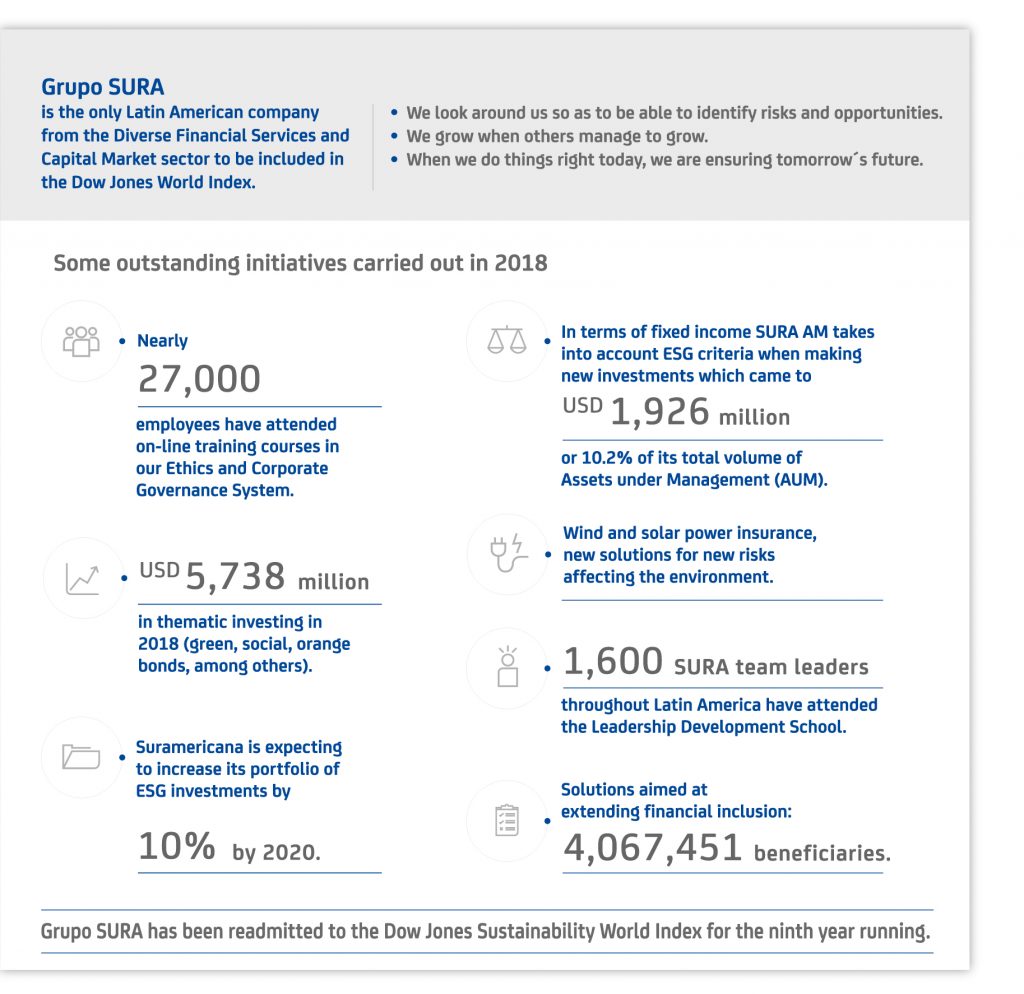

- For the ninth straight year, the Company was included among the 318 companies making up the new Dow Jones Sustainability World Index and is the only Latin American company from the Diversified Financial Services and Capital Markets sector.

