Annual

Download PDF

Photographer: Jorge A. Arango - Fundación herencia ambiental

Performance of

Grupo SURA in

Latin America

was determined by:

- Solid operating performance of its main businesses.

- Strategic decisions of its subsidiaries to ensure profitable growth.

- External aspects such as the high volatility of capital markets.

- Advances in innovation, sustainability, corporate governance, social investment, reputation and brand.

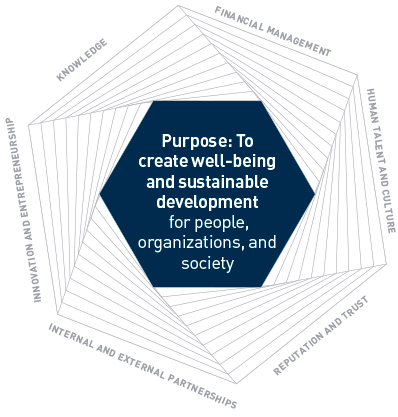

our strategy

Strategic priorities of Grupo SURA

Transformation and evolution of business

To respond, with assertiveness, to constant changes of the environment and look for opportunities, leveraged in new technologies and innovative models.

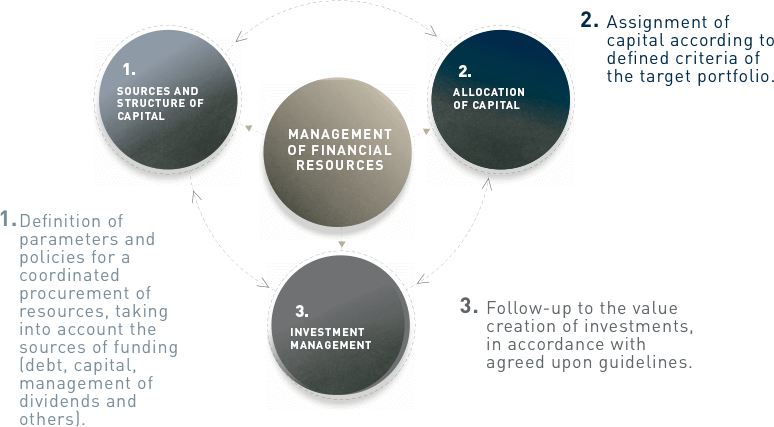

Financial strength and investment capacity

To allow for the resources to support the strategy of the Organization, continue with capital assignment plans, respond to obligations and contribute to the Companies growth, consolidation and profitability.

Creation of greater value to clients

To seek to overcome the expectations, and to support, the Financial Services Companies of our portfolio, in an effort to differentiate ourselves, anticipate issues and scenarios, with solutions, and identify better ways to support each of our clients, throughout the different stages of their lives.

