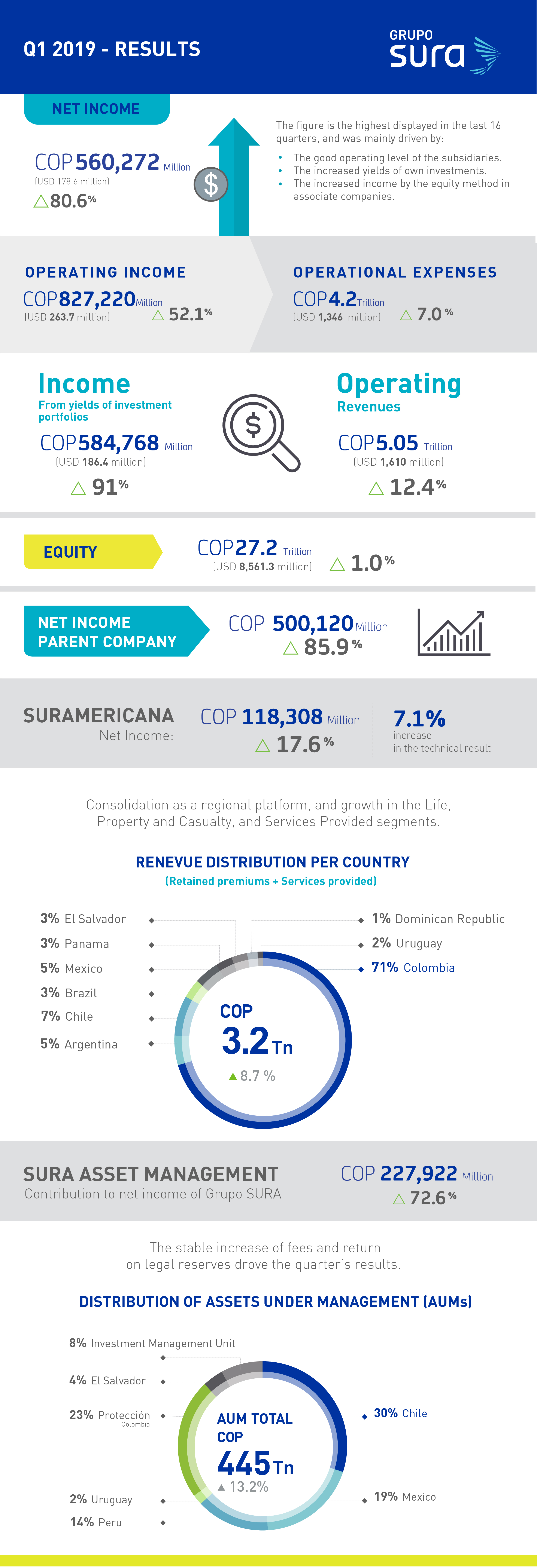

- Consolidated net profits amounted to COP 560,272 million (USD 178.6 million), after posting operating revenues for COP 5.05 billion (USD 1,610 million), a 12.4% increase.

- These results reflect the performance of Suramericana and SURA Asset Management, better yield from investments, and higher income from the equity method in associated companies.

- Performance during the first quarter is consistent with the focus on accelerating the profitable growth of the main lines of business of the Business Group in Latin America.

Grupo SURA reported its financial results for the first quarter of 2019, with an outstanding consolidated net profit for COP 560,272 million (USD 178.6 million*), that is an increase of 80.6% compared to the same period the previous year. These results are consistent with the strategic priorities of Grupo Empresarial SURA for the region: transform and evolve the businesses, create higher value for clients, financial strength and investment capacity.

“During the first quarter of this year we saw the convergence of three key aspects which, mostly, led to the final results: a growth of the operating revenues for Suramericana and SURA Asset Management; a rebound of the yields from investments in the insurance companies’ and pension funds’ own portfolios , and also an increase in revenues from the equity method in associated companies”, said David Bojanini, President of Grupo SURA.

Consolidated operating revenue increased 12.4%, to COP 5.05 billion (USD 1,610 million), driven by the growth of the main lines of business. Suramericana increased its consolidated revenue in Life (11.4%), General (10.8%) and Health Services (24.5%). In turn, SURA Asset Management increased its assets under management (AUM) by 13.2%. Those assets are now up to COP 445 trillion (USD 140,348 million**) and its revenue from commissions increased in the Mandatory (6.0%) and Voluntary (3.6%) business.

The 91% growth in consolidated investment income, which came to COP 584,768 million (USD 186.4 million) also contributed, considering that it was impacted in 2018 by the high volatility of the capital markets. In addition, there was a 64% increase in revenue from the equity method in associated companies, up to COP 340,370 million (USD 108.5 million), especially from Bancolombia, Protección and Grupo Nutresa.

As far as consolidated operating expenses for the first quarter, they were COP 4.22 trillion (USD 1,346 million), with an increase of 7.0%. Thus, operating profits came to COP 827,220 million (USD 263.7 million ), 52.1% more than during the first quarter of 2018.

“These results are consistent with our strategic focus on accelerating an organic, profitable growth in the main lines of business in insurance, pensions, savings, investment, and asset management. In this respect, it is worth mentioning that operating revenue increased at a higher rate than the consolidated expenses”, added Ricardo Jaramillo, Vice president of Corporate Finance for Grupo SURA.

The consolidated net profits for COP 560,272 million reflects the positive contributions from the results of SURA Asset Management with net profits of COP 227,922 million (USD 72.7 million ), 72.6% more than in the first quarter of 2018. Suramericana contributed another COP 118,308 million (USD 37.7 million), a growth of 17.6%, and Grupo SURA (holding) contributed COP 214,043 million (USD 68.2 million), an increase of 176% compared to the period January – March 2018.

Finally, Grupo SURA closed the first quarter with an equity of COP 27.2 trillion (USD 8,561 million**), 1.0% higher than what was recorded for last December.

*Figures from the Statement of Financial Situation, at an average rate of exchange of: COP 3,137.26 for the first quarter.

**At the closing rate of exchange for the first quarter: COP 3,174.79.