Annual Report 2022

The following are the most relevant highlights and events concerning Grupo SURA as an investment manager in 2022. This past year was one of learnings with the balanced management of our four capitals, thereby confirming the soundness of a strategy based on a long-term vision as well as our ability to obtain concrete results as we continue on our path towards greater sustainable profitability. We consolidated the positive levels of performance of Suramericana and SURA Asset Management, as well as those of our portfolio associates namely Bancolombia, Grupo Argos and Grupo Nutresa.

Ver PDF

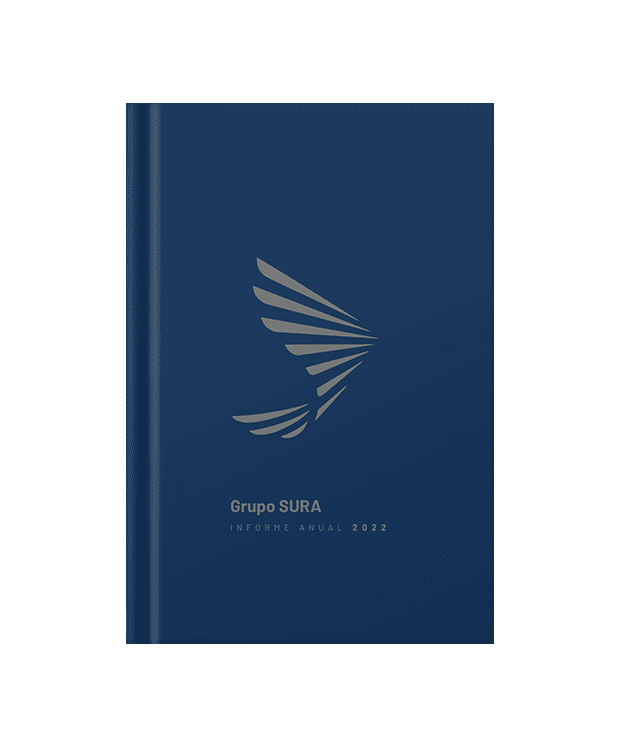

Balanced portfolio

A well-balanced portfolio of strategic investments

Our portfolio focuses on financial and related services through Suramericana (insurance, trends, and risk management), SURA Asset Management (pensions, savings, investments, and asset management), and Bancolombia (universal banking).

Our strategic investments also include our shareholdings in Grupo Argos (infrastructure) and Grupo Nutresa (processed foods), companies with which we share equity ties and the same philosophy in the way we do business.

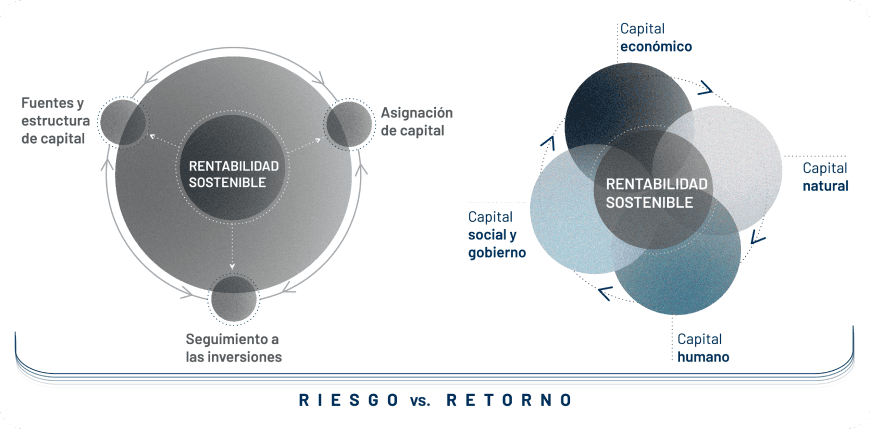

A well-balanced four-capital framework

Financial capital

Social capital

Human capital

Natural capital

Total revenues

∆ COP 31.4 trillion

(USD 7,367 million)