75.4%

of the portfolio in

financial services

Focus on financial services

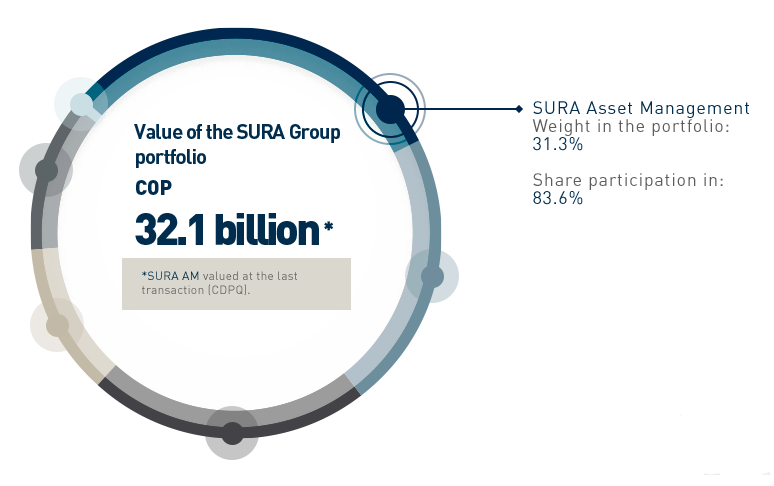

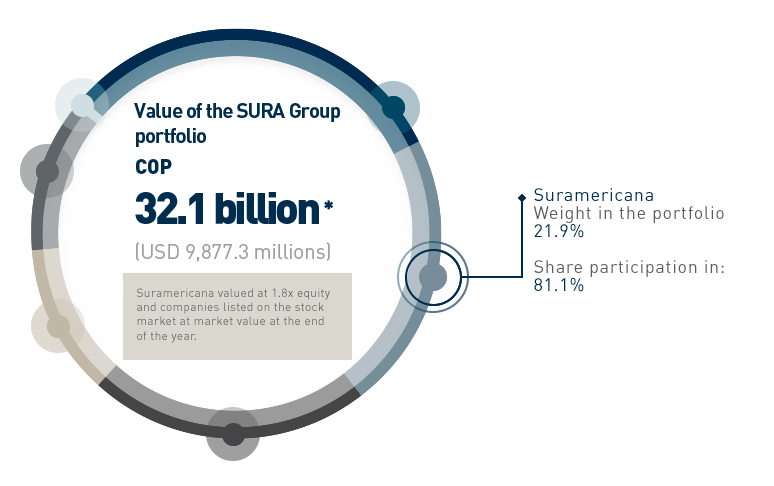

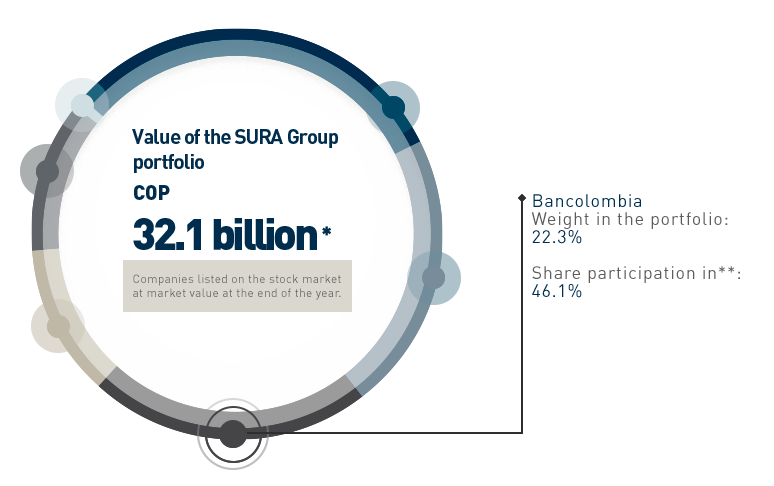

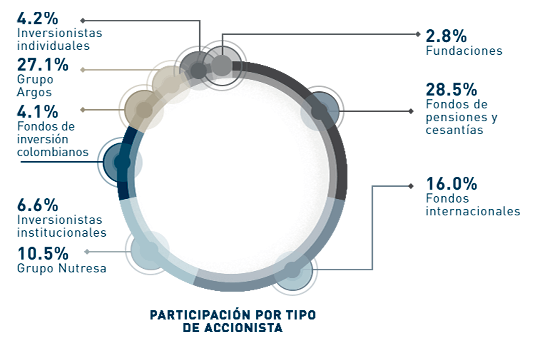

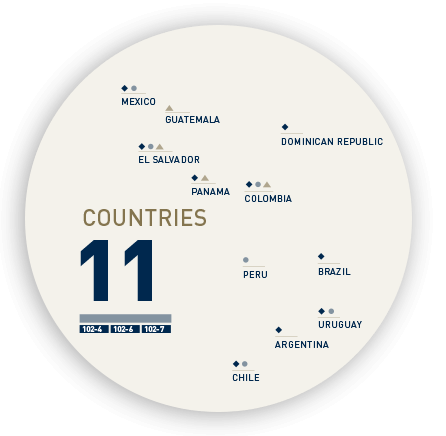

Grupo SURA was consolidated as a holding company of the SURA-Bancolombia Financial Conglomerate. Referent in Latin America in the financial services of insurance, pensions, savings, investment, asset management and banking.

Financial conglomerate

sura-bancolombia

-

Clients:

51

million -

Employees:

59,317 -

Assets under

COP 686.9 billion

management

(AUM)*:(USD 211,367 millon)*Sum of assets managed by Conglomerate Companies. Calculation: sum of AUM of SURA AM; consolidated technical reserves and managed directly by Suramericana; deposits of Bancolombia and AUM of Fiduciaria Bancolombia and Valores Bancolombia. It is not comparable with data published in the Annual Report 2017 due to change in the calculation methodology.

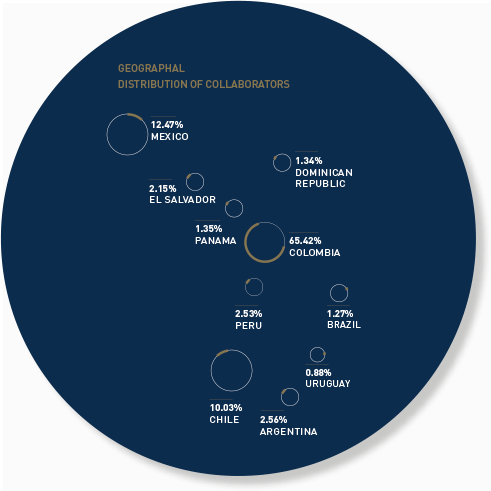

Clients19.8 millon

Collaborators8,705

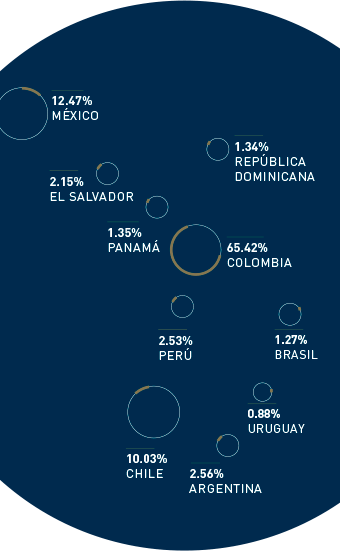

Countries6

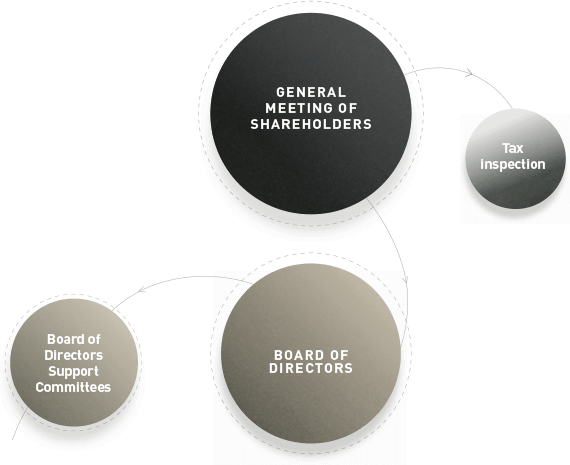

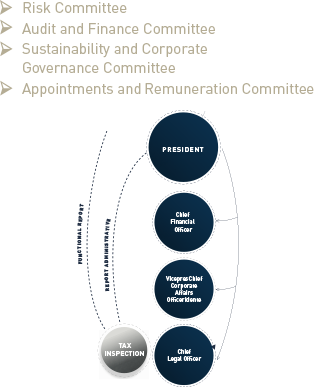

Organizational chart(Commissions + safe margin)

COP

2.24 billon

(USD 758.8 millon)

Net income

COP

0.29 billon

(USD 98.5 millon)

Assets under management (AUM)

COP

418.6 billon

(USD 128,798 millon)

Clients17.2 millon

Collaborators20,445

Countries9

OPERATING INCOME(Premiums issued + provision of services)

COP

15.2 billon

(USD 5,145.1 millon)

TECHNICAL RESULTS

COP

2.38 billon

(USD 804.2 millon)

NET INCOME

COP

524,868 millon

(USD 177.5 millon)

Clients14 millon

Collaborators30,089

Countries4

GROSS PORTFOLIO(Of credits, before provisions)

COP

173.8 billon

(USD 53,487 millon)

NET INCOME

COP

2.66 billon

(USD 899.3 millon)

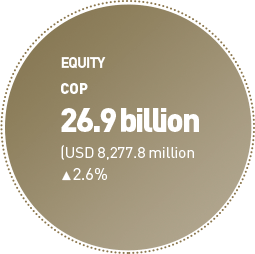

EQUITY

COP

24.8 billon

(USD 7,646.4 millon)

