Last Friday morning, Grupo SURA's shareholders held an Extraordinary Meeting at which they voted on and approved three decisions that were submitted for their consideration as part of the corporate authorizations that are required in order to comply with the Company’s commitments as part of the implementation of the Framework Agreement.

It should be noted that this Agreement was signed on June 15, 2023 by the Company together with Grupo Nutresa, Grupo Argos, IHC, JGDB and Nugil, and establishes the conditions for a series of transactions through which Grupo SURA shall exchange its stake in Grupo Nutresa´s food business for its own shares and those of Grupo Argos.

In this context, the Company’s General Assembly made three decisions that were opportunely communicated today through the Relevant Information channel hosted by the Colombian Superintendency of Finance:

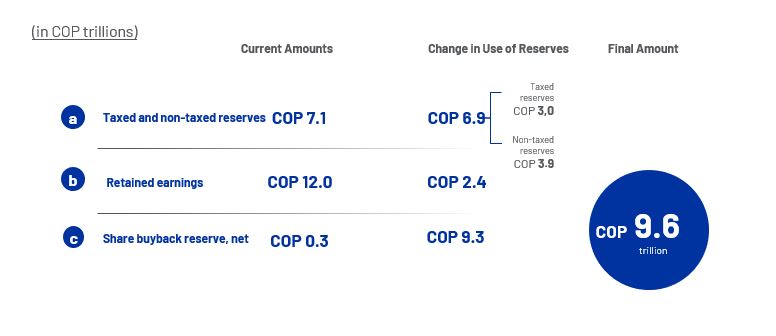

Firstly, they authorized changing the allocation of the Company’s reserves and adding the share buyback reserve, so that the latter shall total COP 9.6 trillion, as shown below.

In this regard, the Company’s Chief Business Development and Corporate Finance Officer, Ricardo Jaramillo, explained to the shareholders present at this Extraordinary Meeting that the final amount of this share buyback reserve is close to 75% of Grupo SURA's total Shareholders´ Equity, which amounted to COP 26 trillion at the end of this past third quarter, according to the Company's Individual Financial Statements. Likewise, it was also explained at this meeting that retained earnings shall be reclassified once the Grupo Nutresa share swap takes place.

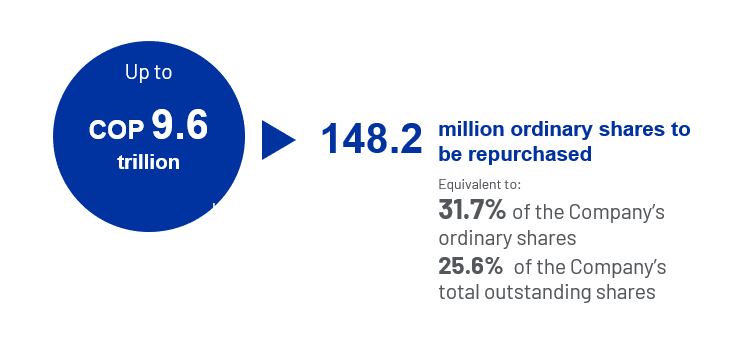

Secondly, the shareholders also authorized Grupo SURA to repurchase its own shares as part of the Grupo Nutresa share swaps established in the Framework Agreement, taking into account the previously approved share buyback reserve.

“Once the various stages of this Agreement have been completed, Grupo SURA shall receive 148.2 million of its own ordinary shares, equivalent to 31.7% of its total ordinary stock and 25.6% of its total shares outstanding”, stated Juan Luis Múnera, the Secretary to this Meeting.

Finally, the Shareholders, in a third vote, authorized the Company to allocate, without being subject to any preemptive rights, up to a total of 26.9 million of Grupo SURA´s ordinary shares to be received in the first share swap, this in order to comply with its payment obligations in the form of securities as part of the subsequent Tender Offer contemplated in the Agreement.

This amount of shares corresponds to the maximum number of treasury stock that the Company could require, amid a scenario in which acceptances to be paid in the form of securities would amount to 10.1% of the Tender Offer for shares in Nutresa.

The second and third authorizations herein described require regulatory approvals that are currently underway before the pertinent authorities. These three proposals were approved by 99.2% of the ordinary shares represented at this meeting.

Once this Extraordinary Shareholders´ Meeting came to an end, the Company's CEO, Gonzalo Pérez, concluded that "these decisions favor one hundred percent all those shareholders that remain with Grupo SURA once this Agreement is completed, since once the share buyback is carried out all of those remaining shall have a proportionally greater stake in the Company's equity".