COP 6.5 trillion (USD 1,539 million) in additional income compared to the previous year

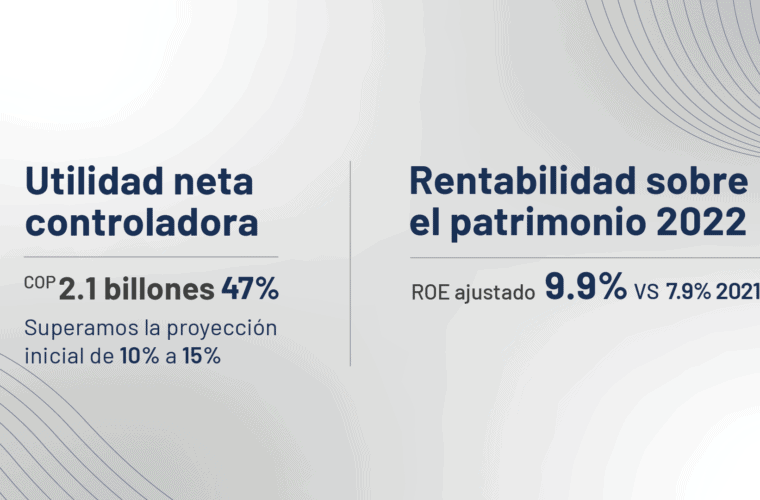

Controlling net income

COP 2.3 trillion

higher than that projected at the beginning of 2022

Adjusted ROE

9.9%

Return on equity vs 7.9% 2021

We achieved an all-time high in earnings based on the performance of our portfolio companies, which exceeded projections. This showed us the importance of having a long-term strategy.

– We shall continue to evaluate alternatives for an efficient allocation of capital on the part of both Grupo SURA and its Companies, taking into account our strategy and the context in which this is carried out.

– In this way, we expect to consolidate an increase in Grupo SURA’s controlling net income of between 10% and 15%.

– Based on the increase in dividends received, we shall continue to reduce our indebtedness with the expectation that our net debt to dividends received ratio shall end up at below 3 times our dividends by the end of 2023, which gives us greater financial flexibility.

– We project our return on equity (adjusted ROE) to be in the range of 9% to 10%, despite a more challenging environment for our portfolio businesses.

27.7 million Latin Americans and 2,508 entities participated in 375 projects through which our Organization channeled its social impact investment.

802 initiatives from 29 departments throughout the country participated in the second annual call for proposals on the part of #PensarConOtros initiative, this aimed at building citizenship and democracy in Colombia

85.6% was the consolidated brand confidence indicator for the SURA Business Group, according to a reputation study carried out in 2022 which surveyed 28,241 people from various stakeholder groups in 10 countries.

USD 10,3 million was the total direct social investment made by the Companies as well that channeled through the SURA Foundation in this past year, for an increase of 5% compared to that recorded in 2021

During 2022 we will nurture various segmented conversation spaces as scenarios to strengthen relationships of trust and as an opportunity to identify processes and initiatives in which, together, we can contribute to building this capital and contribute to the harmonious development of society.

As for our social capital, we shall be reinforcing our dialog with different stakeholders in response to the material issues defined and prioritized over this past year as well as implementing the plans drawn up based on last year´s reputation survey so as to be able to continue building trust, favorability, and referrals for our SURA lines of business.

This shall go hand in hand with continuing to expand on our role as corporate citizens through our involvement in initiatives to strengthen civic training, democratic processes, the quality of education, and inspiring trust in the institutions in all those societies in which we are present.

152 was the total headcount for Grupo SURA, Suramericana, and SURA Asset Management, including its respective subsidiaries in 10 Latin American countries, at the end of 2022.

65.8% of the SURA Business Group´s employees are women holding 56.4% of all leadership positions.

USD 4.6 million was invested in employee training during this past year by Grupo SURA, Suramericana, and SURA Asset Management.