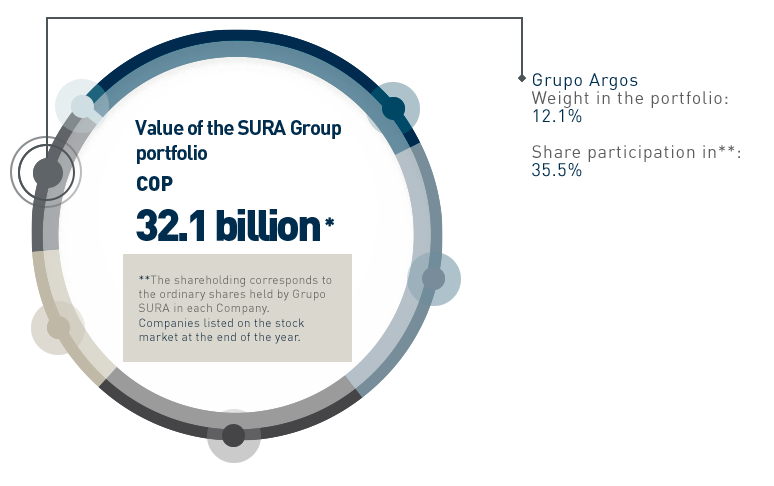

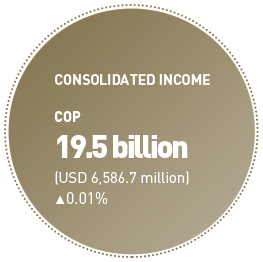

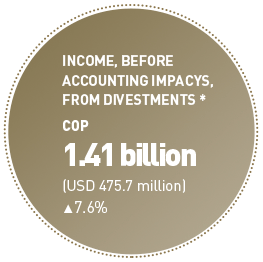

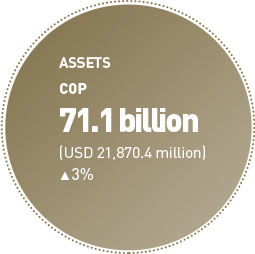

Main figures 2018 grupo Sura (Holding)

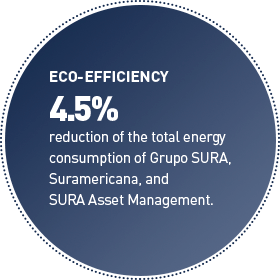

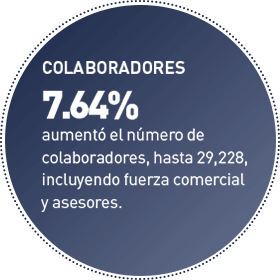

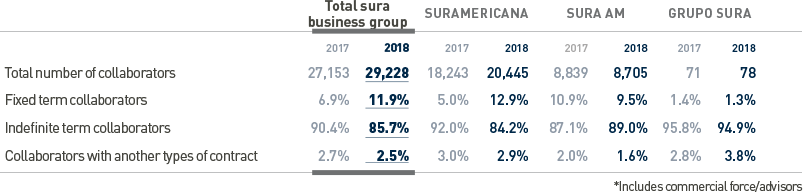

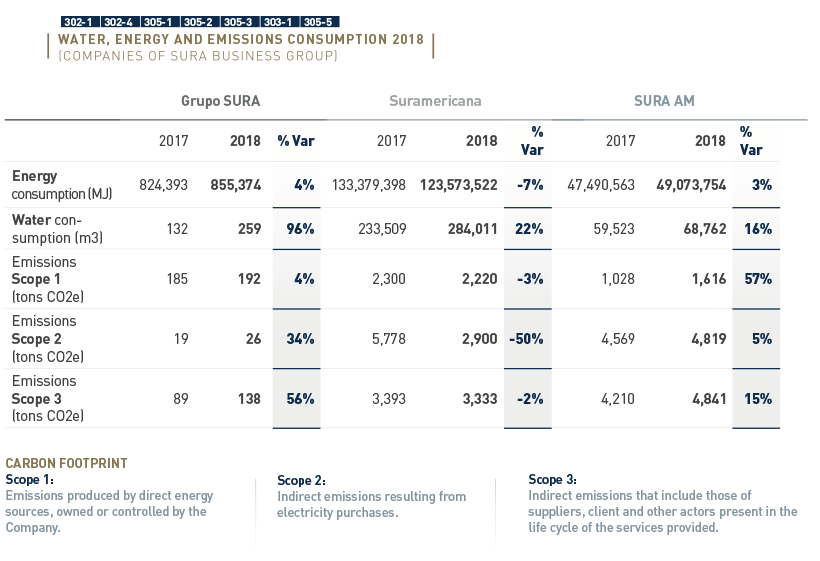

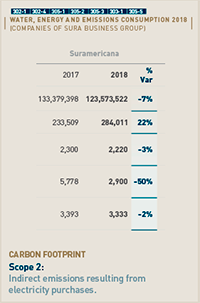

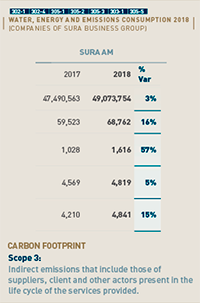

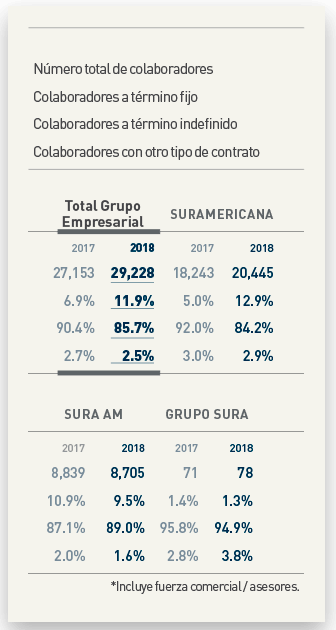

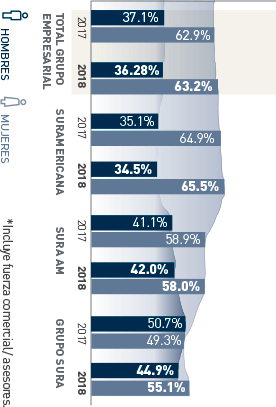

OTHER RELEVANT FIGURES 2018-SURA BUSINESS GROUP

(Grupo SURA, SURA Asset Management y Suramericana)

Among

leaders in

sustainability

- Grupo SURA was included for the eighth consecutive year among the 317 companies that make up the Dow Jones Sustainability World Index.

