- Net income rose by 33.5% compared to the same period last year, on a like-for-like basis. This reflects a positive trend that places the Company on a favorable footing for the end of this year.

- Now that the spin-off process has been completed in July, the multiple benefits this posed for the Company's strategic evolution is now becoming tangible to our

- In 2025, Grupo SURA shall receive around COP 2.1 trillion, as a result of its strength and the sound performance of its financial businesses.

Grupo SURA (BVC: GRUPOSURA and PFGRUPSURA) presents to the market its financial results for the first half of the year, highlighting a net income attributable to its shareholders of COP 1.2 trillion, up by 33.5%[1] with respect to the same period last year. In terms of earnings per share[2], this is equivalent to COP 6,003 for the last twelve months, for a comparable growth of 18.4%, compared to year-end 2024. This result reflects the good levels of performance recorded by its investments, Suramericana, SURA Asset Management and Grupo Cibest (Bancolombia's parent company), this placing the Company on a favorable footing for the second half of the year.

"At Grupo SURA we have made steady progress in our evolution as a company focusing on the financial service sector, with a more straightforward structure that allows us to look confidently towards the future. With the strength that comes from the scale of our regional footprint, and the capabilities and knowledge that we have built up today, we shall continue to strengthen our value proposition and position ourselves as a competitive financial group as well as a benchmark in Latin America," stated Ricardo Jaramillo Mejía, Grupo SURA’s Chief Executive Officer .

At the end of Q2, operating income reached COP 14.7 trillion, 4.7%1 higher than for the same period last year, this mainly driven by the growth in premiums on the part of Suramericana, higher fee and commission income from SURA Asset Management along with an increased contribution from Grupo Cibest. With this, operating income for the first half of the year came to COP 2.5 trillion, for an increase of 13.1%1 along with an adjusted return on equity (adjusted ROE[3]) of 11.7% on a LTM basis, thereby reflecting an uptrend in the profitability shown by our different lines of business.

Investment performance

Suramericana For the first half of this year, this subsidiary issued premiums worth COP 9.4 trillion (+3.1%[4]), driven mainly by the dynamics of the Life Insurance segment, which posted a growth of 12%. This subsidiary´s technical result increased by 10%3 to COP 1.2 trillion and investment income came to COP 1.1 trillion (+2.2%3), thereby producing a net income of COP 431 billion. Suramericana's return on equity[5] on a LTM basis ending at the end of Q2 came to 12.2%.

Sura Asset Management For the first half of the year, this subsidiary obtained COP 2.1 trillion in fee and commission income, which was 9.4% higher than for 2024. Operating income, excluding legal reserves, came to COP 769 billion (+14.7%[6]) compared to the same period last year. As a result, net income reached COP 599 billion, 42%5 more than for the same period last year. Return on equity[7] stood at 10.4% and return on tangible equity at 26.8% on a LTM basis at the end of Q2. These results are leveraged on expanding operating margins, as well as a higher returns on legal reserves.

Grupo Cibest. Bancolombia's parent company achieved a net income of COP 3.5 trillion at the end of Q2 2025, thereby continuing to demonstrate the strength of its competitive position as well as value proposition. With this, it contributed COP 864 billion to Grupo SURA's net income, which was 14% higher than for the same period last year.

"Obtaining net recurring earning per share of COP 6,003 on a LTM basis, which increased by 18.4% compared to 2024, reflects a good level of business dynamics, as well as the accretion perceived by our shareholders over time. This level of performance and a sound cash flow allows us to preserve our financial flexibility, reinvest in our profitable and sustainable growth, and continue to reward our shareholders," commented Juan Esteban Toro Valencia, Grupo SURA´s Chief Corporate Finance Officer.

Benefits of Grupo SURA's strategic evolution

Following the completion of the spin-off with Grupo Argos, the benefits stated at the time this was announced to shareholders, the company and the market at large have already materialized.