28 thousand people were trained through programs, initiatives and projects implemented and promoted by Fundación SURA in 2022.

In 2022, we focused on just this, on conversations in the form of natural scenarios to strengthen relationships based on trust, by exchanging viewpoints, knowledge and positions, and as an opportunity for identifying procedures and initiatives in which, together, we can contribute to building this type of capital and ensuring a more harmonious level of development for society.

Here we shall be focusing on transferring and creating knowledge to enable people to exercise their autonomy and freedom, through:

– The different products, solutions, and services offered by Suramericana and Sura Asset Management through their different lines of business.

– Encouraging the implementation of best practices among our suppliers.

– Expanding partnerships with universities and think tanks so as to provide knowledge to both our stakeholders and to society as a whole.

– Training programs for employees with an emphasis on personal development and strengthening our organizational capabilities.

Also, we shall be strengthening our employer brand as well as all those measures designed to strengthen employee loyalty, amid increasing competition and greater job market mobility.

Risk management built into the strategy

We have policies in place that define the guidelines and basic principles that are common to the handling of Grupo SURA’s own risks and those of the Companies that make up its investment portfolio. Furthermore, the risk governance function is directed by the Risk Committees and the individual work teams, which provide each Company with expert risk management.

57% increase in the number of thematic investments included in the portfolios pertaining to Suramericana and its subsidiaries in 2022 compared to the previous year.

10% increase in this past year in the number of so-called thematic investments in SURA Asset Management’s fund management business, according to its taxonomy of sustainable investments.

USD 703,4 million is the total amount invested by SURA Asset Management in its portfolio offerings incorporating ESG and carbon risk criteria.

Suramericana recorded USD 13.4 million in premium income from its environmental, social, and governance (ESG) underwriting solutions.

Grupo SURA and our subsidiaries have a financed carbon footprint baseline. We have extended our practices and processes relating to sustainable investment and underwriting, the quantification of financial risks derived from climate change, and the efficient management of our natural resources in our different operations.

– We have prioritized reducing our carbon footprint, based on the previously constructed baseline.

– We shall be moving forward on our path toward decarbonizing the Company´s investment portfolios, as well as those of Suramericana and SURA Asset Management.

– We shall also be furthering our knowledge of the bio-economy in order to identify opportunities for bringing about the necessary changes for regenerating our natural capital.

– We shall also be working on quantifying and analyzing climate risks.

Finally, we shall be expanding the information we provide to our stakeholders through reporting frameworks such as the TCFD (Task Force on Climate-related Financial Disclosures).

Risk management built into the strategy

We have policies in place that define the guidelines and basic principles that are common to the handling of Grupo SURA's own risks and those of the Companies that make up its investment portfolio. Furthermore, the risk governance function is directed by the Risk Committees and the individual work teams, which provide each Company with expert risk management.

Recognitions

- Fitch Ratings ratified Grupo SURA´s long-term local ("AAA") and international ("BB+") ratings, based on a sound investment portfolio.

- This rating agency also maintained SURA Asset Management's local rating at BBB..

- We were included in the Sustainability Yearbook for 2023, which recognizes 700 companies worldwide implementing the best economic, social, and environmental practices after being included in 2022 in:

The Dow Jones Sustainability World Index (DJSI).

.

- For the first time ever, Grupo SURA was included in Bloomberg’s Gender Equality Index for promoting equality and diversity..

- CDP (the Carbon Disclosure Project) is an organization that promotes the global disclosure of environmental commitments.

- The CDP report rated the Company with a score above the global average for its climate change management..

- No. 1 Colombian Company among 100 Latin American companies with the best reputation (Merco Iberoamerica).

- 5th socially responsible company with the best corporate governance (Merco Responsabilidad ASG 2023).

.

- We obtained for the 9th consecutive year the IR seal for having better information reporting levels, with which we are strengthening our relationship with investors..