- Grupo SURA had a rating higher than 98% of the companies in the Financial Services and Capital Markets sector.

- Included in the Sustainability Yearbook 2019 of the RobecoSAM firm and recognized with a silver medal (Silver Class), as one of the three with the best performance in its sector.

Our financial

results

during 2018

were especially

determined by:

resultados

2018 del

grupo

empresarial

sura

David Bojanini

President Grupo Sura

“The operational growth of the main lines of business of Suramericana and SURA Asset Management in 2018, as well as the higher efficiencies, allowed us to offset part of the impact that the high volatility of the financial markets had on the returns of our own investments throughout the year of the Companies. Strategic decisions were also made in our subsidiaries to ensure profitable and sustainable growth in the long term”.

Management Report of thePresident and the Board of Directors

Ethics and Corporate Governance

27 thousand employees

Trained, virtually, on the Ethics

and Corporate Governance System

97.3% of recomendations

Were adopted in the

Country Code survey.

Ethics and Corporate Governance

of Directors

management

structure

SURA-Bancolombia

Our Board

of

Directors

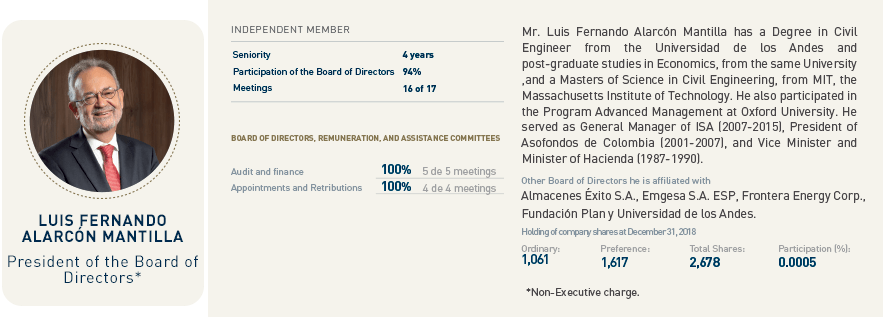

LUIS FERNANDO

ALARCÓN MANTILLA

President of the Boards of Directors

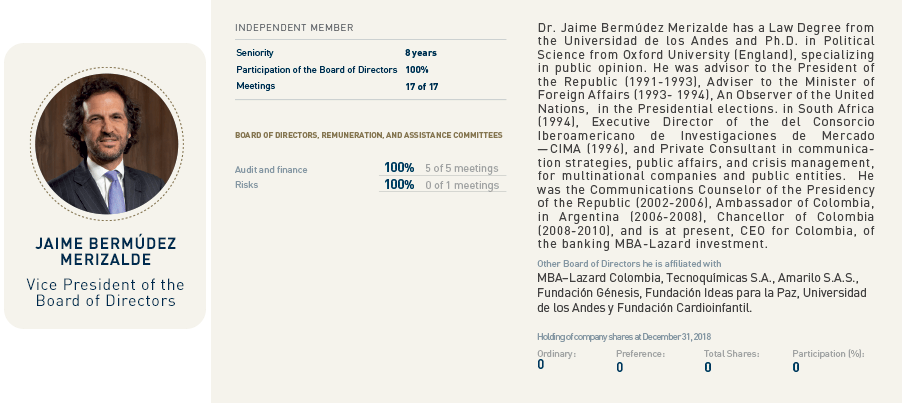

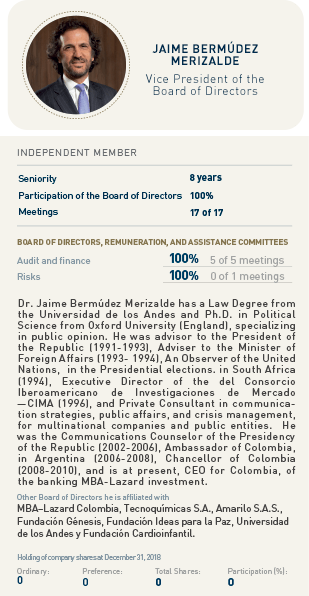

JAIME BERMÚDEZ

MERIZALDE

Vice president of the Board of directors

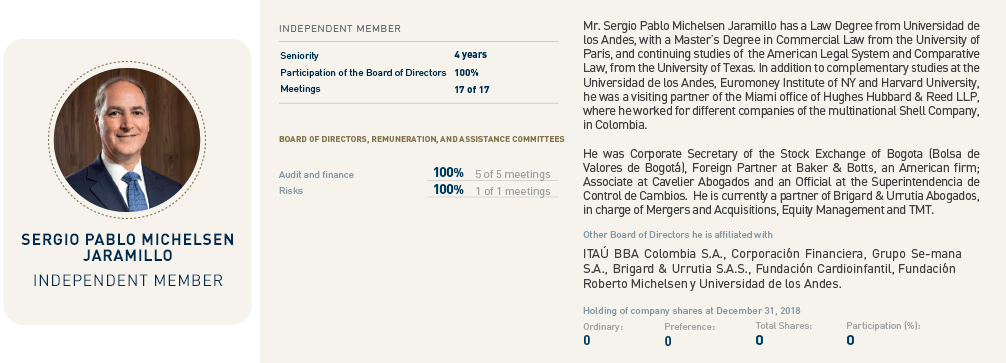