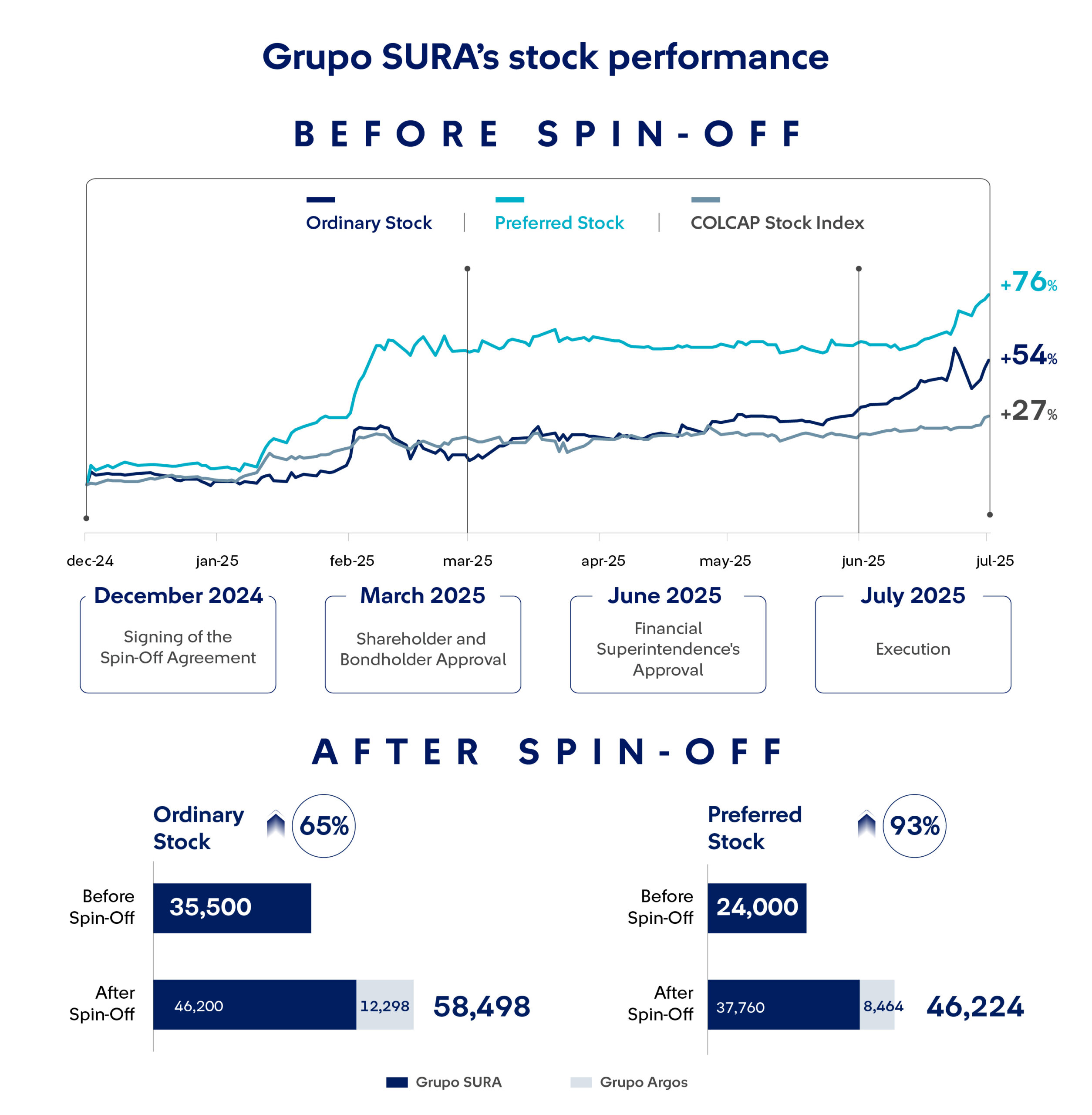

Valorization Shareholders have seen a significant appreciation in the value of their investment since the spin off transaction was first announced on December 18, 2024. Between December 2024 and July 31, 2025, and taking into account the investment received by each shareholder in Grupo Argos as a result of this process, the Company’s ordinary share has increased in value by 65% with the preferred share gaining 93%, placing both types of share among the three top performing stocks on the Colombian Stock Exchange during this same period of time.

Accretion. Shareholders have increased their economic stakes in Grupo SURA by 77% compared to year-end 2023, this as a result of the Company's strategic evolution over the last two years. In other words, a shareholder with a hypothetical 1% stake in December 2023, today holds 1.77% of Grupo SURA's economic rights. This same shareholder has also received a 0.6% stake in Grupo Argos´ share capital, which has increased the total value received as part of this spin-off process.

Greater trading volume The aforementioned benefits have also been reflected in increased investor interest. The average daily trading volume of Grupo SURA shares increased from around COP 2.700 million between July 2023 and September 2024 to more than COP 11,100 million between October 2024 and July 2025. This implies a four-fold increase in volume, thereby evidencing greater share liquidity on the market.

Index inclusion and participation. As a result of the above, in addition to a higher float, the Company's shares have recently been included in international indexes such as MSCI and FTSE. Similarly, significant advances have also been seen with the local COLCAP index, where Grupo SURA has increased its weighting by 50% in terms of both types of shares, which took the company from the sixth to the second largest issuer on this index.

A broad and diversified shareholder base. After the spin-off, Grupo SURA went from having around 26 thousand shareholders to more than 41 thousand. This growth was due to now having a more diversified group of shareholders such as institutional investors, legal entities and individual shareholders, both at home and abroad.

Other recent highlights:

- On June 26, 2025, the Colombian Superintendency of Finance announced the definitive filing of the administrative procedure begun back in 2024, relating to the exit agreements with Grupo SURA's partners in Suramericana and SURA Asset Management. This announcement reaffirms that Grupo SURA has fully complied with all legal obligations applicable to the disclosure of information and evidences the robustness of its internal control system that guarantees the transparency of its management.

[1] For comparability purposes, figures for 2024 have been adjusted to exclude the following: a) earnings from the share swap with Nutresa totaling COP 4.0 trillion along with taxes worth COP 363 billion; b) revenues via the equity method in 2024 for Grupo Argos totaling COP 587 billion along with those of Sociedad Portafolio worth COP -4 billion; c) also excluding the SURA healthcare subsidiary in 2024. No adjustments have been made to the 2025 figures.

[2]Recurring earnings per share exclude revenues obtained via the equity method from Grupo Argos and Sociedad Portafolio in 2024 divided by 327.7 million shares outstanding after completing the spin-off by absorption in July 2025.

[3]Grupo SURA´s ROE is adjusted for: a) the amortization to net income of intangible assets resulting from acquisitions; b) the investment in Grupo Argos is excluded from equity as well as from net income over the last 12 months given the non-recognition of the equity method as of 2025; c) non-recurring earnings associated with the share swap with Nutresa in 2024 is excluded; d) the SURA health care subsidiary is excluded in 2024 .

[4] Growth with respect to last year´s proforma figure, i.e., excluding the health care subsidiary EPS SURA in 2024. Figures for 2025 do not show any adjustment.

[5]Suramericana´s adjusted ROE (a) excludes the amortization of intangibles; (b) its ROE for 2024 isolates the effects of the sale of its operations in Argentina and El Salvador in 2023; (c) the health care subsidiary EPS SURA is excluded from the 2024 figures.

[6]Change at constant rates.

[7] Adjusted ROE and ROTE exclude amortization expense on intangible assets relating to acquisitions.