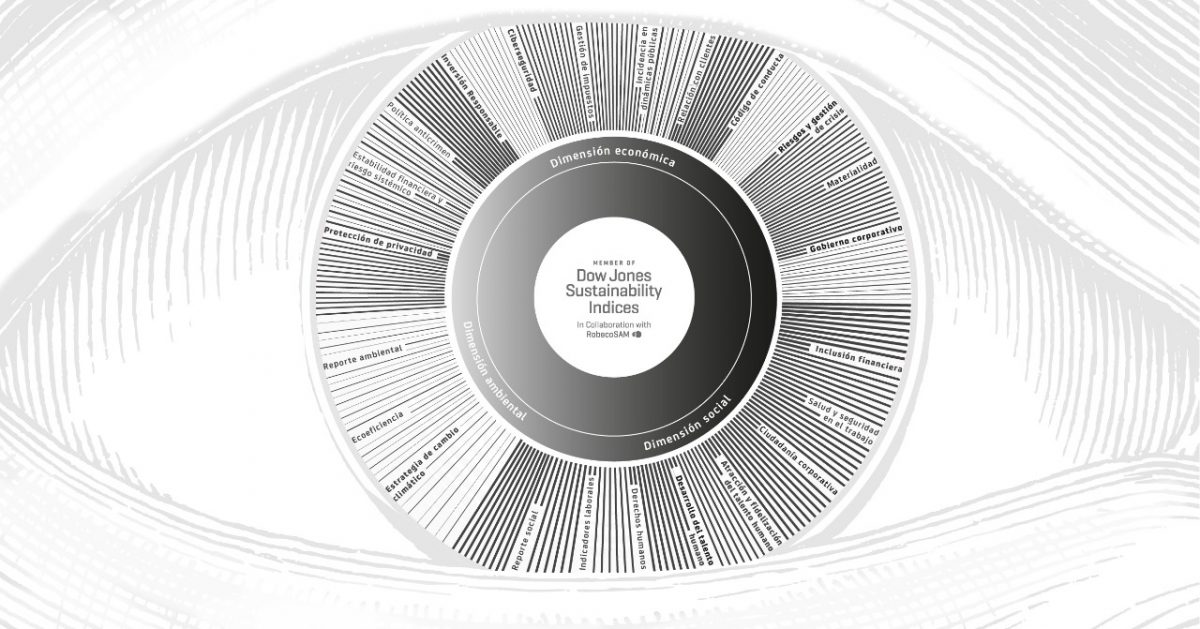

- Grupo SURA stands out as one of the organizations with the best economic, social and environmental practices among 16 companies from its own sector and is also listed on the DJSI Emerging Markets and DJSI MILA indices.

- The DJSI Index evaluates Grupo SURA´s own performance as a holding company, as well as the sustainability strategies of its subsidiaries, Suramericana and SURA Asset Management.

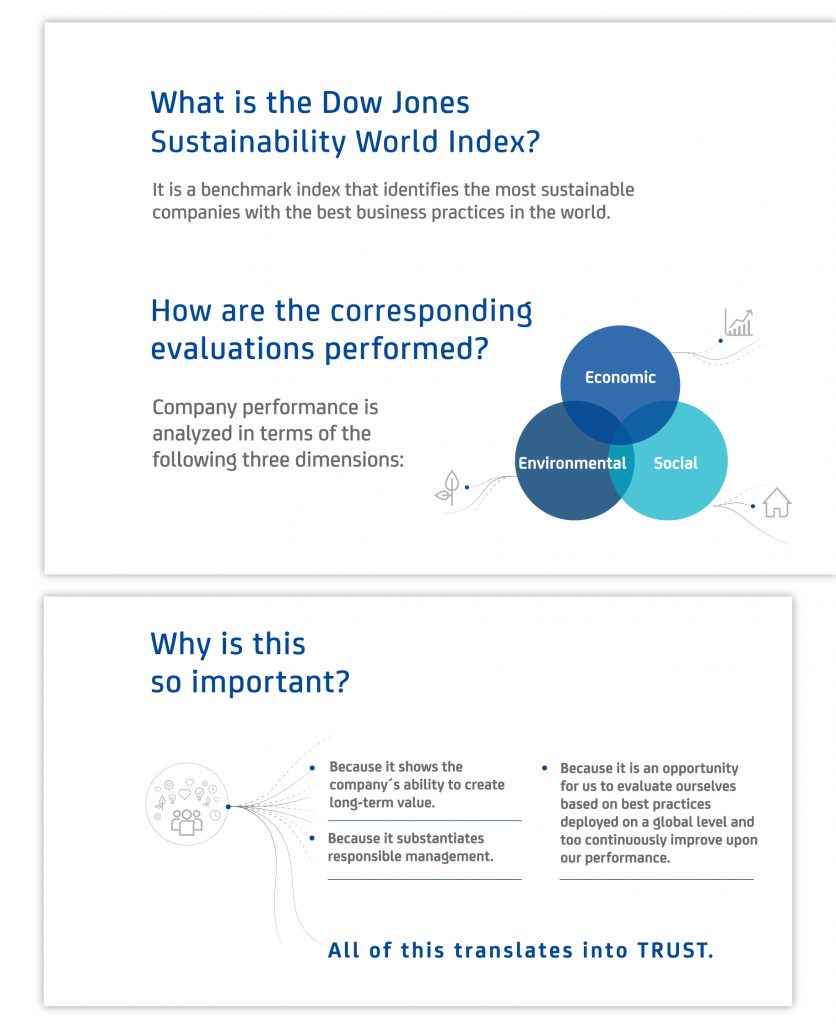

As announced this Friday, Grupo SURA, along with XX other companies, was re-admitted to the Dow Jones Global Sustainability Index (DJSI), which tracks organizations with the best sustainability practices, this after evaluating their economic, social and environmental performance.