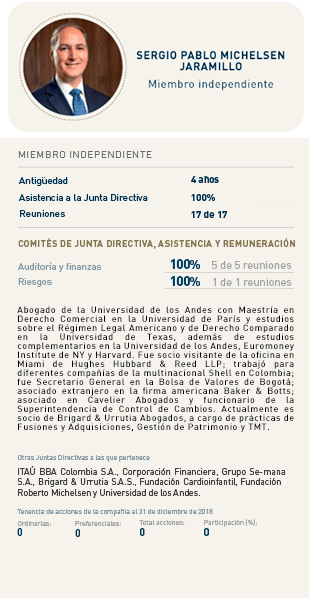

SERGIO PABLO MICHELSEN JARAMILLO

Independent member

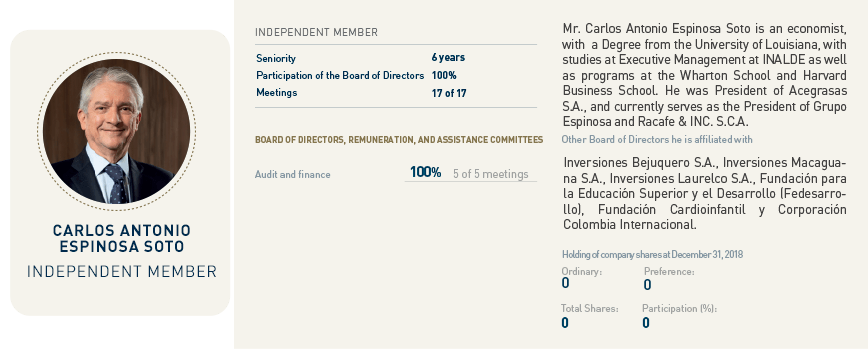

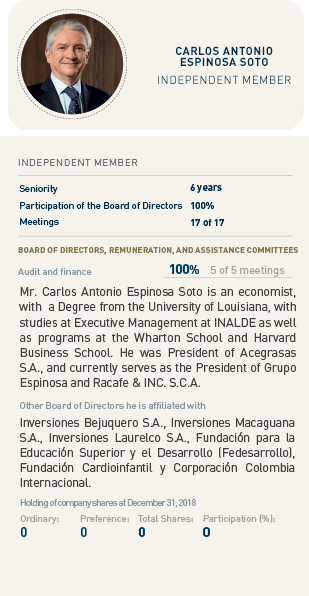

CARLOS ANTONIO

ESPINOSA SOTO

Independent member

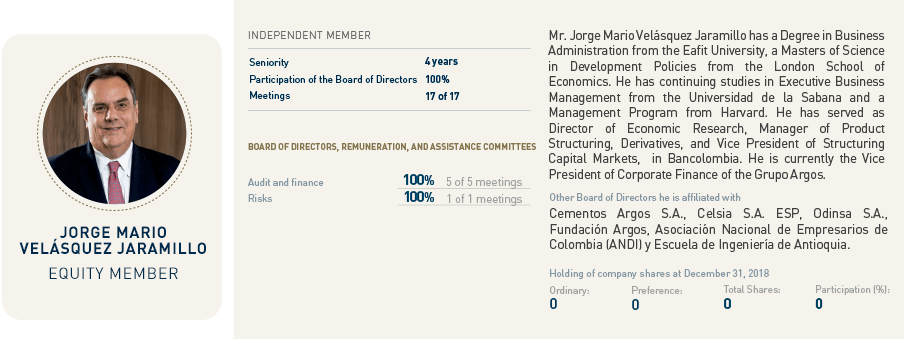

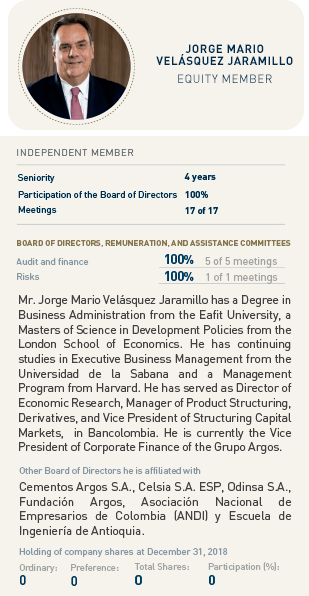

JORGE MARIO

VELÁSQUEZ JARAMILLO

Equity member

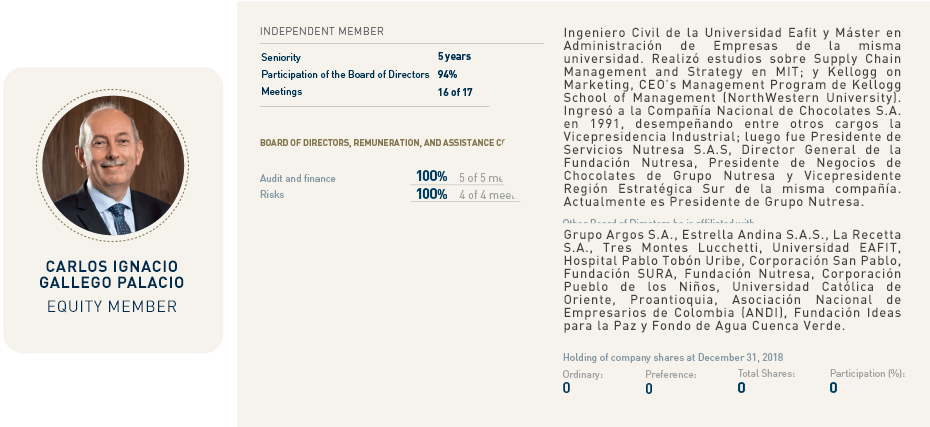

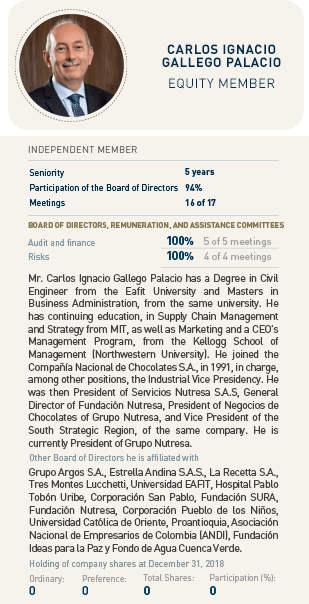

CARLOS IGNACIO

GALLEGO PALACIO

Equity member

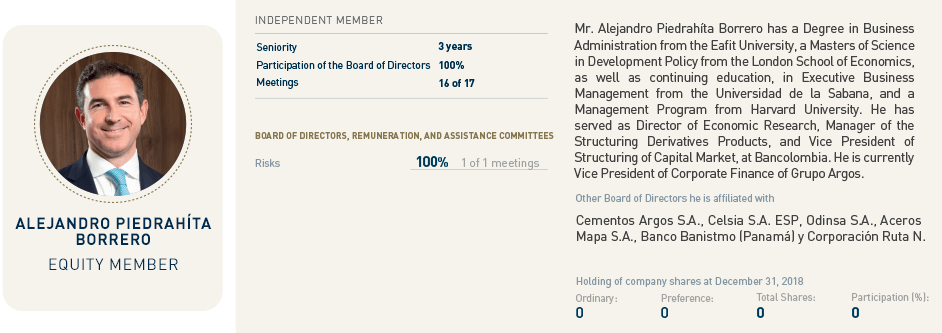

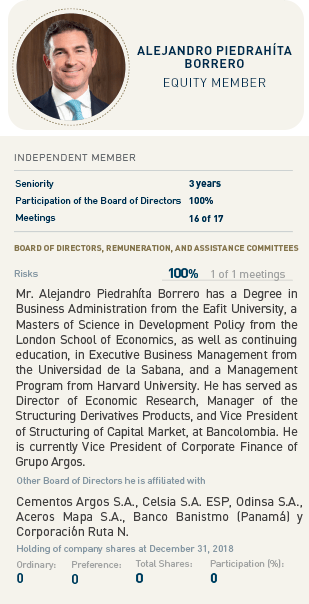

ALEJANDRO

PIEDRAHÍTA BORRERO

Equity member

LUIS FERNANDO

ALARCÓN MANTILLA

Presidente de la Junta Directiva

JAIME BERMÚDEZ

MERIZALDE

Vicepresidente de la Junta Directiva

SERGIO PABLO MICHELSEN JARAMILLO

Miembro independiente

CARLOS ANTONIO

ESPINOSA SOTO

Miembro independiente

JORGE MARIO

VELÁSQUEZ JARAMILLO

Miembro patrimonial

CARLOS IGNACIO

GALLEGO PALACIO

Miembro patrimonial

ALEJANDRO

PIEDRAHÍTA BORRERO

Miembro patrimonial

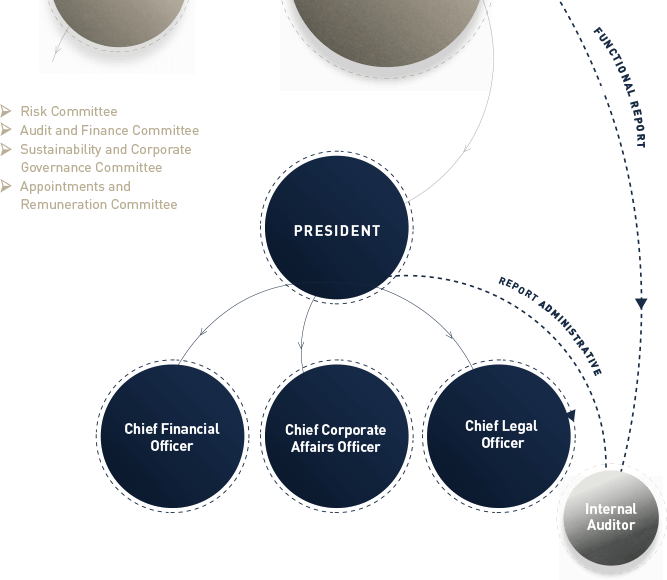

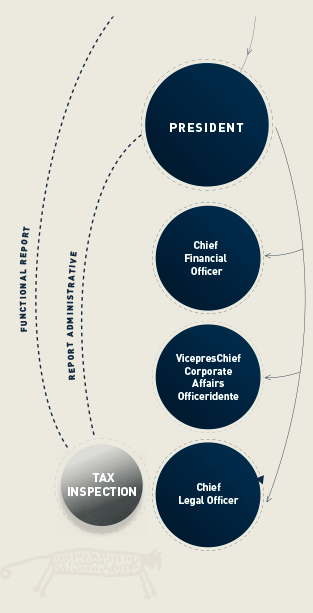

High

management

DAVID BOJANINI GARCÍA

Chief Executive Officer

TATYANA MARÍA OROZCO

DE LA CRUZ

Chief Corporate Affairs Officer

Management and Departments, in charge of:

- Planning and Strategy.

- Risk.

- Human Talent.

- Internal and Shared Services.

- Corporate Responsibility (Sustainability and Social Management).

RICARDO JARAMILLO

MEJÍA

Chief Financial Officer

Gerencias a cargo:

- Investors Relations.

- Accounting.

