By Valora Analitik for Grupo SURA*

Corporate governance is a clear expression of best practices. This includes factors such as transparency and accountability, as well as sustainability, social contributions and governance.

It’s not enough to be responsible, but to be seen to be responsible. This popular saying applies perfectly to the present and future of Latin American and global companies, which have had to transform their status quo over the years.

It is no secret that, in past decades, factors that went beyond those related to a Company’s bottom line or return on investment or EBITDA were considered to have a secondary importance when analyzing a corporate balance sheet.

This short-sighted view of company performance has led to a series of problems that have entailed, over time, not only drawbacks for both society and the environment, but also to the fact that many companies have not remained sustainable with the passage of time, according to Alejandro Useche, professor at the Universidad del Rosario’s School of Management (Colombia).

As if that were not enough, "poor corporate governance can lead to misappropriation of funds, corruption, lack of transparency, indifference to the impact that this has on society, among other factors," added Useche.

A primer on corporate governance

For the Organization for Economic Co-operation and Development (OECD), corporate governance in keeping with current business dynamics includes good practices being upheld both inside and outside a company.

The aim of this is to "help build an environment of trust, transparency and accountability which are so necessary for fostering long-term investment, financial stability and business integrity".

This, says the so-called club of good practices, "helps drive stronger growth and the development of more inclusive societies".

In this way, corporate governance makes the internal processes of companies more transparent, when historically their movements and decisions have been mainly marked by economic and financial terms.

Behind this lies a new international reality, in which it has been found that the role of the private sector goes far beyond the financial results it produces.

In fact, in Useche’s opinion, "a company with a good level of corporate governance performance helps to secure a good internal working order and to ensure transparency with regard to the different processes applied. It also contributes in a positive way to society with the clarity and openness driving its policies".

An open-door policy

To be successful, companies need to establish clear and visible rules for decision making and to understand how decisions are made.

This is according to César Tamayo, Dean of the School of Finance, Economics and Government at the Universidad EAFIT, who adds that this roadmap must be made visible, so that it can be understood both internally and externally.

"It is very important for shareholders, customers and the community in which a company is located to have a transparent notion of the system of rules under which decisions are made and under which those decisions are controlled," said this university professor.

On this point, several experts who were consulted agree that strong corporate governance benefits the various stakeholders of a company, particularly its investors, employees, suppliers and customers. Consequently, decision making becomes the central axis of the relationship between companies and their various stakeholders.

In the case of employees, it is essential these work in favorable conditions, in order to improve their well-being and productivity; suppliers on the other hand, need long-term relationships, which allows for more reliable inputs; and in the case of customers and shareholders, this will translate into a better level of sustainability for the company.

Let´s not forget that the actions taken within companies can have an impact not only on thousands, but also on millions of people, especially with regard to their resources. For example, strong corporate governance becomes the cornerstone of any decision regarding whether or not to make an investment.

For Andrés Rojas, Vice President of Corporate Affairs for Asobancaria (the Colombian Association of Banking and Financial Institutions), this "guarantees that the company is being run optimally, that there is a sound, institutional structure in place that does not respond to a single opinion, but rather that a structure that supports any decision that is taken".

He also adds that "for an investor, corporate governance is key", especially because it can swing the pendulum of decisions to and fro between whether or not to invest their money in a company.

At the end of the day, these strengths have a positive impact and become "a fundamental building block in how well companies are performing today and is the basic pre-requisite for having a well-governed company," according to José Ignacio López, Head of Economic Research at a Colombian Financial Corporation, Corficolombiana.

Value maximization

Corporate governance is constantly evolving at the present time, and this is not just on paper. Progress in the current global landscape revolves around ensuring that decisions made internally by companies not only maximize value for investors and shareholders, but also for other stakeholders.

All of this becomes yet another step to be taken in order to have a strengthened corporate governance, which, at the end of the day, has an effect on how companies are viewed from the outside.

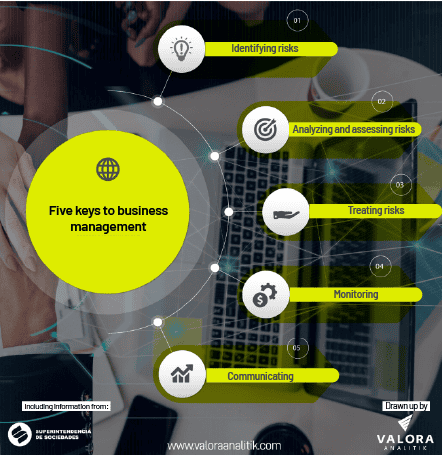

According to Alejandro Useche of the Universidad del Rosario, financial markets, in addition to evaluating what happens with profits and stock market prices, are increasingly attentive to monitoring and incorporating aspects relating to corporate governance in their decision making.

"This means that, at the current time, it is also a requirement on the part of the markets to carry out processes in order to be able to measure aspects relating to corporate governance," said the professor.

The next step

However, this transcends all of the above to include companies being transparent on issues such as possible concentrations of power in certain governing bodies, good relations between managers, potential conflicts of interest and, in addition, how they are doing in terms of gender equality.

Generally speaking, corporate governance not only becomes a challenge, but also an opportunity for companies, since its absence undermines their sustainability.

In any case, the opportunities on this front are enormous and include providing diverse socio-demographic groups better representation and participation, according to the Dean of the Universidad EAFIT’s School of Finance, Economics and Governance.

They are also key to advancing social and environmental agendas, which, according to the aforementioned Vice-President of Asobancaria, must go hand in hand with corporate governance. All of the above, concludes the aforementioned officer, "must form part of a Company’s DNA".

*This article was prepared by the Valora Analitik staff for Grupo SURA. Its content is of a purely journalistic nature and does not compromise any specific positions taken or recommendations made by our Organization.