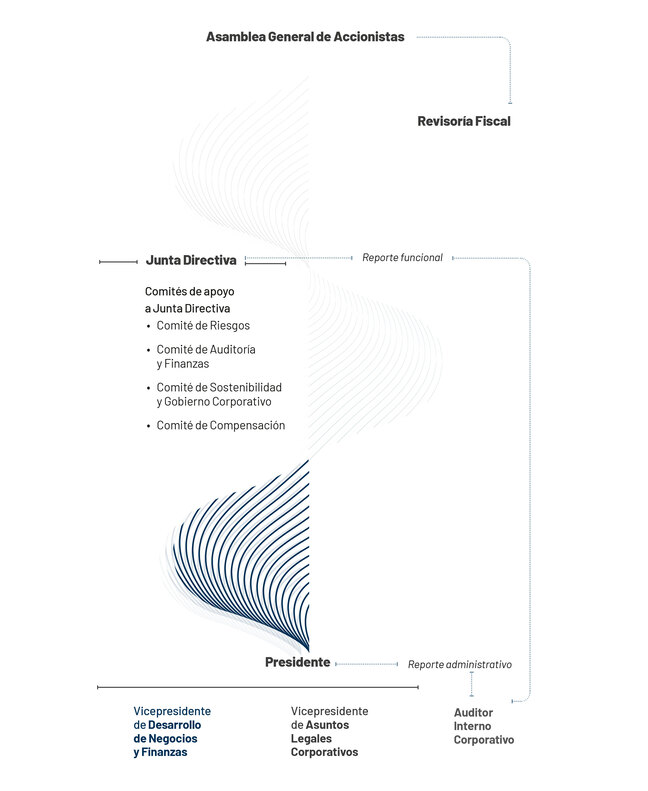

Our Ethics and Corporate Governance System

Corporate Principles:

Respect

Responsibility

Fairness

Transparency

Governing bodies:

General Assembly of Shareholders Board of Directors and it’s respective Support Committees Senior Management Statutory Auditor (external auditing firm)

Internal Auditing function Among others

Rules and regulations:

By-laws

Code of Conduct

Code of Good Governance Framework Policies

Governance structure

Share capital and ownership structure

| Authorized capital | Subscribed capital | Paid-in capital |

COP 112,500,000,000 divided up among

|

COP 109,120,790,250

|

COP 109,120,790,250

|

Ordinary shares*466,720,702 |

Preferred shares*112,508,173 |

Repurchased shares2,748,673 |

*Outstanding shares.

Distribución del capital social por clase de acción:

| Ordinary = 80.6% | Preferred=19.4% |

The Company had 16,428 shareholders at the end of 2022, of which 15,325 were individuals.

Our subsidiaries

Suramericana

- Clients: 22.3 million

- Countries: 9

- Employees: 22,895

- Written premiums: COP 27.0 trillion ∆24.4% (USD 6,355 million)

- Net income: COP 490,377 million ∆494.3% (USD 115 millions)

SURA AM

- Clients: 22.9 million

- Countries: 9

- Employees: 7, 189

- Operating revenues*: COP 3.3 trillions ∆4.7%** (USD 773 millions)

- Controlling net income: COP 440,677 millions ∇29.6% (USD 104 millions)

*Includes insurance margin

* *Reflecting the accounting effect of ceasing to recognize Protección via the equity method and instead consolidating its results as a subsidiary of SURA Asset Management as of November 2022, along with the subsequent creation of a new insurance subsidiary, Asulado.

This subsidiary is specialized in trends and risks management and, through its subsidiaries in nine countries throughout the region, provides solutions in the Property and Casualty, Life, and Health Care insurance segments for individuals and companies, both voluntary and mandatory, together with their respective complementary services and benefits.

Juana Francisca Llano - CEO Suramericana

This subsidiary is an expert savings, investment, and asset management firm, with a presence in nine countries4. It leads the Latin American pension industry, as measured by the volume of Assets under Management held in its Savings and Retirement business, which includes its pension fund management subsidiaries in six countries.

Ignacio Calle - CEO SURA AM