- Treasury.

- Tax matters.

- Investment Management.

- Projects and New Businesses.

JUAN LUIS MÚNERA GÓMEZ

Chief Legal Officer and Corporate Secretary

Direcciones a cargo:

- Corporate Legal Issues.

- Financial Legal Matters and Investments.

- Compliance.

- Corporate Secretariat.

- The Communications and Corporate Identity Management reports to the Presidency.

- The Internal Audit, functionally, reports to the Board of Directors, and administratively, to the Presidency.

Financial

Conglomerate

SURA-Bancolombia

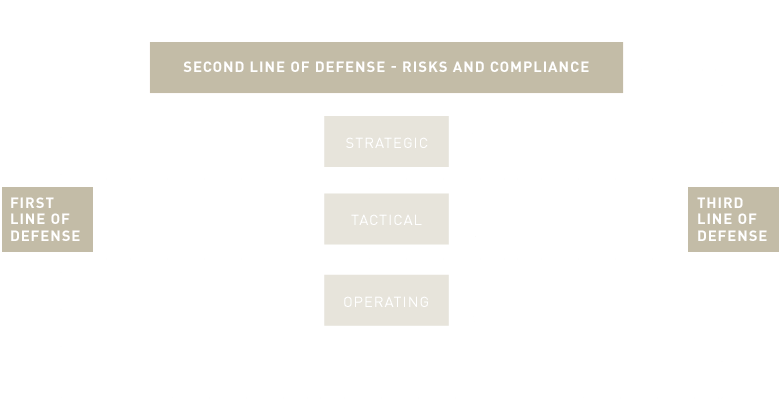

For the purpose of the expedition of issuance of the decrees and other regulations that govern the Ley de Conglomerados Financieros en Colombia (Financial Conglomerates Law), in Colombia, Grupo SURA, as a financial holding Company, continued to lead a Plan of Action, with all the Companies who became part of the Conglomerado Financiero SURA (SURA Financial Conglomerate). The aforementioned, assumed the challenges entailed, in the implementation of the new guidelines, contained in these regulations, especially in Corporate Governance, risk management, conflict of interest management, and capital adequacy.

Grupo SURA actively participates in the formal spaces for dialogue, that the Colombian Government has arranged, to build these guidelines, in order to have adequate regulation, adjusted to international standards, and to the local context of financial industry, also adhering to normative issues of the countries, where the Companies of the Organization operate.