This was the ninth straight year that the Company was included in this Index, being the only Latin American company from the Diversified Financial Services and Capital Markets sector to do so. The Company is also listed in the DJSI Emerging Markets as well as the MILA Indexes.

Grupo SURA obtained a score of 72 out of a total of 100 points, compared to 79 in 2018 and 75 in 2017, which was higher than 98% of the companies belonging to this same sector, and corresponds to the weighted results in all three dimensions: economic (67), social (80) and environmental (82).

With this, Grupo SURA, as a holding company, and both its subsidiaries Suramericana (insurance, trends and risk management) and SURA Asset Management (pensions, savings, investment and asset management), are amply demonstrating their commitment to upholding practices that respond to an ever-changing environment, so as to continue remaining relevant and taking full advantage of new opportunities.

“The Dow Jones Sustainability World Index is important to us because it gives us the opportunity to evaluate our own performance and identify opportunities for our ongoing transformation and growth, this based on best business practices. Standards are becoming increasingly more demanding with each year that passes and so we must constantly rethink how we can remain relevant and useful to society, in what is after all a dynamic and changing environment," stated David Bojanini, Chief Executive Officer of Grupo SURA.

The private sector has been a key ally in being able to fulfill the objectives set for our 2030 Agenda in terms of sustainable development. In this sense, being readmitted to the DJSI shows that we have an even greater commitment towards responsible management and developing new innovation models along with a much greater conviction of how we can proactively respond to the main challenges faced by today´s society.

“Sustainability has been a permanent quest of ours over these past 75 years since Suramericana was first founded, as we have endeavored with our daily efforts to contribute to greater levels of well-being and competitiveness for both private individuals and businesses, first in Colombia and later in nine Latin American countries. Evaluations such as those carried out by Dow Jones only goes to reaffirm our conviction that consistency and forging harmonious levels of growth between economic, social and environmental aspects only goes to strengthen us in our trend and risk management role” stated Gonzalo Perez, Chief Executive Officer of Suramericana

Similarly, the Dow Jones Index shows that sustainability has become an increasingly relevant criterion for both markets and investors, when it comes to making long-term investment decisions, since it provides support and justification for comprehensive strategies from the financial and non-financial standpoints that make for better investment decisions.

“Being part of the Dow Jones Sustainability World Index substantiates our commitment to building trust and long-term relationships with all those people throughout the region who have chosen us to handle their pension funds as well as other savings and investment objectives they may have at different stages of their lives. It is also a token of our commitment to going beyond the confines of business and making a real contribution to the development of all those countries where we are present," stated Ignacio Calle, Chief Executive Officer of SURA Asset Management.

Outstanding initiatives

Grupo SURA´s long-term perspective and vocation has been a key factor in its ongoing growth and expansion in Latin America in being able to manage both its investments and relationships. Our purpose has always been to build a lasting presence while making our own contribution to the development of all 10 countries where we are present, going beyond immediate achievements and results while preferring to focus on sound ways to achieve these.

The following are just some of the initiatives that have helped the SURA Business Group give concrete form to its sustainability strategy:

- 4 million people in Latin America benefiting from our insurance solutions and savings and investment products, thus providing greater financial inclusion.

- Nearly 27,000 employees that have attended on-line training courses in our Ethics and Corporate Governance System.

- 1,600 SURA team leaders throughout Latin America have attended the Leadership Development School.

- USD 5,738 million in thematic investing in 2018 (green, social, orange bonds, among others).

- USD 1,926 million in new fixed income investments on the part of SURA AM in 2018, these based on environmental, social and governance (ESG) criteria.

- Suramericana is committed to increasing its portfolio of ESG investments by 10% in 2020.

Finally, it is worthwhile noting that pointed out by the firm, Deloitte in its report "2030 Purpose: Good Business and a Better Future", based in turn on different economic studies: “Companies who have taken on a firm commitment to sustainability have achieved results that are on average 11% higher than those of their listed competitors”.

This is why Companies today have to choose between focusing on returns in the short to medium term or, instead, redirecting their business strategy towards long-term objectives, thus setting themselves apart from the rest of the pack and being more favorably looked upon by different stakeholder groups.