Advances

of the

SURA Business Group

on four fronts

Strengthening

leadership

Attraction and

loyalty

Development of

talent

Creation of

well-being

Featured facts:

The Occupational Health and Safety System was implemented with coverage for collaborators, contractors and suppliers in Colombia. Practices were also established that fulfill this same objective in the Companies of the other nine countries in which SURA has a presence.

The development program was extended to commercial teams, with the training of more than 400 leaders in six countries.

The different training programs, for leaders in all countries, were continued, appropriating common basic concepts, and strengthening our corporate culture.

Key

indicators

Training

Total investment in training:

USD 6,266,009

Total hours of training:

1,123,187

Average investment

per employee:

USD 214

Training hours

per employee

(total annual average and per Company 2018)

SURA Business Group:

38

Suramericana:

34

SURA Asset Management:

50

Grupo SURA:

64

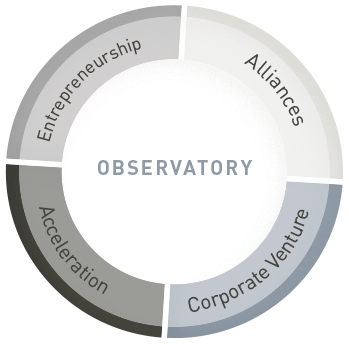

Innovation

System

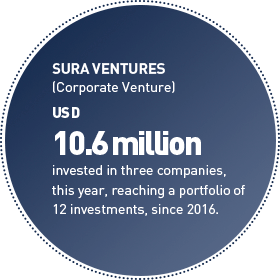

USD 32.3 millon

invested through SURA Ventures (2016-2018); 3 investments in 2018, after analyzing 154 companies.

2 alliances

potential development between SURA Ventures companies and the financial services companies of the Grupo SURA portfolio.

2 projects

in progress, to generate new sources of income, with the potential to become new companies.

This is how we do

Sustainability for Grupo SURA is the ability to rethink, anticipate, ask the right questions and manage risks to face the challenges of a competitive environment, based on our corporate principles.

We engage

stakeholders

We consider our stakeholders

in decision making

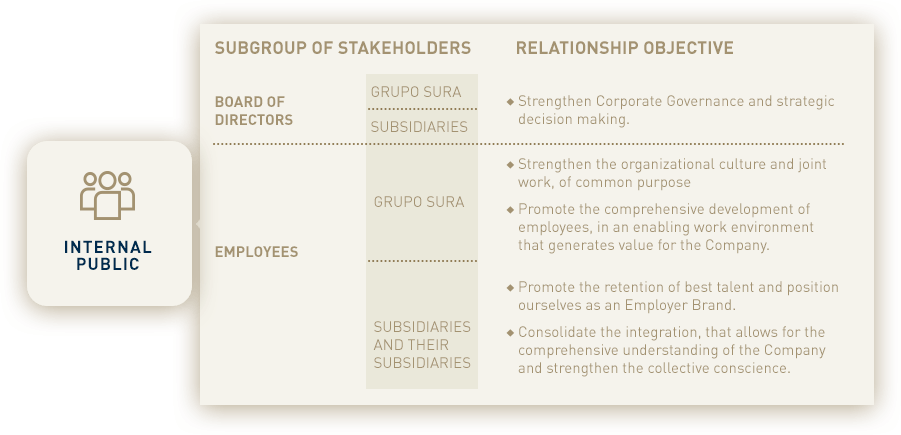

INTERNAL PUBLIC

SHAREHOLDERS AND INVESTORS

SUPPLIERS

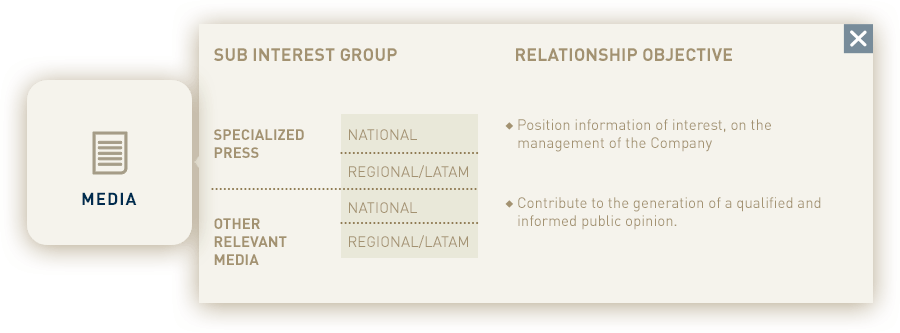

MEDIA

COMMUNITY

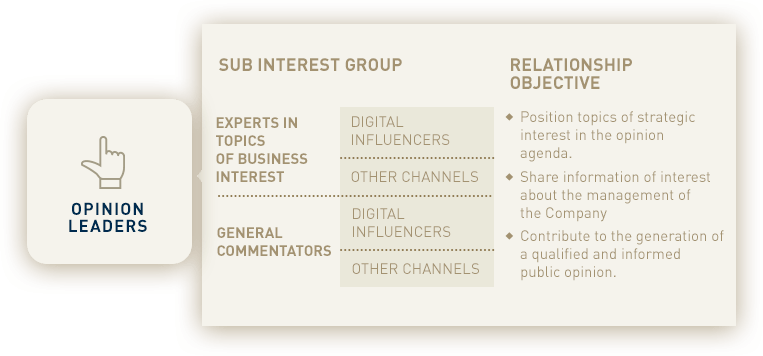

OPINION LEADERS

STATE

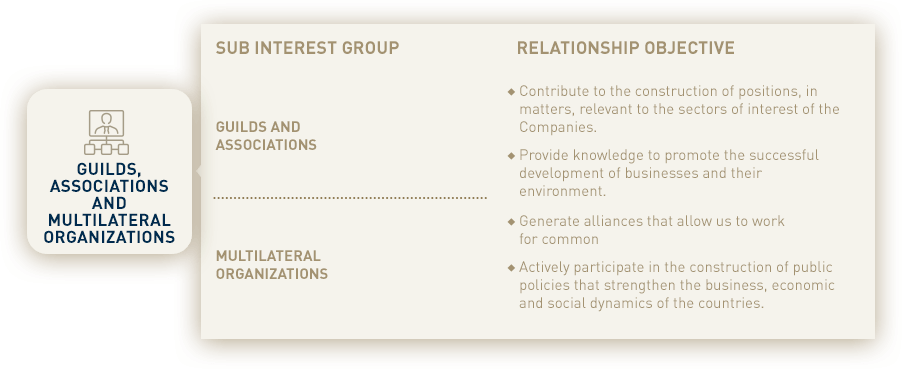

GUILDS, ASSOCIATION AND MULTILATERAL ORGANIZATIONS

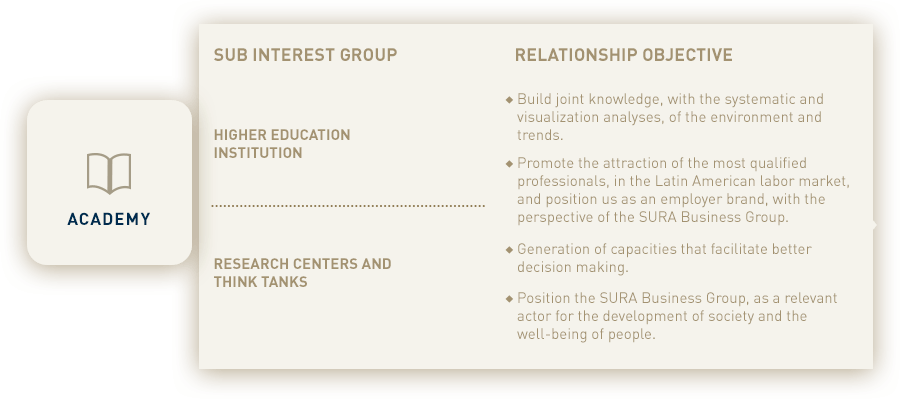

ACADEMY

We foster

corporate

streghthening

institutional strengthening

We work hand in hand with organizations, institutions and governments, providing resources, knowledge and talent, without compromising particular interests, to reflect, investigate and positively influence the construction of public policies that promote the development of the countries where we are present.

Meet some of our main allies here:

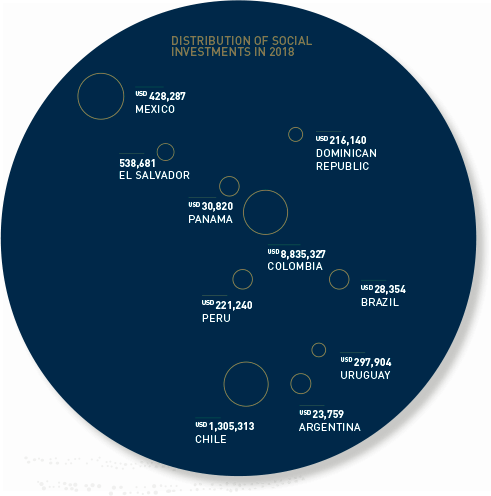

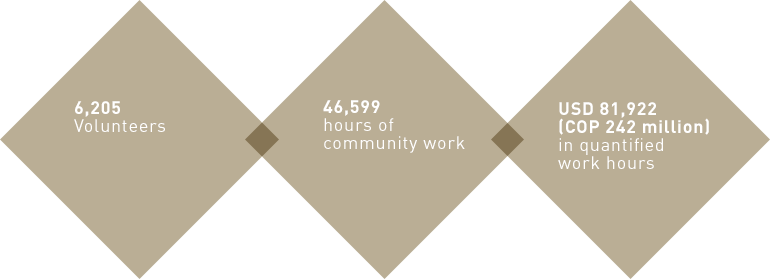

We contribut

e to social

development

Reputation

and trust

Reputation and trust is one of the strategic pillars of Grupo SURA, understood as the result of fulfilling the promise of value, based on good practices, based on ethical principles and developing long-term relationships with stakeholders.

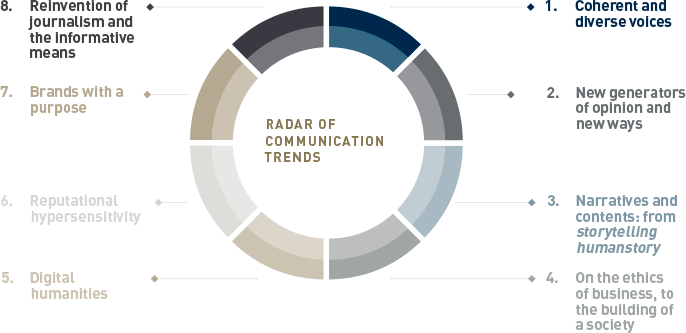

Radar of

communication

trends

A RADAR OF TRENDS IN COMMUNICATION WAS BUILT

the fundamentals

of communication Back to top

Featured

facts

Featured facts 2018

- In the brand digital architecture component, the integrated portals of the businesses of our subsidiaries were launched in Mexico, Uruguay and Colombia (Insurance, ARL and EPS).

- The Policy Framework for Risk Management and Reputational Crisis was updated and approved, with the scope of the Business Group.

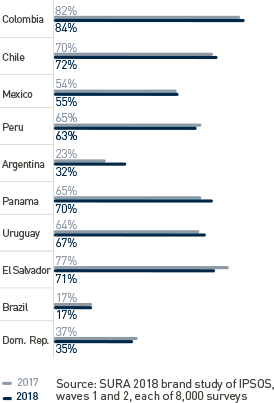

- The indicator of knowledge and familiarity of the brand continued to grow in six of the 10 countries where SURA has presence.

- An own reputation study was carried out that consulted the perception of our stakeholders in dimensions and key attributes to position the Companies.

Some

recognitions

in 2018 that

build

reputation

- Grupo SURA ranked 52 in the world and 4 in Latin America within the organizations considered "the best to work in the world," according to Forbes magazine.

- Suramericana, seventh among 25 multilatinas highlighted as best places to work, according to Great Place to Work.

- SURA went from 8th to 4th place in the Merco ranking, in Colombia, of companies with a better corporate reputation and rose from 9th to 7th place in Merco Talento.

- Afore SURA Mexico obtained the highest rating of the investment firm Morningstar for managing funds for retirement.

- Afore SURA and Seguros SURA Mexico ranked third among 500 companies in the Corporate Integrity ranking, an initiative of the Mexican organization Against Corruption and Impunity.

Annual report 2018